An Examination of Market Risk Benefits with Reinsurance under LDTI

By Nelson Lum and Christie Shi

The Financial Reporter, June 2021

In 2018, the Financial Accounting Standards Board (FASB) issued “ASU 2018-12, Targeted Improvements to the Accounting for Long-Duration Contracts (LDTI).” The standard changes how entities recognize, measure, present and disclose long-duration contracts issued by insurance entities. Since 2018, the FASB issued ASUs 2019-09 and 2020-11 to extend the effective date for all entities. The revised effective date is Jan. 1, 2023 for SEC filers, excluding smaller reporting companies, and Jan. 1, 2025 for all other entities. This article focuses on the market risk benefit (MRB) measurement model and will examine a generic guaranteed minimum death benefit (GMDB) in the context of LDTI and its impact from both the ceding entity and the reinsurer standpoints. We will discuss the measurement of gross MRB and ceded MRB in a GMDB example.

Under current US GAAP, benefits in addition to a contract holder’s account value are either measured under ASC 820 (formerly FAS 157) if they are embedded derivatives or under ASC 944 (formerly SOP 03-1) if they are within the insurance accrual model. Under LDTI, these benefits will be measured as market risk benefits if they meet the following definition: An MRB is a contract or contract feature that both protects the contract holder from other-than-nominal capital market risk and exposes the insurance entity to other-than-nominal capital market risk. Benefits that are in addition to the account balance, such as guaranteed minimum benefit features, will be MRBs and recognized at fair value. Two methods are expected to be used to measure the fair value of the MRB when separated from the underlying insurance contract: an option-based valuation approach or a non-option valuation approach. The focus of this article is the non-option valuation approach, which is also referred to as the “attributed fee” method. Under this method, discounted cash flows are scenario dependent. Risk neutral stochastic scenarios are generated with an average return consistent with risk-free rates. The discount rate is the sum of the risk-free rate and the credit spread of each scenario. Using the average of the discounted cash flows from all stochastic scenarios, an attributed fee ratio is determined as the average of the present value (PV) of future benefits over the average of the PV of future fees as of the contract issue date. Once set at issuance, the attributed fee ratio is locked in. The fair value of the MRB will be zero at issue which is achieved by the attributed fee calculation. The attributed fee cannot exceed the total contract fees and assessments from the contract holder or be less than zero. Subsequently, the fair value of the MRB is calculated as the average of the PV of future benefits less the average of the PV of fees multiplied by the locked-in attributed fee ratio.

Under the current insurance accounting model, contract features are frequently aggregated for measurement—this is referred to as the unit of account. Under LDTI, from the perspective of a ceding entity, when there are multiple contract features in an individual contract, each feature is separately evaluated to determine if it meets the definition of an MRB. If a contract includes multiple MRBs, those benefits are aggregated and measured as a single compound MRB (a single unit of account), which means that all fair value assumptions are considered together and the valuation considers the interdependencies of all benefits.

From the perspective of a ceding entity, the MRBs are valued on a gross and a ceded basis. The ceded MRB is valued separately because it is based on the ceded cash flows. The valuation discount rate for the gross MRB is the risk-free rate plus the entity’s credit spread, reflecting the entity’s own credit risk. The discount rate is updated at each reporting date based on the current rates. A change in the fair value of an MRB is recognized in net income, except for that portion of the fair value change attributable to a change in the instrument-specific credit risk which is recognized in other comprehensive income (OCI). The discount rate for the ceded MRB valuation is the risk-free rate plus the reinsurer’s credit spread, reflecting the default risk of the reinsurer. The change in the fair value of the ceded MRB, which includes the change in the reinsurer’s default risk, is recorded in net income.

From the perspective of the reinsurer, the MRB is measured as of the date that the reinsurer assumes the risk. For a reinsurer, if only the rider (contract feature) is assumed, the premiums are set at the reinsurance premium in the treaty while in contrast. If the inception value for the reinsurer is not zero, then some reinsurers may choose to adjust the risk margin to achieve a zero-inception value. This may occur if the valuation hasn’t captured market expectations for experience and risk. Alternatively, the reinsurer may explain why the price of the reinsurance is different from a market price.

For the ceding entity the attributed fee is capped at the total contract fees and assessments collectible from the contract holder. Assuming a non zero gain or loss is deemed appropriate under a fair value measurement, then any gains or losses that occur at the issuance of the reinsurance contract would be considered part of the cost of reinsurance (COR) amortized over the life of the underlying business. Neither current GAAP nor LDTI specifies the method of amortization for the COR.

