Findings and Calls to Action from the SOA Emerging Technology Study

By Arthur da Silva and Yvonne Zhang

Actuary of the Future, May 2022

In 2021, Deloitte and the SOA conducted a research study on emerging technologies in which the current use and future outlook of these technologies for the actuarial profession were evaluated. The study used a three-year outlook period and evaluated the application of these emerging technologies. The SOA report evaluated prospective tools that actuaries can use across aspects and domains of work spanning Life and Annuities, Health, P&C, and Pensions in relation to insurance risk. This article summarizes the findings and key action items that insurance companies, health care providers, and actuaries can take.

Summary of Key Finding Across Technologies

Technology Outlook

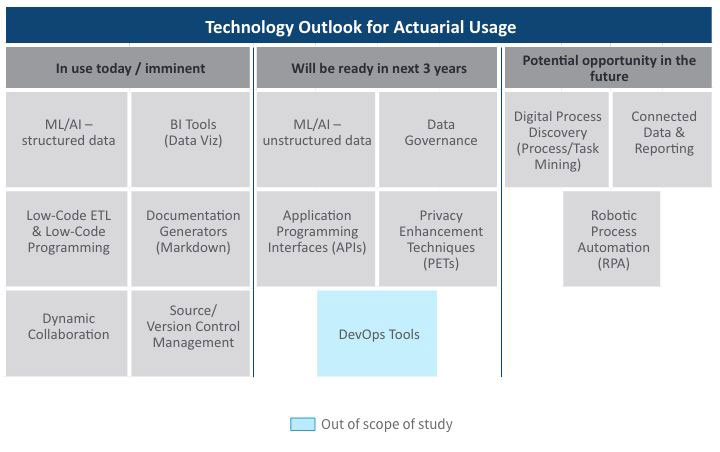

Based on the analysis of actuaries’ current usage and future outlook of the technologies reviewed, we have grouped the technologies into four segments based on their potential readiness for actuaries: (1) in use today, (2) ready in the next three years, (3) potential opportunity in the future, (4) and likely no actuarial usage. (See Figure 1 summarizing the first three of these segments)

Figure 1

TECHNOLOGY OUTLOOK FOR ACTUARIAL USAGE

Notes

1- ML/AI: Machine Learning/Artificial Intelligence, BI: Business Intelligence, ETL: Extract-Transform-Load

2 - In Figure 1 above, we also added DevOps tools in blue as we did not explicitly cover this in our initial scoping of technologies but have identified such tools as having potential for use by actuaries in the next three years

3 - These technologies do not include technologies that will affect actuaries but are anticipated to not have direct usage by actuaries (e.g., cloud data storage platforms, Blockchain, etc.). Such technologies will be important and potentially even enablers of many of the technologies in our scoped list. However, such technologies were evaluated to not be used directly by actuaries, hence the exclusion of these tools.

- Technologies that have reached widespread adoption today:

- Dynamic Collaboration Tools—e.g., Microsoft Teams, Slack, Miro—All companies are now using this type of technology partially due to theCOVID-19 pandemic and companies shifting to work in a virtual or hybrid world. Some are using the different functionalities (e.g., digital whiteboarding, project management tools, etc.) more fully than others at this time.

- Technologies that are reaching early majority adoption today:

- Business Intelligence Tools (Data Visualization component)—e.g., Tableau, Power BI—Most actuarial respondents have started their journey in using these tools, with many having implemented solutions. While a few respondents are lagging in its adoption, some companies have scaled applications of this technology to all actuaries. BI tools will change and accelerate the way actuaries diagnose results, understand results, and communicate insights to stakeholders.

- ML/AI on structured data—e.g., R, Python—Most actuarial respondents have started their journey in using these techniques, but the level of maturity varies widely. The average maturity is beyond the piloting phase amongst our respondents. These are used for a wide range of applications in actuarial functions, including pricing business, modeling demand, performing experience studies, predicting lapses to support sales and marketing, producing individual claims reserves in P&C, supporting accelerated underwriting and portfolio scoring on in-force blocks.

