Aging Populations and Actuarial Projections: Challenges and Opportunities

By Julia Friedman

Actuary of the Future, July 2024

The concept of time and its impact on our age is a simple concept we learned as children on each birthday. As time continues forward, we age, and many of us mark the day of our birth every year as a special time to celebrate with family and friends. Counting birthday candles can be fun, but a deeper understanding of how our population is aging over time, and the ramifications of that aging, is a topic of serious importance for actuaries. As we move further into the 21st century, the proportion of people aged 65 years and above is increasing at a faster rate than those below that age. This means that the percentage of the global population aged 65 and above is expected to rise from 10% in 2022 to 16% in 2050, according to the United Nations.[1]

No discussion of population aging would be complete without mentioning the baby boomer generation. This population is centered around individuals born in the post-World War II years in the United States—about 1946 to 1964. Especially in developed nations, baby boomers are a substantial portion of the world’s population.[2] In the United States, individuals aged 65 and older will make up about 20% of the US population by 2029, which is up from about 14% in 2012.[3]

Because of the sheer size of this cohort, baby boomers are an important population cohort and a key driver of societal aging. Said simply, our society is getting older, on average, now and in the near future. As actuaries, an aging population has implications for our work, and we need to be prepared to provide insight into the risks and uncertainties this global change presents our society. In this article, we will discuss some of the impacts of an aging population on a few different types of insurance and how actuaries can respond to them.

First, let’s consider two key aspects of financial risk—frequency and severity of insurable events. As a population ages, older individuals represent a larger proportion of the overall population, and the age-related needs such as health care and retirement income of this cohort are often more severe, requiring greater intervention. My own actuarial work is largely focused within the Medicare Advantage (MA) market, and in MA I often see this when looking at risk scores of older individuals within the population. An MA risk score is a number representing the predicted cost of treating a specific patient or group of patients compared to the average Medicare patient, based on certain characteristics and health conditions.[4] As individuals age, their risk scores tend to increase, on average. This increase in risk scores can be driven by a combination of utilization (older individuals utilizing more health care services than those who are younger, often driven by higher prevalence of medical conditions), and service mix (older individuals requiring costlier services to treat their conditions than younger individuals with those conditions). This may be for acute conditions such as a hip fracture (higher frequency as bone density decreases with age[5]), or because of long term health needs and chronic conditions, such as maintenance or complications from diabetes.[6]

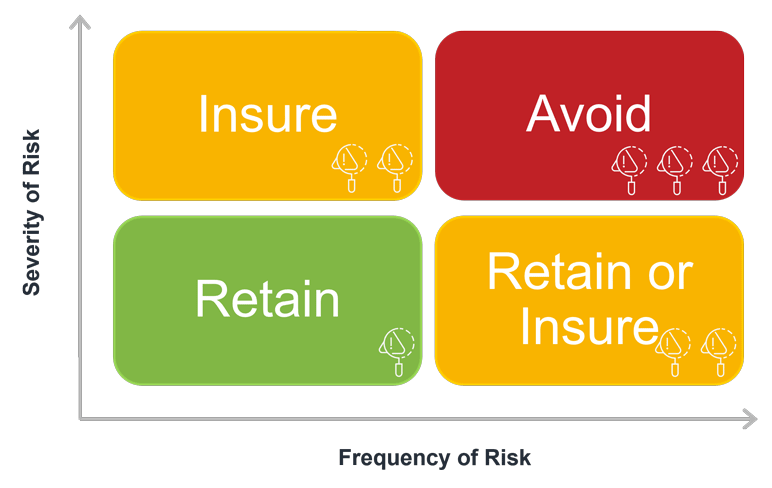

Referring to Figure 1 below, actuaries generally can use our expertise to identify either high severity/low frequency (top left) or low severity/high frequency (bottom right) events in order to determine the appropriate mechanism to manage such risks, usually financial, and usually insurance. (In the context of this article, I use insurance more broadly to describe insurance carriers, other financial services entities, and pension plan sponsors, who all have a vested interest in actuarial projections). Insurance seeks to manage risk and avoid over-exposure to high frequency and high severity adverse events on behalf of their policyholders, while allowing the policyholders to retain low severity and low frequency events. Using the construct presented here, insurance companies strive to determine which risks they are able to manage and sell insurance products against, which risks to avoid, and which risks are insufficiently material to pursue insurance-based solutions.

