Small Program, Big Dream: Our Journey to the 2024 SOA Student Research Case Study Challenge

By Jiacheng Cai

Expanding Horizons, August 2024

In the spring of 2019, I started to serve as the Actuarial Science Program coordinator at Salisbury University, a medium-sized public teaching school in Maryland. At that time, the program was small, with only two faculty members who focused on both statistics and actuarial science with approximately 10 students. During the next five years, we did make some achievements in curriculum development, student exam preparation, job placement and recognition, but I continued to have a dream to make our program unique. I believed that the skill sets our students learned, even from a small program, could enable them to compete with anyone on a global basis. In spring 2024, I advised a group of exceptional actuarial students to participate in the 2024 Society of Actuaries (SOA) Student Research Case Study Challenge (SRCSC),[1] and we won third place—behind two teams from the University of New South Wales, Australia. This article is the story of our journey.

Our Program: The Background

Located on the rural Eastern Shore of Maryland, Salisbury University (SU) is a public university with about 6,500 students. With the help of Dr. Michael Gauger, ASA, a retired actuary and an actuarial educator who was hired by SU in 2008, and two statistics faculty members, Dr. Veera Holdai and Dr. Barbara Wainwright, the Mathematics Department successfully proposed and launched its Actuarial Science Program in 2010. The program provided courses that covered SOA Exams P, FM and MLC at that time. In addition, five of the courses had been approved for Validation by Educational Experience (VEE) credit in Economics, Corporate Finance and Applied Statistics Methods.[2] After Gauger retired from SU, he made an initial donation to establish a departmental fund. With his support, as well as that of subsequent donors and the department, this fund has been helping to reimburse our students for their SOA exam fees when they pass.

While the program has been growing and supporting students to successfully pass the first two exams, new challenges have also been growing: the retirement of Gauger, the developing changes in the SOA exam curriculum,[3] the changes of the SOA VEE requirements,[4] the need of higher recognition in the industry[5] and the impacts from data science.[6] I joined the Department of Mathematical Sciences at SU in 2018 and was appointed the Actuarial Science Program coordinator in 2019. To address the challenges, I explored, designed and performed the following practices with the help of my amazing colleagues:

- VEE: In 2018, the SOA made several significant changes in the Associateship of Society of Actuaries (ASA) curriculum. One of these was the VEE categories: Accounting was added to Finance, and Applied Statistics was replaced with Mathematical Statistics. To address this change, I collaborated with the SU Accounting Department, Economics Department and Finance Department to collect the course materials. I then prepared the VEE course renewal and new course approval applications and successfully got five SU courses recognized as VEE credits that cover all three categories in 2019.

- UCAP: Based on the existing program curriculum (designed by Gauger, Holdai and Wainwright) and the VEE recognition, I represented the SU Actuarial Program in applying for and attaining the SOA University and Colleges with Actuarial Programs – Introductory Curriculum (UCAP-IC) designation in 2019. This designation put the SU Actuarial Program on the radar of actuarial academia and industry, which provided invaluable opportunities for our students.

- Faculty completion of SOA exams: When I joined SU, another faculty member and I had passed the first two SOA exams, but both of us were more mathematics/statistics educators than professional actuaries. Gauger’s retirement, the other faculty member’s administrative responsibilities, and the need to reflect the developing changes in the SOA curriculum made it imperative for a faculty member to pass higher-level actuarial exams. Since late 2020, I have taken and passed four more SOA exams, which enabled me to teach and create more advanced actuarial courses for our students.

- Student exam and professional preparation: Two of the features that SU is proud of are the small class sizes and the faculty advising system for students. These help to build a close relationship between faculty and students. As the program coordinator, I know each of my students and actively have both formal advisory meetings each semester and informal advisory meetings as needed with them. During these meetings, I provide suggestions to achieve academic success, review resumes for internship/job application preparation and offer advice about internship/job interviews. To help students prepare for the SOA exams, I created a seminar course that meets once per week to go over the exam topics, review the material details, practice the problems, master the calculator operations and learn exam-taking strategies and techniques.

- Curriculum development: The SOA made several significant changes in 2018 and 2021: several exams were retired, and new exams were launched. Particularly, the SOA ASA requirements added a focus on data science, resulting in two new exams (SRM and PA). In addition, the old exams MLC and C were replaced by exams LTAM and STAM, then further changed to exams FAM, ALTAM and ASTAM. To address these changes, I developed a new course to cover the contents of SRM/PA and modified the existing advanced course (which used to cover MLC) to cover FAM-L and some of ALTAM. I plan to create another new course to cover the entire FAM and further adjust the advanced course to focus more on ALTAM. Ideally, the program curriculum should be able to meet all the requirements of UCAP-AC in the fall of 2025.