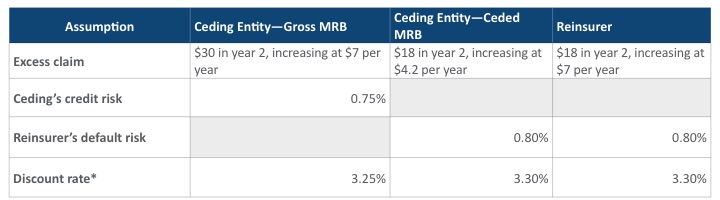

The following example shows the measurement of a GMDB contract feature within an annuity contract from the perspective of both the ceding company and the reinsurer. On Jan. 1, 2023, the ceding entity writes the contract and simultaneously reinsures 60 percent of the GMDB rider to a third-party reinsurer.

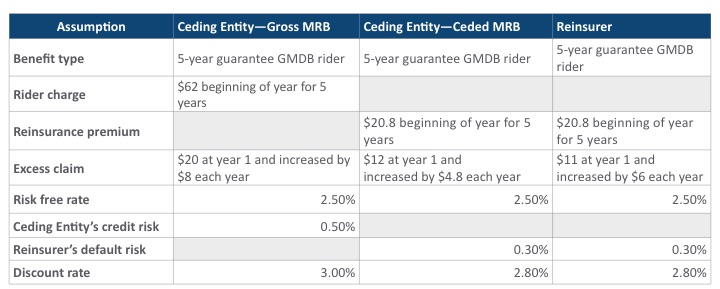

In practice, multiple stochastic scenarios are expected to be used for the MRB measurement. In this example, we assume that there is only one scenario: A declining equity market scenario. Table 1 shows the assumptions and inputs as of Jan. 1, 2023 for both the cedant and reinsurer. We assume the rider charge to be a flat percentage of the guaranteed value for the ceding entity. The equity market is assumed to decline leading to an increase in the excess claims and stable fees. The reinsurer and the ceding entity have different views on the liability assumptions and therefore different excess claims. The discount rate is the sum of risk-free rate and the credit spread of this scenario. All numbers in the tables are rounded.