- Documentation Generators (Markdown)—e.g., R Markdown, Sphinx—Many actuarial respondents have started using these tools, but maturity level varies widely. The average maturity for those who have started amongst our respondents is beyond the piloting phase. As the use of R/Python becomes more prolific amongst actuaries, the ability to simultaneously generate documentation and reports for developed applications and processes will increase in importance.

- Low-Code ETL and Low-Code Programming—e.g., Alteryx, Azure Data Factory—Amongst actuarial respondents, most have started their journey in using these tools, but the level of maturity varies widely. The average maturity is beyond the piloting phase with our respondents. Low-code ETL tools will be useful where traditional ETL tools requiring IT support are not sufficient for business needs (e.g., too difficult to learn quickly for users or reviewers, ad-hoc processes) or where IT is not able to provision views of data quickly enough.

- Source Control Management—e.g., Git, SVN—A sizeable proportion of the actuarial respondents are currently using these technologies. Amongst these respondents, solutions have already been implemented. These technologies will become more important in the context of maintaining code quality for programming-based models and tools such as those developed in R/Python. The value of the technology will be further enhanced with the adoption of DevOps practices and tools, which blur the lines between Development and Operations teams to accelerate the deployment of applications/programs.

- Technologies not yet adopted by the majority but moving closer to that adoption level in the next three years:

- ML/AI on unstructured data—e.g., R, Python—For the actuarial respondents who provided answers, a sizeable portion have started their journey in using this technology, but the level of maturity varies between piloting/implementing and beyond. The average maturity amongst those who have at least started planning is beyond the piloting phase. These techniques are utilized for a wide range of uses across actuarial functions; however, the use cases are more concentrated in Research & Development/Analytics and Pricing/Underwriting/Product Development in comparison to the use cases on structured data.

- Data Governance—e.g., Collibra—There was a low level of adoption and familiarity of these tools by actuarial respondents since data governance has been seen by companies’ senior management as an IT responsibility. However, front- running companies see this technology as providing high value to actuaries and are beginning to pilot such tools. Increased reliance on data, particularly in ML/AI applications, will require the companies to be more involved in preventing and managing risks associated with the misuse of data and changing data dimensions over time, which will be better managed with the use of governance tools.

- Application Programming Interfaces (APIs)—e.g., Swagger, R’s Plumber—Actuarial respondents had a very low level of familiarity and adoption of APIs. However, some companies have identified opportunities for APIs to be deployed in future actuarial applications. For example, as ML/AI models need to be deployed in real-time to downstream applications, usage of APIs will likely increase in importance.

- Privacy Enhancement Techniques (PETs)—e.g., Privitar, CryptoNumerics—Actuarial respondents also had a very low level of familiarity and adoption of PETs. However, companies that do use them or are looking into them have identified these tools as having high value. As privacy regulations around the use of data evolve, these tools could potentially become more useful for actuaries indirectly in terms of helping them share data and join datasets in a manner that is compliant with those regulations.

- Potential opportunity in the future:

- Robotics Process Automation (RPA)—e.g., Automation Anywhere, UIPath—The direct usage of RPA by actuaries is very limited due to other types of automations that are already in place or because implementations have been IT-led with minimal actuarial involvement. Many companies that are using RPA at the enterprise level are not doing so for actuarial processes. It should also be noted that most of the respondents indicated no plans to adopt RPA over the next three years. However, if several different applications are being used in one process, RPA could be useful to streamline across applications. That being said, it’s not clear whether such processes would be better served by a combination of other automation tools (i.e., R/Python, low-code ETL, and automation built into actuarial software).

