Income Volatility Under LDTI

By Bruce Rosner, Joy Zhang, Daniel Dvorin and Jack Zheng

The Financial Reporter, February 2021

Long-duration targeted improvements (LDTI), also known as Accounting Standards Update 2018-12, include a collection of big and small changes to US GAAP calculations. Many of these changes will require us to develop a new “muscle memory” or instinctive sense for the way that income will react to unexpected variances, such as claims variances, financial market movements and nonfinancial assumption updates. It will be incumbent on actuaries to help finance and business leaders understand the financial impacts and develop that same muscle memory under LDTI.

In this article, we aim to cover the following:

- We provide an assessment of income volatility for several key types of long-duration contracts, along with select illustrations, and areas where accounting policies or methodologies can influence income volatility.

- We show how a company’s management reporting can be adapted to help explain income variances under LDTI.

This article assumes that the reader has a basic knowledge of LDTI and aims to build on that foundation.[1] Our analysis below is based on projected income statements for a variety of illustrative products; actual results can vary from our findings based on specific facts and circumstances.

High-Level Results at a Glance

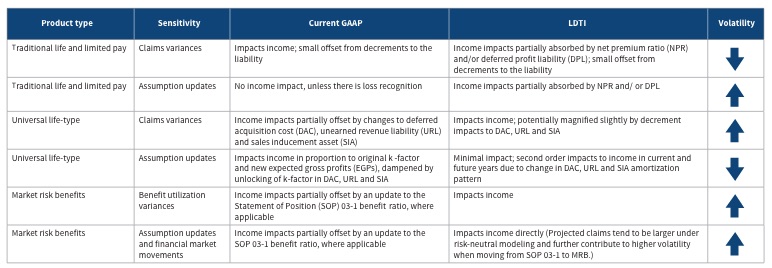

For traditional life, limited pay and universal life (UL) types of products, and products with a market risk benefit (MRB), an overview[2] of impacts for selected variances is provided in Figure 1. The down arrow indicates income volatility is reduced under LDTI as compared to current GAAP, and vice versa for the up arrow.

Figure 1

Overview of Impacts of Selected Variances

Traditional Life

Under current GAAP, traditional life products follow the guidance in Accounting Standards Codification (ASC) 944-40-30 (previously Financial Accounting Standard (FAS) 60) where reserves are locked in at issue using padded assumptions unless there is a loss recognition event. Under LDTI, however, the liability is calculated with current best estimate assumptions and NPR is unlocked retrospectively back to issue (or transition). During times of unexpected variances, income volatility will behave as follows under current GAAP vs LDTI:

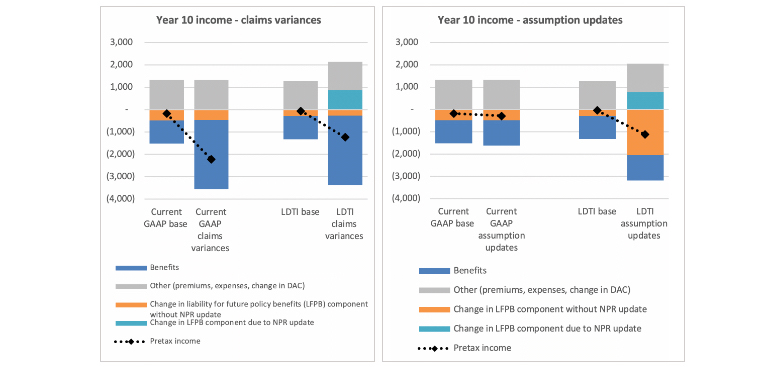

- Lower volatility under LDTI for claims variances—Suppose we have a large unexpected claim in year 10. Under current GAAP, the increased claim amount would reduce income in the year it occurs, and there is only a slight offset since the reserve is locked-in and only adjusted to reflect the additional decrements. Under LDTI, the increased claim would similarly flow through to income for that year. However, the reserve is also reduced as NPR is retrospectively unlocked and increased with the excess claims. This provides a partial offset to the claim impact and mutes the income loss. In general, the change in reserve would not fully absorb the impact from claims, but LDTI is expected to produce more stable income to the extent NPR is not capped at 100 percent. When NPR is capped, income volatility under LDTI will be similar to current GAAP.

- Higher volatility under LDTI for assumption updates—Suppose we increase our mortality assumption starting in year 10. Under current GAAP, this does not impact income, as the liability remains at padded assumptions set at issue assuming the company still passes loss-recognition testing. Under LDTI, the liability is updated to reflect the higher future claims. However, NPR is also increased, which reduces the liability, providing a partial offset. The degree of this offset varies based on duration since issue or transition, which is discussed later in this section. Overall, income under LDTI is more sensitive to assumption updates as compared to current GAAP; however, it is not as sensitive as it could have been if there had been no retrospective unlocking of NPR.