- Outreach and alumni connections: With the aforementioned changes, the next step is to promote our program. I actively participate in many of the university’s mathematics/STEM outreach activities and attend actuarial teaching conferences to learn from the experiences of and build connections with other educators. I maintain contact with alumni and frequently invite them to give presentations to current students.

As the result of the above practices, the SU Actuarial Science Program has entered a period of rapid development. Many of our students have successfully passed SOA exams and have received internships as well as job offers with such top-notch companies as PricewaterhouseCoopers, GEICO, Centers for Medicare and Medicaid Services, Guardian Life, Aetna, Travelers, Aon and New York Life. Since 2019, at least three of our alumni have attained ASA credentials. In particular, all of our 2024 actuarial seniors have successfully passed two SOA exams and/or have received internship/job offers. Among those, four students stand out: Cameron Cash of Georgetown, Delaware; Carly Pfaff of Oakland, Maryland; Emily Shaeffer of Odenton, Maryland; and Lauren Specht of Frederick, Maryland.

When I saw these intelligent, hard-working and motivated young people, I knew this was a great opportunity to find out if our students could compete with top students from around the world. In late fall 2023, I invited these four students to participate in the 2024 SOA SRCSC, and they were all very excited to apply what they had learned in the classroom to a professional case. After the 2024 challenge case was posted, Cameron suggested the team’s name—Mew Consulting, a play on the Greek letter mu and a synonym for seagull, the Salisbury University mascot. This is how the team was established.

From left: Carly Pfaff, Dr. Jiacheng Cai, Lauren Specht, Emily Shaeffer and Cameron Cash.

Our Preparation: Project-Based Coursework and Studying Previous Challenges

The SOA Student Research Case Study Challenge is an annual global competition held by the SOA Research Institution, where “teams of two to five students will research a case study situation, conduct an actuarial analysis, formulate solutions, and present recommendations in a report.”[7] Unlike solving problems in an exam, the team is given a comprehensive fictional case with multiple complicated big-scale datasets and a set of open-ended tasks. Students need to identify the key issues and priorities of the case, understand and select the appropriate dataset, potentially explore external data sources and research, rationalize and develop multiple actuarial models and methods, evaluate the reliabilities and assumptions of the models, summarize the outcomes and present the results in a professional report. Teamwork, communication, time and project management, professional presentation and high-level analytic thinking are required to succeed in this challenge—skills that are not often taught with regular coursework.

Earlier, when I was creating and modifying the SU actuarial courses, I considered the balance of exam preparation, mathematical foundation and reasoning, and career skill set training. The outcome was to move the exam preparation to the seminar course and to focus more on the mathematics behind the models and training of advanced modeling and analytics via projects. When I taught the Financial Mathematics course, I provided detailed derivations and analysis of the models, and introduced the implementation of the models via Excel worksheets. When I taught the Statistics for Risk Modeling and Predictive Analytics course, I presented the mathematical intuition behind the models and guided the students to write their own R functions of the linear regression models rather than using the package functions directly. In each course, I encouraged students to form teams, to find the research problems/datasets they were really interested in, and to apply the methods/models they had learned to the problems. In addition, SU actuarial students are required to take multiple accounting, economics and finance courses, where they can learn business concepts and applications. Given this coursework, the team had been exposed to some research projects, which helped them prepare for the Case Study Challenge.

During the winter of 2023, I had each member of the team study previous winners’ papers; write a summary of each paper (goals, approach, methods/models, presentation setup and their own opinion of the paper); and share their summary with their teammates. This assignment helped the students get familiar with the challenges and understand the expectations. In January 2024, we were ready for the start of the competition.

Our Journey: The Research, Challenges and Significance

This year, the participants of the Case Study Challenge played the role of external actuarial consultants for SuperLife, one of the major life insurance companies in the fictional country of Lumaria. SuperLife was looking for ways to reduce its policyholders’ expected mortality rate with potential health incentive programs that could pair with its long-term insurance products. Its product development team had conducted some initial research, and executives believed that the next step would be to bring in outside consultants to get some new ideas and confirm some of the team’s findings.[1]

Playing one of the external consulting firms, our team contracted with SuperLife to develop a health incentive program that could be bundled with its long-term life insurance offerings. Team members were provided with in-force data for SuperLife’s current block of business, the initial research assembled by the product development team and key facts about Lumaria. They were asked to produce a professional report of their proposed health incentive program within 9 weeks. The proposed program needed to meet SuperLife’s primary goals of incentivizing healthy behaviors, decreasing expected mortality, increasing life insurance sales, improving product marketability and competitiveness, and adding economic value to the company.