Table 1

Assumptions at Jan. 1, 2023

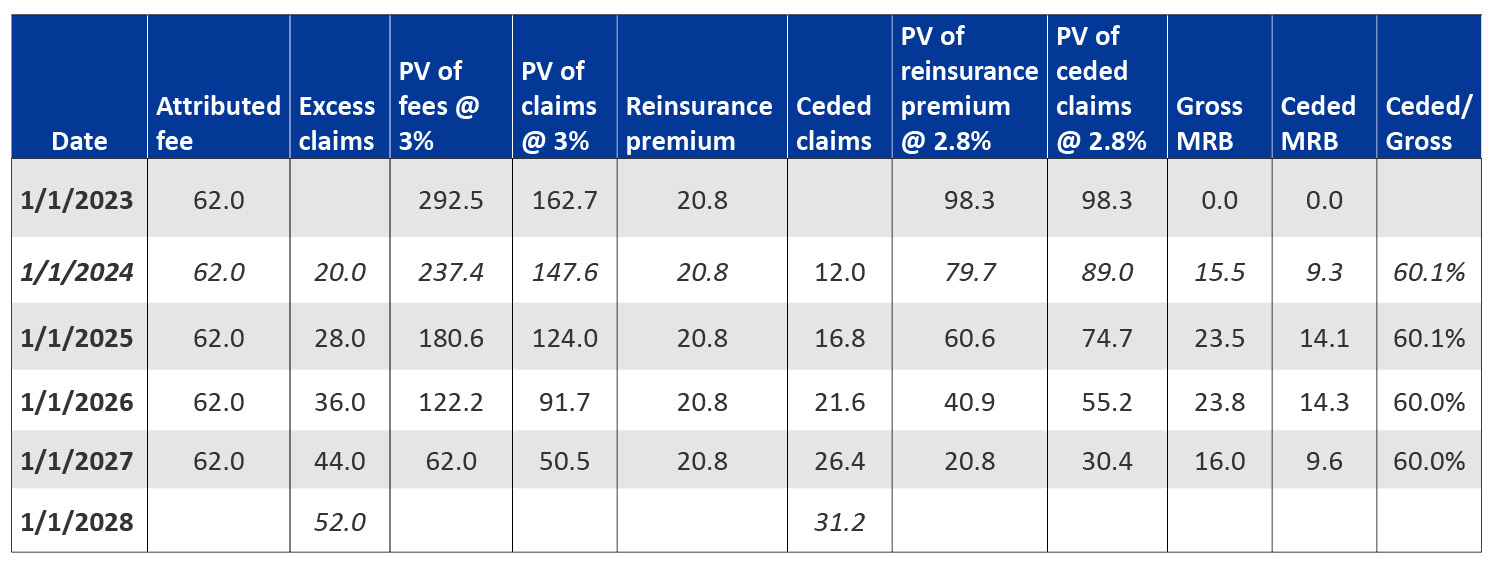

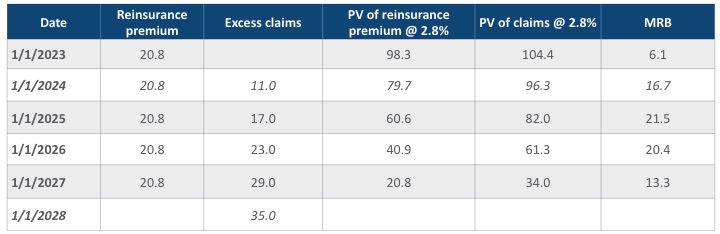

Table 2 below shows the measurement of the gross and ceded MRB calculated by the ceding entity as of Jan. 1, 2023. The at-issue gross attributed fee ratio is 55.6 percent determined as the average of the PV of excess claims divided by PV of fees. Note that the ratio of ceded MRB to gross MRB is not exactly 60 percent due to the different discount rates used in determining the present value of the gross and ceded cash flows. In Table 2, there is no gain or loss at inception for either gross or ceded MRB. Since the reinsurance transaction does not have a gain or loss, there is no cost of reinsurance to be amortized.

Table 2

Cedant Measurement at Jan. 1, 2023

Table 3 shows an update of the credit spread (or non-performance risk) assumption and the cash flow assumptions at Jan. 1, 2024. Both the ceding entity and reinsurer have been downgraded and update their non-performance risk by increasing their credit spread or default rate. We assume no change in the risk-free rate. With the new credit spread, the discount rate for gross and ceded cash flows is 3.25 percent and 3.30 percent respectively.

Table 3

Updated Assumptions at Jan. 1, 2024

*Discount rate is the sum of risk-free rate of 2.5 percent and credit spread of 0.75 percent for the gross MRB calculation, and the sum of risk-free rate of 2.5 percent and reinsurer’s default risk of 0.8 percent for the ceded MRB and reinsurer’s MRB calculation.

