Accounting for Ceded Reinsurance Under LDTI—Constraints

By Steve Malerich

The Finanical Reporter, July 2022

Among the changes to accounting for traditional contract liabilities under GAAP’s Targeted Improvements to the Accounting for Long-Duration Contracts (LDTI), net premiums may not exceed gross premiums (ASC 944-40-35-7A) and the liability for future policy benefits may not be less than zero (ASC 944-40-35-7B). Unchanged is an existing provision stating that an additional liability for insurance benefits under a universal life-type contract may not be less than zero (ASC 944-40-35-10). (We’ll return to universal life later, in closing thoughts.)

Nowhere does GAAP place similar constraints on a reinsurance recoverable asset or a cost of reinsurance liability. Sometimes, however, the events that produce a loss from applying these constraints are reinsured, at least in part. When that happens, guidance from the American Institute of Certified Public Accountants (AICPA) advises that the reinsurance asset or liability may be adjusted to recognize an immediate gain to the extent an immediate loss was recognized on the reinsured portion of the underlying contracts.[1]

The AICPA guidance does not suggest any techniques for measuring the portion of the direct loss occurring on the reinsured portion of the underlying contracts, except under narrow circumstances. This article looks at various circumstances and offers practical solutions for such a measurement.

Framework

In the only circumstances addressed in the AICPA guidance, “coinsurance of the entire cohort with all terms matching the direct contracts,” the proposed framework will produce the same result as the approach described in that guidance.[2]

Objectives

The proposed solutions are consistent with a performance objective that I introduced in an earlier article[3]—to align remeasurement of reinsurance with remeasurement of the direct liability. That and two following articles also described techniques for achieving the performance objective in the absence of constraints.

For measuring the reinsured portion of a direct loss, we need to recognize that such a loss is never the result of a single event. Pricing and product design affect measurements for all subsequent events. The larger the pricing margin, the less likely a net premium ratio above one. The more heavily premiums prefund ultimate benefits, the less likely a negative liability. In addition, all experience (including assumption changes) will affect the likelihood and amount of an eventual loss from a constraint-triggering event.

How well reinsurance protects against direct losses will depend on how closely the reinsurance pricing and design align with the underlying products, how much reinsurance was involved in prior experience, and the amount of reinsurance involved in a triggering event.

This suggests another performance objective for the purpose of measuring the reinsured portions of direct losses—in addition to triggering events, measurement considers everything that put the cohort in a position to be triggered. That includes the design and pricing of both reinsured and reinsurance contracts, all prior experience, and the triggering event.

Direct and Net Measurements

When first considering the performance objectives, the current challenge may seem daunting. It becomes much simpler, however, if we recognize a fundamental element of all reinsurance that transfers insurance risk.

In exchange for the cash outflow of reinsurance premium, recovery from a reinsurer offsets the cash outflow of a direct benefit to the extent it’s reinsured.

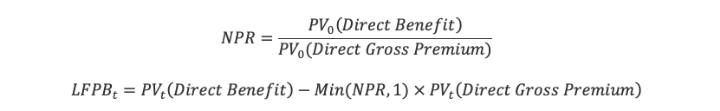

When the liability for future policy benefits (LFPB) is measured using a net premium methodology:

where NPR is the net premium ratio, PV is the present value of the identified cash flows, subscript 0 indicates measurement as of inception (using actual cash flows prior to a valuation date and expected cash flows thereafter) and subscript t indicates measurement for valuation at time t after inception.

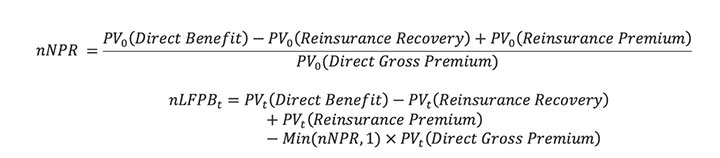

Accounting for the economic protection provided by reinsurance is best achieved when reinsurance premiums replace reinsured costs in NPR and LFPB to produce a net ratio (nNPR) and a net liability (nLFPB).

An appropriate technique for measuring the reinsured portion of a loss can be found in the relationships between direct and net liability calculations.

Fundamentally, the question is about whether and how much reinsurance helps the net liability to recover from the constraints imposed on the direct liability.