There were three rounds of judging. The submitted reports were evaluated in the first two rounds to determine the semi-finalists and the finalists. The finalist teams were then invited to present their submissions to the judges for the final round of evaluation via video conference.

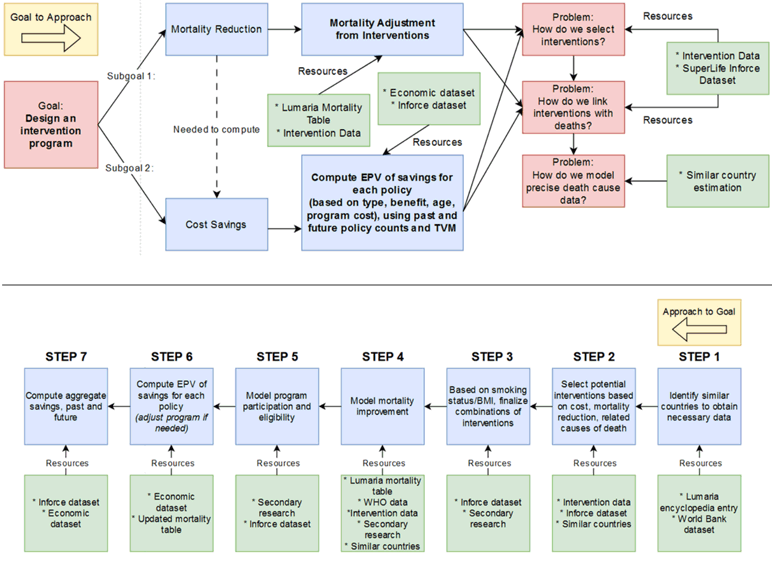

When the details of the case study were posted, the team faced the first challenge of identifying the key goals of the program; recognizing the major problems, questions and concerns; determining the tasks needed to achieve the goals; analyzing the resources provided; and listing the external research and datasets needed. After doing their initial research on the information provided, discussing it, and seeking my advice on the overall approach, the team was able to resolve this challenge by creating the overall plan presented in Figure 1.

Figure 1

The Big Picture

Once the road map was established, the team decided to divide the tasks to accelerate the progress of the research. This naturally led to the second challenge: how to collect and synergize the work of separate people dealing with disparate parts of the program. To resolve this, the team held weekly meetings to ensure they always had a chance to align the objectives, share work and discuss goals for the following week. As a faculty advisor, I attended the meetings and provided suggestions when asked. In addition, the team shared files through online cloud services—a set of Google Drive folders that Carly created, organized and maintained. Team members also communicated and collaborated with each other in several areas. They were able to maintain a strong line of sight toward their next set of goals and an idea of how their work would combine into the final project.

Each team member faced the challenge of completing their own work. Cameron’s first notable challenge was deciding which health interventions to use based on the limited data available. While the Lumaria encyclopedia was useful, there were barely any details regarding the population’s health. Cameron sought out any external data available to the team that might approximate the leading causes for mortality reduction. He matched relevant characteristics of Lumaria from the encyclopedia with those of other nations publicly available from the World Bank. He standardized the values obtained from that site and used a distance formula to estimate similar countries to Lumaria, then he used these nations and their health data from the World Health Organization (WHO) for comparison. Next, Cameron used the Sankey diagram to visualize the connection between the health interventions and the leading causes of mortality, which was completely new knowledge to him. He was able to find a useful site called SankeyMatic, quickly learned the concepts and operations, and attained the output needed. Based on these research outcomes, Cameron composed a report about the health intervention selection, which became the foundation of the program. He was also in charge of risk mitigation and sensitivity analysis.

With Cameron’s list of health intervention candidates, Carly designed the detailed features of the health program. In her role, she needed to answer three important questions: how to design the program to match the varying needs of different population groups; how to estimate the effect of the health intervention combinations on mortality reduction with the consideration of diminishing adjustment; and how to encourage public participation in the program. Carly did a lot of research and developed mathematical models to address these questions. To match the needs of various populations, she decided to focus on two key characteristics—smoking status and body mass index—to separate the population into four groups and designed separate intervention programs for each group. Each program contained four to five different interventions. Next, to estimate the effect of these intervention combinations, Carly used the cause of death data for Lumaria and similar countries (identified and collected by Cameron) to link with the intervention. The median of mortality reduction was used, and the age factor was considered. Carly developed a comprehensive mathematical model to reflect the general mortality reduction, then a diminishing model was added to adjust the overestimation of multiple reduction effects. Finally, she created another mathematical model to reflect the relationship between the participation rate and the amount of monetary incentives. As the program designer, Carly composed the main body of the reports.