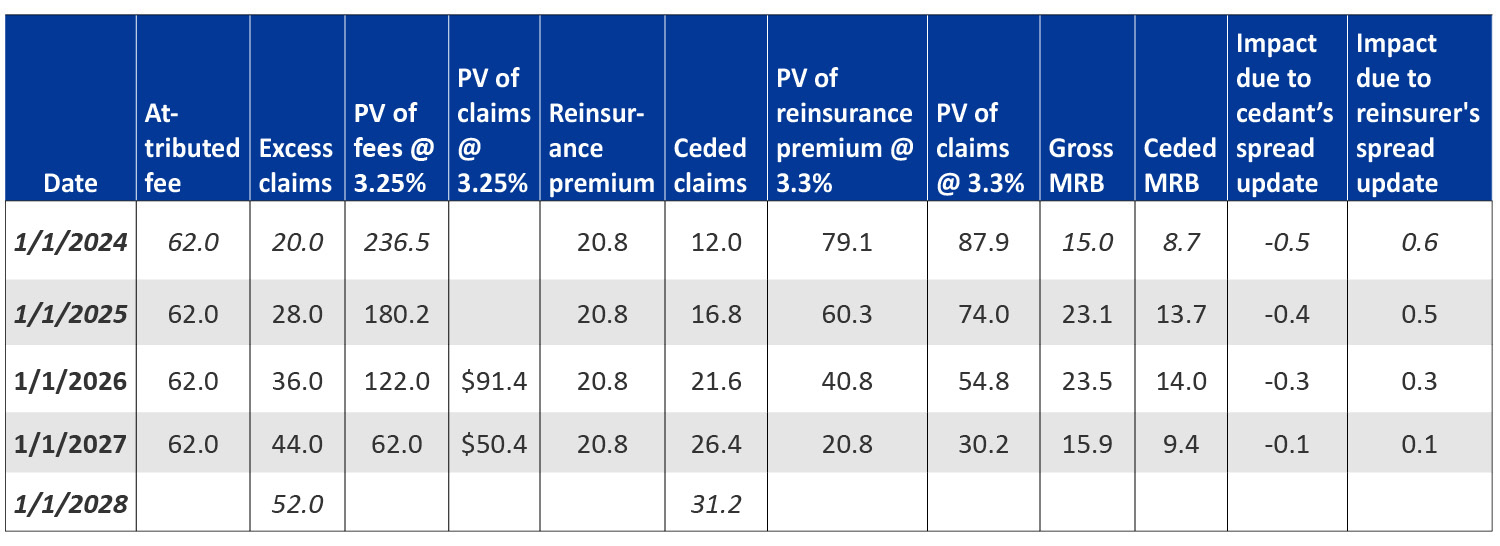

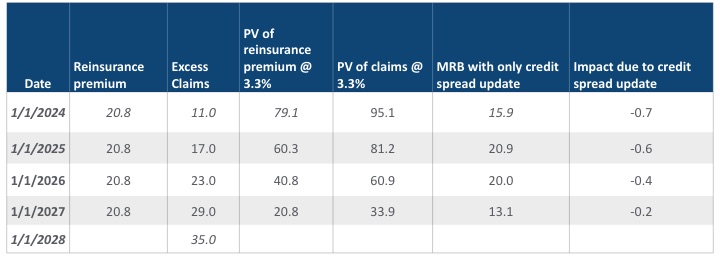

We first examine the impact of the credit spread, excluding updates to the cash flow assumptions. Table 4 shows the new measurements of the ceding entity based on the updated credit spread for the cedant and the updated default risk for the reinsurer. The changes in the gross MRB due to cedant’s spread update are the difference between Table 4 and Table 2; these impacts are recorded in OCI. A higher cedant’s credit spread reduces the MRB liability, which increases the impact on OCI. Similarly, the changes in the ceded MRB due to reinsurer’s default risk update are the difference between Table 4 and Table 2; these impacts are recorded in net income. A higher reinsurer’s default risk reduces the ceded MRB asset, which reduces net income.