Figure 2 illustrates these effects on a 20-year term life product.

Figure 2

Term Life Income Impact

DAC is not a major driver of income volatility under current GAAP or LDTI for these products, because of the lack of retrospective unlocking of the k-factor under either basis and simple amortization drivers; see the next section on universal life for further discussion of DAC under LDTI.

Similarly, interest rates are not a driver of income volatility under current GAAP or LDTI. Under current GAAP, interest rates are locked in. Under LDTI, changes in discount rates will affect equity via other comprehensive income (OCI) and are not addressed further in this article.

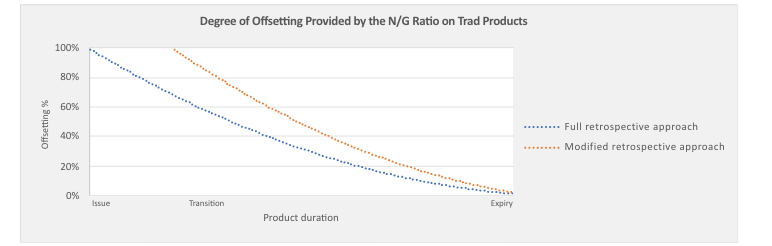

As shown in Figure 3, under LDTI, NPR absorbs income volatility at different degrees over the product’s life cycle, ranging from close to 100 percent near contract issue to close to 0 percent near cohort expiry under the retrospective transition approach (and for new contacts issued after the LDTI transition date) when the NPR is not capped at 100 percent at transition or issue. Under the modified retrospective approach, a similar pattern holds, but it ranges from close to 100 percent near transition (rather than issue) to close to 0 percent near cohort expiry.

Figure 3

Term Life NPR Offset

Given that NPR unlocking is an important lever that potentially reduces income volatility, companies may want to consider how the level of aggregation affects the potential for capping NPR at 100 percent. The more granular the level of aggregation, the more likelihood the NPR would be capped at 100 percent. Additionally, companies will likely want to avoid updating NPR on a lagged basis, as that would further increase volatility in income when the offsetting effects of claims/assumption updates and NPR updates happen in different periods.

Limited Pay

Limited pay products’ results are similar to traditional products discussed above, using DPL as part of the mechanism to absorb variances. NPR will still unlock (other than for single-pay products, which do not have NPR), and then the DPL will act to further push the impact of experience variances and assumption changes into the future as it amortizes past the premium-paying period.

Universal Life

Under current GAAP, UL life products follow the guidance in ASC 944-40-30 (previously FAS 97), where the base contract reserve is set equal to the account value, premiums are not accounted for as revenue and only claims paid in excess of the account value are accounted for as an expense. DAC, URL and SIA balances are calculated using best-estimate assumptions and unlocked retrospectively each period when there are experience and assumptions updates. These balances are typically amortized over EGPs, where EGPs typically consist of mortality margin, contract administration margin, investment earnings spread, surrender charges, and other expected assessments and credits.

Under LDTI, reserves are still equal to account value, and there are no direct changes to the SOP 03-1 liability.[3] The calculation of DAC, URL and SIA balances has been simplified and made consistent among all long-duration contracts. They are now amortized on a constant-level basis over the expected term of the contracts, along with a number of other changes.

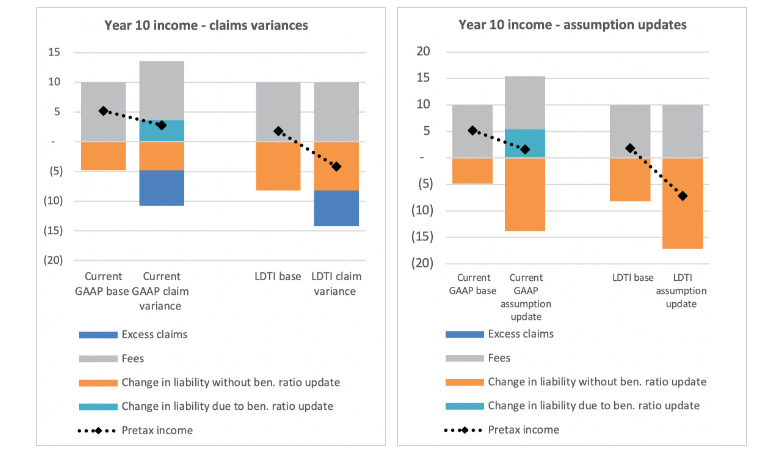

While the new DAC calculation and amortization method under LDTI does provide for a more simplified calculation, it comes with some consequences to income volatility during times of unexpected variances for UL products:

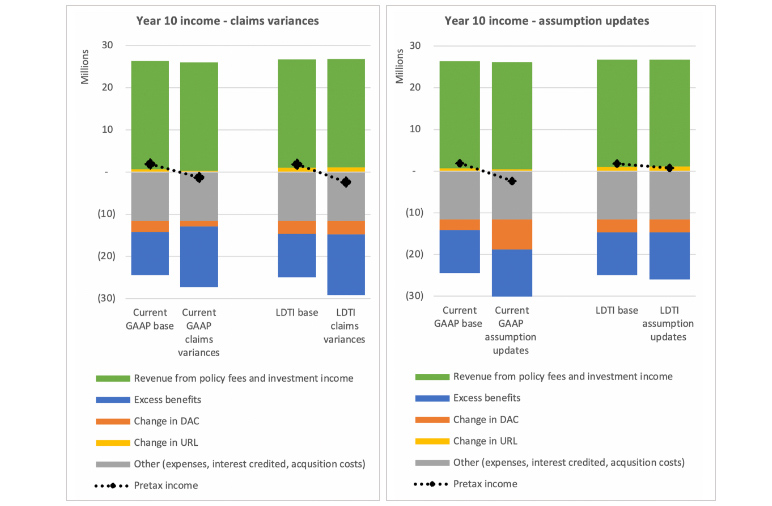

- Higher volatility under LDTI for claims variances—Suppose we have a large unexpected claim in year 10. Under current GAAP, this would reduce the profit in that year (while having a marginal impact on future years’ EGPs) and increase the k-factor. The smaller actual gross profits in the year (offset by a higher k-factor) result in less DAC, URL and SIA amortization during the period, which produces a buffering effect to the adverse claims experience.[4] The magnitude of the buffering ranges from the percentage of the net k-factor to 0 percent, depending on the contract duration and subject to factors like a cap to the balance, recoverability and potentially flooring of EGPs.

Meanwhile, under LDTI, there will no longer be any buffering effect from an adverse claims experience. With more deaths (and keeping lapses and other decrements constant), the number of units in force will be reduced, which will result in a slight increase to the amount of amortization in the year. Thus, the impact to net income will be slightly magnified, rather than buffered. - Lower volatility under LDTI for assumption updates—Suppose we increase our mortality assumption starting in year 10. Under current GAAP, this would reduce current-period (year 10) and future years’ profits given higher excess claims and increase the k-factor. This causes a potentially large prospective unlocking adjustment to the current period DAC balance (depending on the degree of assumption updates), where additional DAC is written down to reflect lower future EGPs, which is partially offset by a higher k-factor.

Under LDTI, however, the impact of the assumptions update to DAC would be spread over the remaining life of the contract due to the change in the amortization pattern, with a relatively small impact to current period income.

Figure 4 illustrates these effects on a UL product.[5]

Figure 4

UL Income Impact

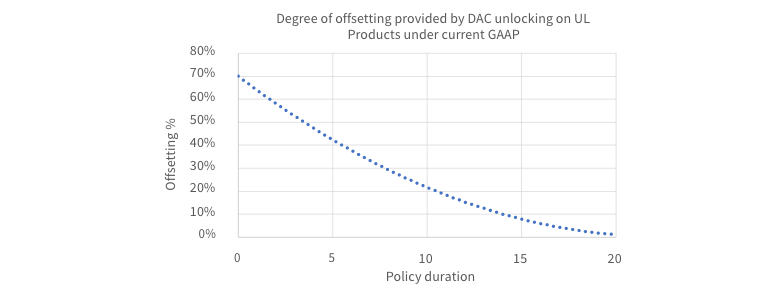

We also observed that under current GAAP for claims variances, the degree of offset provided by unlocking of DAC is highest near contract issue (where the offset percentage is equal to the net k-factor), and the offset percentage decreases steadily over the life the contract, as illustrated in Figure 5.

Figure 5

UL DAC Unlocking Offset

Given the increased level of volatility from claims variances, companies may want to consider whether they need to more tightly manage or reduce the risk exposure with this type of business.

Variable Annuity With a Guaranteed Benefit Rider

LDTI introduces the concept of MRBs, which will now apply to many features previously measured as an embedded derivative or under SOP 03-1. The value of MRBs under the revised framework is determined using fair value (similar to embedded derivatives), typically based on a risk-neutral projection and a locked-in attributed fee ratio.

The following are some of the key changes to income volatility for these products (organized by current valuation methodology):

PRODUCTS CURRENTLY FOLLOWING FAIR VALUE GUIDANCE

- Changes to own credit spread (OCS) will shift from recognition in income under current GAAP to OCI under LDTI, reducing volatility in net income for a risk that is particularly difficult/undesirable to hedge.