Once the program design and mortality reduction effect were finalized, Emily and Lauren performed the calculations of mortality saving for the past 20 years if the team’s plan had been implemented and the predictions of the aggregate value of policies with the proposed program for the next 20 years. It should be noted that none of the students had been exposed to the actuarial mathematics needed before the project. In fact, they took the long-term actuarial mathematics course simultaneously with the Case Study Challenge. This means that Emily and Lauren had to learn the material as they did the project, especially understanding and implementing the formulas they used in Excel and for many other calculations. First, Emily and Lauren summarized the interest rate and inflation rate dataset and the SuperLife in-force dataset that contained almost one million policy data for the most recent 20 years. The summary was also used in the mortality reduction modeling. Premium price of each product without the program was computed, then the expected present value of each individual product after mortality reduction was computed for all the programs and ages. The time value of money was calculated and aggregated for all the in-force policies in the past 20 years. Finally, based on the time series of the policy numbers, the future 20 years’ policy numbers were forecasted and used in the prediction of future economic values generated by the program. In addition to the calculation, Emily and Lauren kept the records of all the model assumptions and data limitations.

During the nine weeks of research, the team had multiple discussions on the project priority, time management and methods/models to be used. Due to the large scale of the datasets, the complexity and openness of the problems and the time limitation, the most difficult challenge the team faced was how to determine the most important and urgent issues to be addressed at the time. The team had learned how to give up some unrealistic practices and focus on the major goal of the project. Running through the final report composition and editing in the last two weeks, the team submitted the report on the last day.

At that time, we did not expect to be able to go any further, as this was our first participation in a competition at such a high level, and our team was from a small program. We just celebrated that we had finally gotten this done and went back to normal life. We were extremely surprised and excited when we received an email announcing that we had been selected as one of the semi-finalist teams. One week later, we were informed that we were one of the finalists.

The team spent one week preparing the PowerPoint presentation document. I helped them review the document, listened to their Zoom presentation practices and provided feedback. I also let the team practice an in-person presentation in front of their classmates during one of my long-term actuarial mathematics classes. The team listened to several presentations on the SU student research conference that were held at that time. With all these practices and experiences, the students were prepared and confident to do their best on the final presentation day. On May 3, 2024, we received the email saying we were the third-place winner among 57 teams from 12 countries, the only US institution to win a prize.

Our Team: Feedback and Suggestions from Students

After the challenge, I interviewed the team for feedback and suggestions for future participants. (The challenges they faced during the project were listed in the previous section.)

Here’s Carly’s observation of what they learned from the challenge: “The most important thing I have learned is how to work with different people on the same project. Each of the four of us was involved in some separate part, and we had to find a way to work all of it into the program. Make sure it’s all compatible, has the right inputs and outputs. And it all makes sense in the context of our overarching goal.”

As to the biggest takeaway from this challenge, Emily explained, “The main thing that brought me to this project was getting some actual research experiences and understanding what it would really be like to work in real-life professional scenarios. I was happy that I decided to participate in this challenge.” Lauren added, “My biggest takeaway from this challenge is the impact working as a team can have. For this project, we only had nine weeks to get a considerable amount of work done—and none of us would have been able to do it alone. As a student, group projects can sometimes be strenuous, but this one has taught me just how important it is to be able to organize and divide tasks, communicate clearly and take others’ ideas into consideration.”

Finally, for the suggestions to the future participants, especially for those from small schools or programs, Cameron advised, “Our team got third place competing with some of the top universities in the world, with some of the best graduate programs in actuarial science. With an interesting approach and a thorough, detailed justification of your approach to the research, there’s no doubt you’ll get far. We were also lucky enough to have such an involved and helpful advisor. For the next challenge, be sure to use every resource available to you, and never be afraid to seek out help from your advisor and teammates. The more you inform and rely on each other to further your research, the further you’ll go.”

Conclusion: Small Program, Big Dream

Looking back at the three-month journey of the Case Study Challenge, it was an amazing learning experience that was full of challenges yet very rewarding—not just for the students, but also for me as the advisor. What I have learned from this journey is that, even if you’re a small program, don’t be afraid to dream big. One day, your efforts may surprise you by making the dream come true.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Jiacheng Cai, Ph.D., is an associate professor and the Actuarial Science Program coordinator in the Department of Mathematical Sciences at Salisbury University. Jiacheng can be reached at jxcai@salisbury.edu.