- Connected Data & Reporting—e.g., Workiva—Actuarial respondents also had a very low level of familiarity and adoption of Connected Data & Reporting tools. Respondents who are using these tools are only doing so in a very limited fashion, generally as inputs for accounting. It appears that actuaries aren’t fully aware of how these tools will help them over alternative tools. For example, one company is trying to pilot collaborative editing elements using a Dynamic Collaboration tool instead. Further investigation would need to be performed to learn how these tools might benefit actuaries in combination with other departments.

- Digital Process Discovery (process mining and task mining)—e.g., Celonis, FortressIQ—There was no current application of this technology nor any stated implementation plans from the actuarial respondents; however, some participants noted that such tools could help with respect to process flow documentation and analysis of customer behavioral patterns.

- Likely no actuarial usage:

- Close Automation—e.g., BlackLine—Most actuarial respondents were not familiar with these tools; however, those who were saw such tools as more accounting and finance focused, so they do not appear to have much actuarial application.

Technology Journey Positioning of Insurance Participants

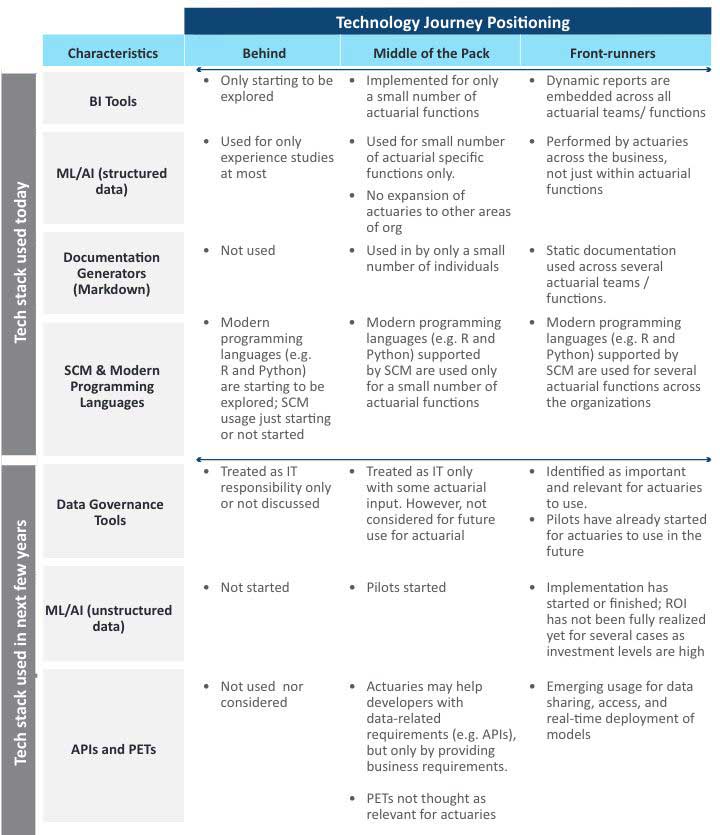

Upon reviewing the responses from the actuarial interviews conducted with study participants, we clustered companies together based on their demonstrated characteristics with respect to the technology stacks “used today” and “ready in the next few years.”

The technology journey positioning clusters are relative groupings across the respondents for each technology in Figure 2 below that show differentiation in behaviors and characteristics across the participants, with participants falling into three buckets: “Behind,” “Middle of the Pack,” and “Front-Runners.” The figure also summarizes the separation in features among each of the clusters for each technology. It should be noted that being behind is not necessarily a bad position to be in. A company’s position is subject to its technology strategy and corresponding decisions regarding where and when to invest in such technologies.