PRODUCTS CURRENTLY FOLLOWING SOP 03-1 GUIDANCE

- Benefit utilization variances—Under SOP 03-1, an increase in benefit utilization would have the effect of increasing the benefit ratio, which would dampen the loss resulting from the increase in utilization. This unlocking mechanism goes away with LDTI. For an MRB, the attributed fee ratio is locked-in at issue. Consequently, the higher utilization is not offset with the benefit ratio mechanism, and the impact of the full experience variance flows through to the bottom line.

- Assumption updates and financial impacts—Under SOP 03-1, an increase to expected claims is dampened by the increase in benefit ratio, similar to the rationale outlined above for utilization variances. For an MRB, the impact of this assumption update comes through as the full impact of the change to future projected cash flows, due to the locked-in attributed fee ratio. Furthermore, the risk-neutral framework typically used for fair value tends to yield a projection where more policies are “in the money.” This results in larger impacts from assumption changes, and more income volatility.

Figure 6 illustrates these effects on a guaranteed minimum income benefit (GMIB) product[6] that is accounted for under SOP 03-1 for current GAAP purposes and as an MRB under LDTI.

Figure 6

VA With GMIB Rider Income Impact

Companies have different policies and methods that will influence the level of volatility of the MRB balance (e.g., option versus non-option approach; which fees to incorporate in the attributed fee ratio; how to measure changes in OCS going through OCI). We also expect that companies hedging GAAP earnings will use this as an opportunity to refresh their hedging and risk management strategy for variable annuities, alongside updates to statutory accounting for variable annuities.

Understanding and Explaining Income

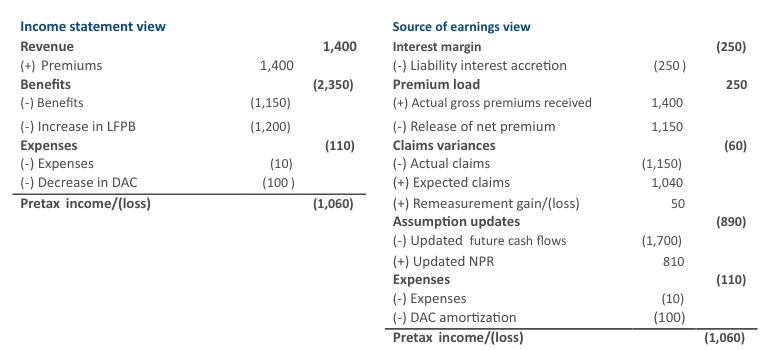

The changes to traditional and limited pay products in particular pose new challenges in understanding and explaining income. One of the more powerful tools in companies’ arsenals to do so is a source of earnings (SOE) report. An SOE report commonly arrives at the same net income/loss as the income statement, but with results broken out in a way that is more insightful and actionable.

Figure 7 illustrates one possible way to do this for a sample 20-year term product. In the current reporting year, actual mortality is 10 percent higher than expected, and future mortality assumptions have also been increased by 10 percent. Under the income statement view (left table), it is difficult to explain why there is a loss of $1,060. Under the SOE view (right table), the $1,060 loss is broken down into income drivers. We can clearly see that the mortality assumption update is the most significant driver of this year’s loss.

Figure 7

Income Statement View Vs. Source of Earnings View

The overall structure of this SOE report will be familiar to many people. Our illustrative example shows additional line items for remeasurement gain/loss from experience variances, as well as two new line items reflecting the assumption update. Additionally, the expected amount of income coming through various line items will shift around as a result of changes to the locked-in interest rate, DAC amortization methods and the many other revised calculations.

Conclusion

LDTI introduces many changes to GAAP reporting. We identified areas with the potential for increased income volatility—assumption updates for traditional life products, experience variances for universal life products and annuity products currently following SOP 03-1 guidance. We also identified certain areas with potentially reduced income volatility—experience variances for traditional life products and assumption updates to many universal life products.

As actuaries gain familiarity with the new mechanisms that LDTI introduces, they should seek to take the next steps that will provide ongoing value to management. They should analyze real products using financial assessment tools in order to identify suitable accounting policies and actuarial methodologies. They should update management reporting with input from key stakeholders and take a lead role in providing education to others in the organization. And they should reassess hedging and risk management practices in a way that considers financial reporting alongside the underlying economics.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Bruce Rosner, FSA, MAAA, is a managing director at Ernst & Young LLP. He can be reached at bruce.rosner@ey.com.

Joy Zhang, FSA, CERA, MAAA, is a manager at Ernst & Young LLP. She can be reached at joy.zhang@ey.com.

Daniel Dvorin, FSA, MAAA, is a manager at Ernst & Young LLP. He can be reached at daniel.dvorin@ey.com.

Jack Zheng, FSA, MAAA, is a manager at Ernst & Young LLP. He can be reached at jack.zheng@ey.com.