Figure 1

Risk Assessment Matrix

The frequency of health events, whether acute or chronic, increases with age. The severity of those events increases as well, driving the pattern of health needs further into the high severity/high frequency quadrant (top right). Since individuals are living longer than they did 100 years ago, there are more older individuals utilizing more health care services (and a costlier mix of those services), placing greater demands on our health system. How actuaries think about and understand these risks and how they can best be mitigated and insured in different sectors is addressed below.

Health Insurance: Governments and health care systems around the world need to be prepared to support the higher use of health care services. National health expenditures for the United States, as a percentage of gross domestic product, were 17.3% in 2022.[7] All else equal, this proportion will increase with an aging population. A recent Milliman study indicated, among other considerations, that for a 65-year-old retiring in 2023, living five years longer than average increases health care spend approximately 40% over the remaining lifetime of the individual.[8] Taken together, these two statistics imply it is likely the aging population will drive increases over time in both the utilization of services, as well as the cost of services. Increasing cost of services could likely be tied to higher intensity services (e.g., mix) necessary to address the needs of the aged and the scarcity of certain health care workers, such as home health aides, driving up labor costs. These utilization and cost patterns are important to understand in order to assist the insurance industry to better prepare for the costs of an aging population. As actuaries, it is our job to help our employers and clients understand and quantify the impacts of these higher frequency and higher severity events on health care outcomes, benefit offerings, and ultimately plan liability and member premiums or managed care capitation rates.

Life and Long-Term Care (LTC) Insurance: Life and LTC insurers will need to be prepared to address longevity risk, as people are continuing to live longer than they have in the not-so-distant past. Longevity risk will also likely create additional financing challenges for LTC more broadly, as Medicaid remains the largest payer of LTC costs.[9] Some states have recognized this, with the state of Washington funding a first of its kind state-based LTC social insurance program.[10]

A person aged 65 has a greater than 50% likelihood of needing LTC at some point in their remaining lifetime.[11] As the overall population continues to age, both private LTC carriers and public programs will face increased demand for LTC services. Further, with medical advances, individuals may require LTC services over a longer period of time, which can increase liabilities for LTC carriers. A Milliman survey conducted in 2023 indicated participants in the LTC space had significant concerns with high future expected LTC claims if they did not invest in wellness programs, with the idea being that investing in such programs would have a meaningful impact on lowering end-of-life costs (through addressing both frequency and severity of such events, as outlined in the introduction of this article).[12]

Additionally, many life insurance carriers offer whole life insurance products that allow a policyholder to access the policy’s cash value prior to death. Life insurance actuaries need to consider the economic impact of an aging population, as work patterns and retirement can impact economic growth, which in turn can impact how the assets accumulated by the premiums collected from these policies are invested and grown, and are eventually paid out, sometimes through the cash value option.

Actuaries need to pay close attention to the economics of an aging population through life expectancy and other financial services models. By modeling different aging scenarios into the distant and not-so-distant future, we can help life and LTC insurance organizations better understand the range of future scenarios that could occur.

Retirement: Retirement actuaries are well positioned to help organizations understand key financial assumptions underlying long-term funding projections and an aging population may impact modeled outcomes. It is a positive sign that as of year-end 2023, the top 100 U.S. public companies with defined benefit (DB) pension plans improved their funding ratios—in fact, funding ratios have steadily increased in the last few years.[13] However, as more individuals age into retirement and call upon their 401K or pension accounts to fund retirement, retirement focused actuaries should think critically about population dynamics that may result in long-term impacts to retirement funding. Specifically, as individuals live longer, retirement actuaries must consider the possibility of funding shortfalls—and build in assumptions to stress test this. Further, as baby boomers retire, they leave behind relatively fewer working age individuals in the workforce. As a result, programs such as Social Security and Medicare (which rely heavily on payroll taxes levied against individual wage income) will likely experience a reduction in funding inflows in addition to increased benefit outlays. Government actuaries should be prepared to advise leaders on the options available to fund these programs, along with the implications of these options, with the goal of keeping them stable for future generations.

An aging population has wide-reaching implications for our work as actuaries, with the above sectors being just a few of the areas where actuaries typically are employed to manage risk. Ultimately, our job is to advise the decision makers in these industries about risks to be considered, options available to address those risks, and the impacts of their decisions to ensure solvency for the good of all stakeholders.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Julia Friedman, FSA, MAAA, is a principal and consulting actuary at Milliman. Julia can be contacted at julia.friedman@milliman.com.