Reconsidering Embedded Value

By Joy Chen and Erzhe Zhang

The Financial Reporter, April 2021

Life insurance companies are constantly looking for ways to improve financials, gain insights for strategic decisions, and better communicate value.

Companies are reconsidering an embedded value (EV) framework for external and internal reporting. This article provides an EV overview, current industry usage, key considerations illustrated by MetLife’s strategic spin-off of Brighthouse Financial, as well as implementation notes.

Life Insurance is Unique

Life and annuity business are characterized by long-term contractual features and unique risks. Commonly used accounting-based performance metrics (e.g., return on equity, operating earnings) are not designed for insurance business and do not fully capture the long-term nature of life insurance operations. However, Wall Street analysts anchor to these metrics, resulting in a skewed assessment of life insurance business.

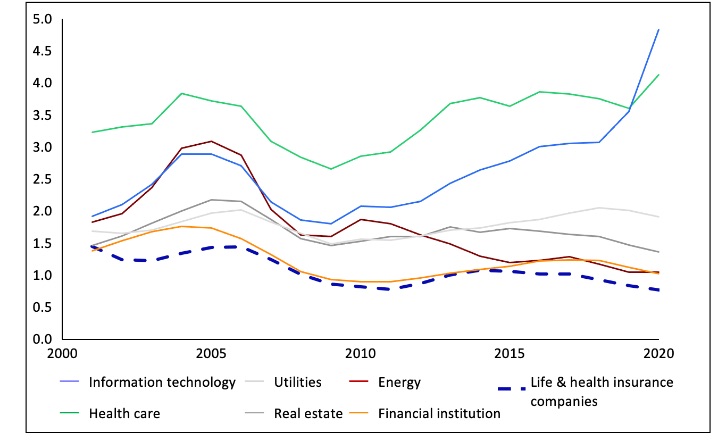

Figure 1 shows a comparison of price-to-book ratios across different sectors. Insurance companies’ market value lags behind book value and company management struggles to explain earnings emergence. As a result, analysts and investors require additional risk premium to compensate for perceived opaqueness.

Figure 1

Price-to-book Ratio by Sector

EV Increases Transparency

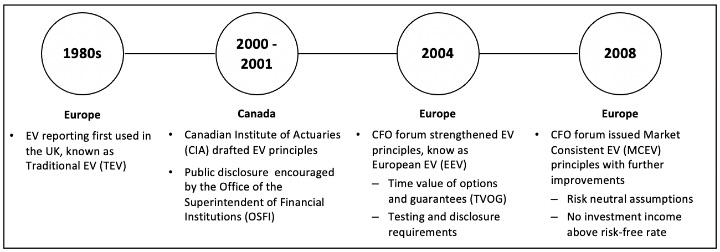

To overcome the shortcomings of accounting-based performance metrics, EV was first developed in the United Kingdom in the 1980s as a supplementary profitability measurement and evolved over time. Figure 2 outlines the history and evolution of EV.

Figure 2

History and Evolution of EV

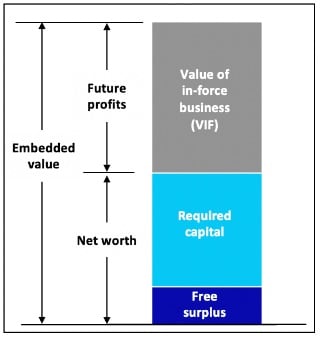

Today, EV is widely calculated and disclosed by life insurance companies domiciled outside the United States to represent shareholder value. Profitability generated under an EV framework is measured as the EV change during a reporting period, split into two parts: Future profits and new worth. Figure 3 outlines the building components of EV.

Figure 3

EV Components

EV provides an economic depiction of overall business performance and realistic valuation of expected shareholder value in life insurance companies, which helps with the following:

EV provides an economic depiction of overall business performance and realistic valuation of expected shareholder value in life insurance companies, which helps with the following:

- Strategic decisions: Value of new business (VNB) analysis can be used to optimize profit and risk during pricing;

- In-force management: EV emergence for in force identifies areas to grow, maintain, or divest; and

- Comparative value: EV supports comparative financials across countries and reporting jurisdictions, and facilitates communication with investors on future profitability generation capabilities.

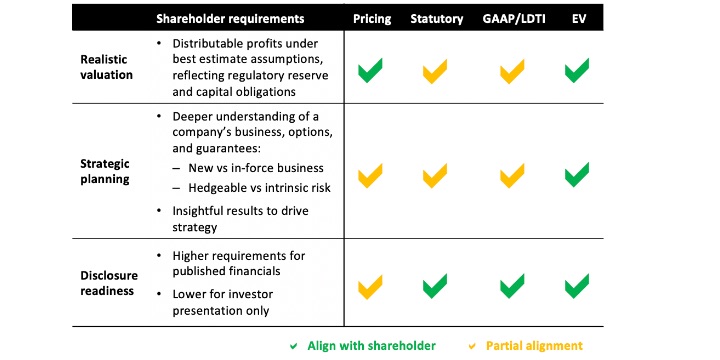

Figure 4 shows a comparison of EV to common U.S. accounting metrics and how EV provides additional insights into value creation. U.S. Statutory accounting contains conservatism and does not reflect true shareholder value. Additionally, regulatory regime variations make cross-country comparisons difficult. GAAP income is not distributable and aligning expenses with revenues can be considered unrealistic.