Figure 2

TECHNOLOGY JOURNEY POSITIONING

Source: Deloitte analysis based on actuarial interviews for this research paper

Note - ML/AI: Machine Learning/Artificial Intelligence, BI: Business Intelligence, SCM: Source Control Management, APIs: Application Programming Interfaces, PETs: Privacy Enhancement Techniques

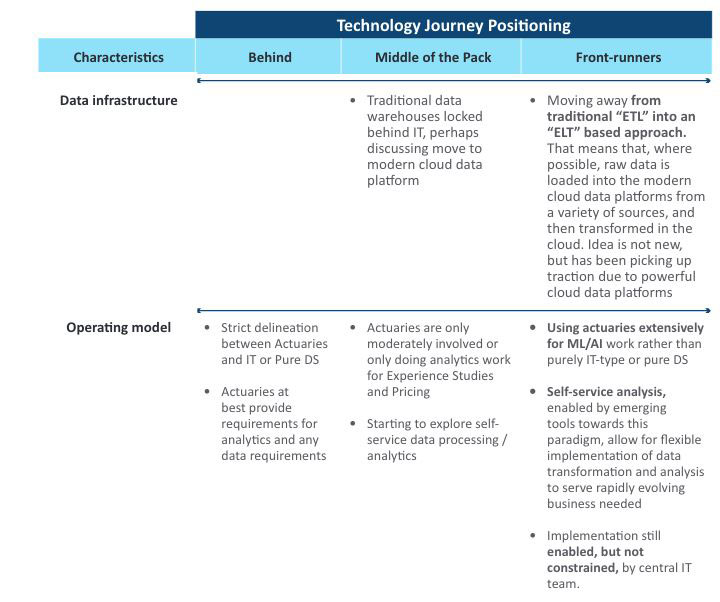

Other Characteristics

In addition to the technologies listed in Figure 2, a number of companies mentioned important characteristics that we noted were different between the more advanced companies and those that were behind. Such characteristics, i.e., data infrastructure and operating model, appear to have a correlation with the maturity of technology adoption amongst the actuarial teams of our participants. Since these topics were not explicitly covered, we did not have data from all companies to confirm whether this phenomenon was widespread. Companies that have been able to scale the emerging technologies for actuaries have shown distinguishing characteristics in their data infrastructure and operating model—see Figure 3 below.

Figure 3

TECHNOLOGY JOURNEY POSITIONING

Source: Deloitte analysis based on actuarial interviews for this research paper

Note – ML/AI: Machine Learning/Artificial Intelligence, DS: Data science, ETL: Extract-Transform-Load, ELT: Extract-Load-Transform

Key Calls to Action for Profession and Actuarial Organizations

As actuaries update the technologies they use and target more effective use of technologies, we recommend the following in light of this research, with detailed considerations by level and stakeholder outlined in the 2021-emerging-technologies-report:

- Actuaries should embrace technologies that enhance the remote working experience within their internal teams and across departments by investigating functionalities beyond messaging and video calls.

- Actuarial organizations and employers should examine technologies where there is a wide range or gap in maturity and familiarity, evaluate whether a knowledge gap exists, determine whether any gap is due to lack of education or training, and assess the impacts of adopting such technologies on actuarial processes.

- Actuaries should consider bolstering their communication methods amongst actuaries and with other stakeholders by using insight delivery tools such as BI and Report Generation tools.

- Actuarial leaders, regulators, and auditors need to become more familiar with ML/AI techniques in order to gain comfort over their results.

- As the use of programming tools (e.g., R, Python) matures for ML/AI applications and other automation applications, companies will need to investigate potential revisions in their processes and technology surrounding the deployment (i.e., SCM tools, DevOps, etc.) of models and applications relying on these programming tools.

- Actuaries should become familiar with data governance tools tailored to business users and look into working with IT to drive change in this area.

- Actuarial organizations should continue to evaluate and promote the potential expansion of areas where actuaries can work (Data Science roles, Life Science and Pharmaceutical companies, etc.).

To review the detailed Deloitte and SOA Report on emerging technologies, please check out the 2021-emerging-technologies-report.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Arthur da Silva, FSA, FCIA, is senior manager, Actuarial & Insurance Solutions, at Deloitte in Toronto. He can be contacted at adasilva@deloitte.ca.

Yvonne Zhang, FSA, is manager, Actuarial & Insurance Solutions, at Deloitte in Toronto. She can be contacted at yvonzhang@deloitte.ca.