Table 4

Cedant Measurement at Jan. 1, 2024—Credit Spread Update Only

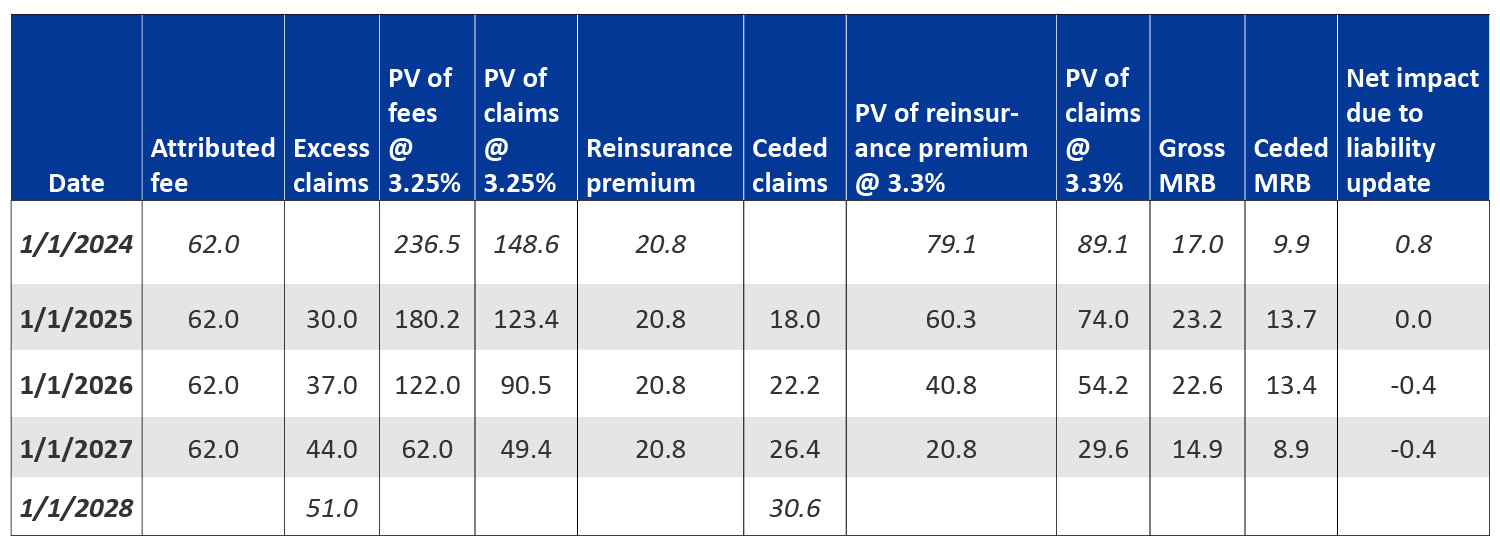

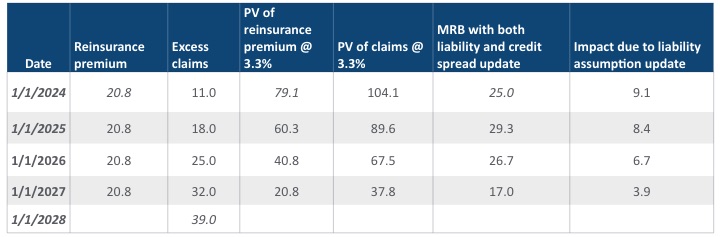

Next, we examine the impact of a cash flow assumption update on Jan. 1, 2024. Table 5 shows the new measurement based on both the credit spread and the cash flow assumption updates for the ceding entity. The changes in the MRB due to cash flow assumption updates (excluding changes in credit spread) are the difference between Table 5 and Table 4. These impacts are recorded in net income. In 2024 and 2025, higher PV of projected claims increase the MRB liability and reduce net income. In 2026 and 2027, lower PV of projected claims decrease the MRB liability and increase net income. Depending on the order in which the credit spread or cash flow assumption updates are quantified there may be slight differences in the numbers booked into OCI and net income due to the interactions between discount rate and cash flow assumptions within the projection.

Table 5

Cedant Measurement at Jan. 1, 2024 With Both Spread and Liability Assumption Update

Next, we examine the measurement from the perspective of the reinsurer. Table 6 shows the reinsurer’s measurement of the MRB liability at Jan. 1, 2023. In order to secure additional market share, the reinsurer is willing to accept a below market rate leading to a non-zero MRB at issue.

Table 6

Reinsurer Measurement at Jan. 1, 2023

At Jan. 1, 2024, the reinsurer updates both its own credit spread and cash flow assumptions as shown in Table 3. The reinsurer first calculates the MRBs fair value by only updating the credit spread. Table 7 shows the new measurement of fair value at Jan. 1, 2024 with only a credit spread update. The impacts due to the credit spread update are the difference in MRB between Table 7 and Table 6. These impacts are recorded in OCI. A higher credit spread decreases the fair value liability and increases OCI.

Table 7

Reinsurer Measurement at Jan. 1, 2024—Credit Spread Update Only

Subsequently, the reinsurer calculates the MRBs fair value due to cash flow assumption updates and measures the impact on Jan. 1, 2024. Table 8 shows the new measurement of fair value at Jan. 1, 2024. The impacts due to cash flow assumption updates are the differences in MRB between Table 8 and Table 7. These impacts are booked to net income. Higher projected claims increase fair value liability and reduce income. Note that the cash flow assumption updates significantly impact the earnings in this example, indicating that the cash flow assumption updates may bring significant volatility to earnings of GMDB policies with the transition from the insurance accrual model (SOP 03-1) to the MRB measurement model. The increased volatility due to market movements can be mitigated through hedging activities which would be offset by increased costs.

Table 8

Reinsurer Measurement at Jan. 1, 2024 With Both Spread and Liability Assumption Update

Summary

In this article we examined an approach to the MRB measurement model for a generic GMDB from the standpoint of both the ceding entity and the reinsurer. Our simplified example assumes cedant fees are based upon the guaranteed value in a declining equity market scenario. We examine the impacts on the MRBs fair value, OCI and net income due to updates of credit spread and cash flow assumptions from the perspective of both the cedant and reinsurer. Insurers with GMxB’s may experience an increase in volatility under LDTI as some benefits, like the GMDBs, will move from the insurance accrual model to the MRB measurement model, which may be mitigated with hedging. There are differences between current US GAAP and LDTI when measuring these benefits including, their classification, potential increased volatility, the unit of account for the ceding entity and recognition of instrument specific credit risk into OCI.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Nelson Lum, FSA, ACIA, MAAA, is a director at KPMG LLP. He can be reached at nlum@kpmg.com.

Christie Shi, FSA, CERA is a senior associate at KPMG LLP. She can be reached at xiaoxiaoshi@kpmg.com.