Since the NPR is an input to the LFPB calculation, first determine whether there is a loss from capping the NPR (type 1 loss) and a corresponding gain from reinsurance (type 1 gain). Then determine whether there is a loss from flooring the LFPB (type 2 loss) and a corresponding gain from reinsurance (type 2 gain). Total gain and total loss will equal the sum of the two types.

Net Premium Cap

Whether and how much reinsurance can be adjusted by a gain to offset a type 1 loss depends on the relationship between NPR, nNPR and the cap, as shown in Table 1.

Table 1

Type 1 Loss and Gain

| Scenario | Direct |

Reinsurance |

|

(1) NPR ≤ 1 |

No loss |

No gain |

|

(2) nNPR ≤ 1 < NPR |

Loss |

Gain fully offsets loss |

|

(3) 1 < nNPR < NPR |

Gain partly offsets loss |

|

|

(4) 1 < NPR ≤ nNPR |

No Gain |

If NPR does not exceed one (row 1), there is no loss. At the other extreme, when NPR does exceed one and nNPR is not less than NPR (row 4), there is no reinsured portion of the loss. In either case, there can be no gain from reinsurance.

If NPR does exceed one, there is a direct type 1 loss. If nNPR does not exceed one, the loss is fully reinsured and the gain from reinsurance equals the direct loss (row 2). If nNPR is between one and NPR, the loss is partly reinsured and the gain will be smaller than the loss (row 3).

The type 1 loss ![]() and type 1 gain

and type 1 gain ![]() can both be expressed in formula.

can both be expressed in formula.

Liability Floor

Whether and how much reinsurance can be adjusted by a gain to offset a type 2 loss depends on the relationship between LFPB, nLFPB and the floor, as shown in Table 2.

Table 2

Type 2 Loss and Gain

| Scenario | Direct | Reinsurance |

|

(1) 0 ≤ LFPB |

No loss |

No gain |

|

(2) LFPB < 0 ≤ nLFPB |

Loss |

Gain fully offsets loss |

|

(3) LFPB < nLFPB < 0 |

Gain partly offsets loss |

|

|

(4) nLFPB ≤ LFPB < 0 |

No Gain |

If LFPB is not less than zero (row 1), there is no loss. At the other extreme, when LFPB is less than zero and nLFPB is not greater than LFPB (row 4), there is no reinsured portion of the loss. In either case, there can be no gain from reinsurance.

If LFPB is less than zero, there is a direct type 2 loss. If nLFPB is not less than zero, the loss is fully reinsured and the gain from reinsurance equals the direct loss (row 2). If nLFPB is between LFPB and zero (row 3), the loss is partly reinsured and the gain will be smaller than the direct loss.

The type 2 loss ![]() and type 2 gain

and type 2 gain ![]() can both be expressed in formula.

can both be expressed in formula.

Closing Thoughts

Loss at Inception

Sometimes, a company might sell a product that hits the NPR cap from its inception. Applying this framework might then result in a gain from the reinsurance at its inception. Such a gain is prohibited by ASC 944-40-25-33. Not adjusting reinsurance recoverable, however, would severely complicate future efforts as actual experience and assumption changes alter the net premium ratio.

In this situation, future complications can be avoided by applying the framework to recognize a gain in reinsurance recoverable but then deferring the gain under ASC 944-605-30-4. Thereafter, this framework can be applied to reinsurance recoverable while the deferred gain is amortized separately.

Discount Rates

This framework can be applied to both income statement and balance sheet measurements. As in the unconstrained calculations, NPR and nNPR are measured by discounting at the original discount rate. Once those ratios are fixed, all present value measures in the liability, loss, and gain calculations use the original or current discount rate according to the specific use of the results.

Universal Life

With no constraint on the benefit ratio, there can be no type 1 loss or gain on universal life contracts. Type 2 gain and loss are measured by the same formulas as traditional measures, except that the additional liability and its net counterpart replace LFPB and nLFPB. In the net liability and its net benefit ratio, reinsurance premiums replace the reinsured portion of excess benefit payments.

Other Techniques

This framework fits with reinsurance valuation approaches that satisfy all the objectives described in “Precedent.”[4] Other approaches are sometimes accepted even though they don’t satisfy all those objectives. This framework might work in such situations, or it might exaggerate any misalignment that already exists between direct and ceded accounting. It might be necessary to find another technique to measure the reinsured portion of a direct loss.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the authors’ employer.

Steve Malerich, FSA, MAAA, is a director at PwC. He can be reached at steven.malerich@pwc.com.