The Actuarial Science Program at the University of Bahrain

By Babacar Seck

Expanding Horizons, April 2023

Although the kingdom of Bahrain has at least five well-established postsecondary institutions, the University of Bahrain has the only mathematics department. The Bachelor of Actuarial Science program, established in 2018, is part of that department.

Development of the Program

Several years ago, the university’s mathematics department identified the need to diversify its offerings in applied mathematics to address the current job market’s requirements. The dean of the College of Science assigned academic staff members to benchmark the needs of actuaries both within the kingdom and in the Gulf Council Countries (GCC) in general. The survey revealed that the Central Bank of Bahrain requires a detailed actuarial report from each insurance company operating in the kingdom. The bank further mandates that all insurance companies operating in Bahrain must implement International Financial Reporting Standard (IFRS) 17 and have an actuarial unit in their organizational structure. Seven of the 10 insurance companies that responded to the survey use consultants from actuarial consultancy firms, and companies in Bahrain, Saudi Arabia and Dubai expressed their support of an actuarial science program at the University of Bahrain.

Given these results, a committee of faculty members in the mathematics department proceeded to build a bachelor’s program in this field. The first step was to look at actuarial accreditation bodies and map their curricula with the existing courses in mathematics and statistics offered in our department, as well as the accounting and finance courses offered by the College of Business Administration. We chose to base our program on the Society of Actuaries’ (SOA’s) curriculum. There followed a rigorous process of developing an appropriate course of studies in accordance with the university’s policies and regulations and the kingdom of Bahrain’s quality assurance standards for higher education, all in close collaboration with the College of Business Administration. The program was approved by the university council in 2018.

One of the targets of this program is to meet the international standards requirements for actuaries, and the most recognized worldwide are those set forth by the SOA. Our bachelor’s program has been listed as a University and College with Actuarial Program–Introductory Curriculum (UCAP-IC) since May 2021, with courses covering the Financial Mathematics (FM), Investment and Financial Markets (IFM) and Probability (P) exams, as well as the Validation by Educational Experience (VEE) topics of Statistics, Economics and Accounting & Finance. Our application for UCAP-AC (Advanced Curriculum) is currently underway as we make the transition to the new SOA curriculum to cover the Fundamentals of Actuarial Mathematics (FAM), Advanced Long-Term Actuarial Mathematics (ALTAM) and Advanced Short-Term Actuarial Mathematics (ASTAM) exams.

The Internship Requirement

A specific requirement of our program is the mandatory internship during the third or last year of study for the bachelor’s degree. This is an immersion in the field for a minimum of eight weeks during the summer period. Organizations are approached through three different channels:

- Through the Bahrain Institute of Banking and Finance, insurance companies receive student résumés and select the students according to their own in-house criteria. Most of these companies require the students to have passed at least two introductory SOA exams, which is another motivation for students to pass as many exams as possible while they are still at the university.

- Faculty members and students themselves network directly with the companies.

- The university administration finds internships for third- or fourth-year students in government organizations.

We advise our students to give preference to internships that expose them to general actuarial experience and financial risk. Students are not required to write a report or do a presentation after the internship, since it can take place as early as the third year. To validate the internship requirement, the student need only complete the eight-week internship, where a follow-up process is put in place by the university with a coordinator in each department.

Student Intakes

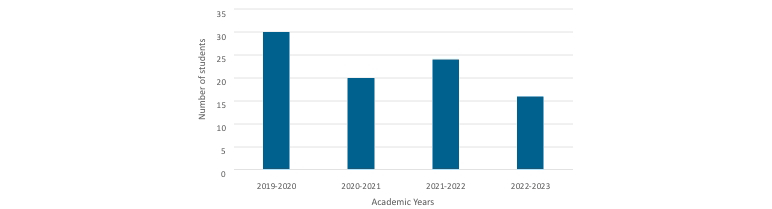

The first class of students for the Bachelor of Actuarial Science at the University of Bahrain was welcomed in September 2019. Each academic year, we receive applications from newly graduated high school students and first- or second-year university students who wish to transfer from their current academic program. A selection is made based on two components: a written exam followed by an oral interview. We test the students’ mathematical background, their oral skills, and their motivations. The oral interviews are also opportunities to point out the long-life learning process in terms of accreditation and professional development students can look forward to if they are accepted to the program. The department is quite ambitious and accepted about 27 out of 57 applicants the first year. Figure 1 gives an overview of our intakes since the program’s inception. Currently, we have a total of 90 students enrolled in the program.

Figure 1

Student Intakes for Bachelor of Actuarial Science Degree at UOB

Looking Ahead

Our collaboration with the SOA was smooth as our curriculum is based on the contents of at least six SOA exams and three VEE topics. We plan to use this solid basis on SOA designation pathways to develop exam exemption or accreditation opportunities with other academic and professional bodies, such as the Institute and Faculty of Actuaries (IFoA) and the Casualty Actuarial Society (CAS). We are a young, ambitious program, but we believe these are reasonable targets because the SOA pathways are already mapped to the requirements of these professional entities. From that perspective, we are working on the possibility of slightly modifying the contents of some of our current courses or introducing new ones, if necessary.

On the business side, we are working closely with actuaries in the GCC region, seeking their experiences and knowledge of the financial and insurance industries to contribute to our program through workshops and seminars. For example, we wish to thank Lux Actuaries, based in Dubai, who conducted two workshops for our students last year, and the SOA administration team who facilitated the contact between our team and Lux Actuaries.

We trust our faculty members’ expertise in conducting seminars and workshops for all third- and fourth-year students in our department, including the actuarial science students. For instance, almost all the third-year actuarial students participated in a workshop on building résumés last year. Currently, with the help of the Bahrain Institute of Banking and Finance (BIBF), we can reach out to almost all the insurance companies operating in this country. This is a very good starting point for knowing the market needs and building a solid network and partnership between our program and the insurance industry. For instance, last summer all the students who requested an internship were able to find a placement in either insurance or finance.

My colleagues in the mathematics department and I work collaboratively with all our partners to play a leading role in actuarial science in the GCC from an academic point of view. To this end, we are open to different types of GCC and international collaboration.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Babacar Seck, Ph.D., is an assistant professor in Mathematical Finance, Insurance and Risk Management, and the program coordinator of the Actuarial Science Program at the University of Bahrain. Babacar can be reached at bseck@uob.edu.bh.