Insights Into Life PBR Modeling Practices

After much anticipation and preparation, mandatory implementation of life principle-based reserving (PBR) has finally arrived in the United States, meaning life insurers’ valuation practices must comply with the requirements of Section 20 of the Valuation Manual (VM-20) for new individual life policies issued in 2020 and later.

Oliver Wyman recently completed its 2020 Life PBR Emerging Practices survey, with results providing a broad industry perspective on implementation impacts, strategy, assumptions and challenges. More than 50 companies, representing 95 percent of the individual life market by written premium, participated in the survey.

While participants are in different stages of PBR model maturity, none of those surveyed are completely satisfied with their initial implementation, with most listing refinements to models as a future area of focus. This article provides further insights into the trends and drivers observed around planned future refinements to PBR models.

Areas of Focus

Figure 1 shows the areas where survey participants are planning future model refinements.

Figure 1

Model Refinements

Analytics and analysis tools were the most commonly cited refinement, as insurers are keen on building out data visualization dashboards and enhanced analytics to enable better understanding and explanation of results. Refinements to the valuation process were also common, with participants focusing on runtime reduction, automation and controls.

Runtimes are Driving Model Simplifcations

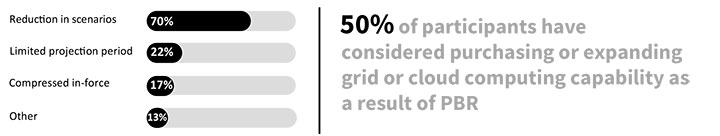

Model runtimes are a growing concern for most life insurers. The time to complete a total production valuation process (i.e., quarter-end run) ranged from a few hours to an entire day. As shown in Figure 2, lengthy runtimes have led to modeling simplifications in order to meet reporting schedules, and many are considering expanding grid or cloud computing capabilities.

Figure 2

Runtime Reduction Techniques

The most common modeling technique to combat lengthy runtime is a reduction in the number of scenarios used in the stochastic reserve (SR). No insurers in the survey are currently running a full set of 10,000 scenarios in their valuation process, and the majority use a scenario-picking tool to reduce their scenario set to 1,000. Additional computing power from grid expansion or cloud-based computing may be desirable not only for point-in-time valuations but also for nested modeling required to project VM-20 reserves.

Software Considerations Continue to be Top of Mind

The two most common software packages used for Life PBR valuations and projections by participants were MG-ALFA and Moody’s AXIS; both received high ratings for ease of use. Although not as widely used, Prophet saw ratings increase significantly compared to last year, with above-average rankings for ease of use, transparency and auditability.

As the focus shifts from initial implementation to business as usual, the appetite for software conversions has remained steady as compared to 2019, with about 50 percent of participants having considered a change to their actuarial systems as a result of PBR.[1] The desire to convert may be driven by modernization efforts in conjunction with other regulatory changes, putting additional pressure on existing software (e.g., GAAP Long Duration Targeted Improvements or International Financial Reporting Standard 17) or by those not completely satisfied with the level of flexibility or robustness allowed for in their initial implementation.

Looking Forward

As the volume of business being reported under PBR grows in the coming years, the need to balance model runtime, accuracy and analytics will only become more essential. Those that develop a scalable and controlled process rooted in back-end analytics at the onset will have the advantage of forward-looking insights that drive strategic decisions, while reducing the strain on systems and staff.