Figure 4

Shareholder Value Alignment Under Various Reporting Framework

Further, EV helps to explain business changes that are often unintuitive under other accounting regimes (and need to be addressed through operating earnings and other measures):

- Shareholder value created by management actions during the reporting period. Further breakdown of earnings by lines of business provides management insights on areas to deploy capital and resources that best align with company’s long-term strategic initiatives. Management assesses value of new business, contributions from in-force business, and operating variance (e.g., backward-looking experience variance and forward-looking assumption changes).

- Economic variance beyond management control: Management can set up a stringent ALM and hedging program in order to reduce exposures and mitigate the risks in economic variance.

US Insurers Reconsidering EV to Represent Shareholder Value

In the United States, GAAP-based profitability metrics are more prevalent than embedded value. Acknowledging the shortcomings in GAAP reporting, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update 2018-12, “Targeted Improvements to the Accounting for Long-Duration Contracts” (LDTI) in August 2018. LDTI is expected to make the reported financials more comparable across different life insurance companies and provide a more realistic view on economic and insurance risks underlying long-duration insurance contracts. However, some insurers remain dissatisfied with LDTI and believe that EV could be a valuable supplemental metric, especially if LDTI is expected to bring significant transitional impacts.

MetLife, an EV Success Story

MetLife began EV implementation in 2014 and has successfully integrated the framework into reporting, strategic decision making and value communication.

Over the past five years, MetLife has been able to align strategy and value and showcase growth to investors through EV-based strategic initiatives. These initiatives are oriented toward writing less capital-intensive business with stronger free cash flows within a reasonable payback period (i.e., more cash sooner and achieve returns over the hurdle rate). The annual year-over-year comparison of VNB and analysis of EV change identify the main drivers of the value creation to support the initiative.

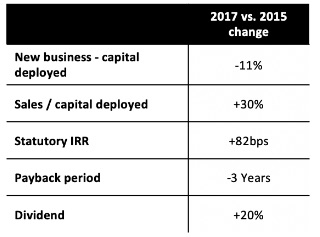

As a result, in 2016 MetLife announced the spinoff of its U.S. retail business (which is now Brighthouse Financial) and shifted focus to its capital-light businesses. Figure 5 shows how MetLife improved value and free cash flow after the strategic spinoff.[1] This spinoff reinforced MetLife’s focus on businesses that have lower capital requirements and greater cash flow generation potential.

After the spinoff completed in 2017, significant capital redeployment to higher IRR business has contributed to increasing value of new business, shorter payback period and higher dividends (i.e., free cash flows).

EV Implementation Considerations

For a company that plans to adopt an EV framework, it’s crucial to get management buy-in on the reasons and resources for implementing EV, embed this into decision-making in the businesses, and assess the strategic impact. Without appropriate definition of performance measurement metrics and ongoing monitoring practices, EV quickly fails its purpose and becomes a pure “reporting” metric.

Below are the key considerations and pitfalls to avoid during the implementation to drive a successful EV framework.

Organizational engagement: Ensure adequate time to operationalize and embed the framework in all areas, including pricing, IT, finance, investor relations, etc. Strong governance over the models and processes will help ensure EV metrics are calculated and reported in a controlled way.

Achieve management buy-in: Align management incentives to metrics to ensure the framework is used for decision making. Several metrics should be included to fully capture risks/management goals and avoid maximizing a single metric.

Align framework to value: Define purpose of performance measurement metrics upfront and align the framework and assumptions to that purpose. This should ultimately relate to shareholder value.

Actuarial capabilities: Ensure capability and capacity to enhance and maintain EV models, especially with regard to embedded options and guarantees.

Active engagement: Ensure all stakeholders understand the purpose, objectives, use and priority of the EV implementation. Clearly written, top-down instructions and training ensure all business units follow the guidance consistently and meet deadlines.

Automation and controls: Automate input load and downstream processes, set up standardized analytics package to support effective management review, promote controls and prevent inadvertent changes.

New business definition: A clear definition of “new business” will help settle questions and make the new business portion of attributions easier to analyze.

The views or opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of Oliver Wyman or of the Society of Actuaries.

Joy Chen, FSA, CERA, is a senior consultant at Oliver Wyman. She can be reached at joy.chen@oliverwyman.com.

Erzhe Zhang, FSA, is a principal at Oliver Wyman. He can be reached at erzhe.zhang@oliverwyman.com.