Embedded Volatility: Insight from Market Risk Benefit Roll-Forward

By Tina Guo, Su Su, Jeffrey Mu and Robert Winawer

The Financial Reporter, November 2023

Public companies have published their restated long-duration targeted improvement (LDTI) GAAP income, including market risk benefit (MRB) retrospective to Jan. 1, 2021. In this article, we share a high-level summary of the volatility that a focus group of companies incurred[1] and summarize the most common ways to mitigate volatility.

We collected data from the companies’ roll-forward disclosures related to calendar years 2021 and 2022. This period includes a portion of the COVID-19 health/financial crisis and the start of its recovery. It created a unique challenge for mortality/longevity assumption setting for current death rates and future improvement. It also featured high equity return volatility, drop and recovery of risk-free interest rates, and widening credit spreads.

Observations

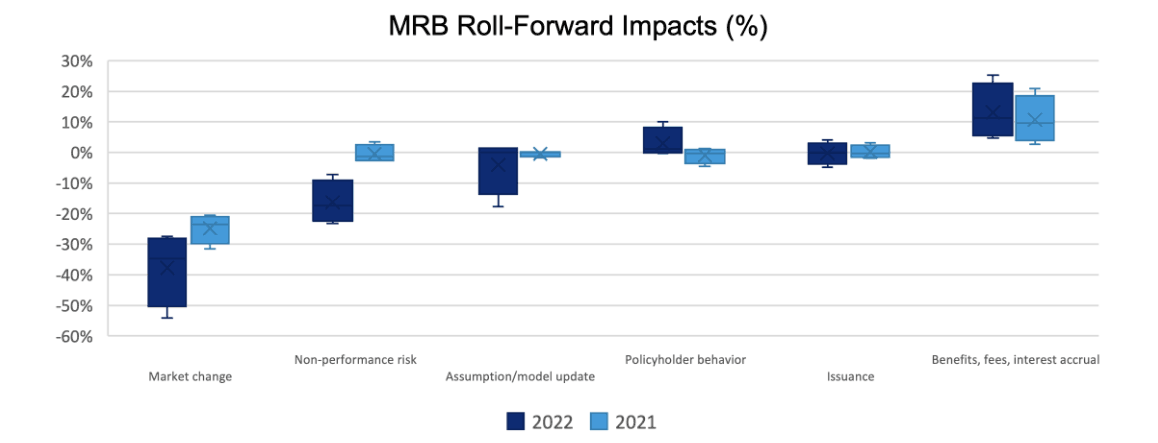

Exhibit 1 summarizes the MRB impacts[2] by different drivers. The article will focus on the potential excess volatility contributors listed below. The common reserve movement items (e.g., benefits, fees, interest accrual, and issuance) are also summarized.

- Market change,

- non-performance risk,

- assumption/model updates, and

- policyholder behavior.

Exhibit 1

Summary of MRB Impacts

Market Change

MRB is the fair value of a company’s contractual obligations to protect policyholders against market risk. Therefore, MRB is primarily driven by movements in financial markets. These obligations are typically long-dated, multiplying the effect.

Over the two-year period, MRB values have gone down due to risk-free interest rate movements. The Federal Open Market Committee’s actions to manage inflation by increasing risk-free interest rates dominated other market factors and drove MRB values down. One mitigating factor was the inverse relationship between rate hikes with decreasing stock prices that kept guarantees in the money. However, stock prices increased during the period due to other factors that led to a further decrease of MRB. Another mitigating factor was implied market volatility. Market volatility increases the fair value of benefits more than the fair value of allocated fees because some product designs subsidize the guarantee with elements other than the guarantee fees, and there is a large amount of in-force in the money. Realized volatility was also a mitigator for contracts designed with ratcheting benefit bases.

Non-performance Risk

MRB fair value calculations capture the price of non-performance risk by adjusting discount rates based on the insurer’s credit quality. Companies first measure non-performance risk at policy inception and track changes through other comprehensive income (OCI) rather than net income. Credit spread widening in 2022 produced lower MRB balances.

Assumptions Changes

The projection of rider fees and benefit payments for MRB is based on best-estimate actuarial assumptions (e.g., mortality, surrender, partial withdrawals, and benefit utilization) plus a risk margin reflecting the market’s assumption uncertainty price.

Insurers face several challenges in setting the actuarial assumptions, including policyholder inefficiency, complex/unique product features, application of assumptions to risk-neutral valuation, lack of data, and risk margin calibration. There were relatively minor assumption updates in both LDTI reporting years. The higher impact in 2022 was driven by one company.

Policyholder Behavior

Companies report MRB volatility created by actual and expected experience variances in their public disclosures. Actual versus expected cash flows are not part of the analysis. Therefore, only persistency is measured. In 2022 MRB increased as more policyholders persisted than expected. Annual assumption review required under LDTI will mitigate the impact.

MRB Methodology Impact on Issuance

Most companies choose the non-option MRB methodology that results in zero reserves at issuance by solving for the portion of fees attributed to the benefits. All companies in this study elected the non-option approach.

Interest, Benefits, and Fees

All companies reported accruing liabilities, i.e., attributable fees plus interest are greater than the benefits and release of stochastic loading in the MRB. Results are similar in both 2021 and 2022.

Volatility Mitigation

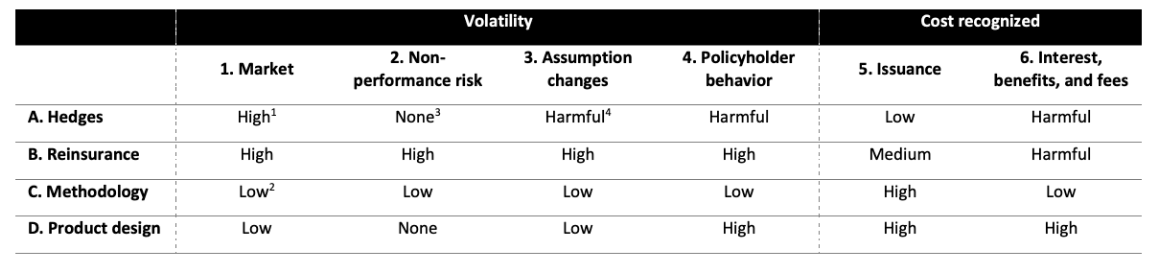

More than half of the companies in this study reported taking action to address MRB volatility. We generalize potential actions into four broad categories and summarize their effectiveness in Exhibit 2.

Exhibit 2

Effectiveness of MRB Volatility Mitigation Actions

1 High: Highly effective to mitigate MRB volatility

2 Low: Mitigate MRB volatility moderately

3 None: No impact on MRB volatility

4 Harmful: Adversely impact on MRB volatility

Hedges

Hedging is one of the common tools companies use to manage market-related volatility. However, they are not always well suited to mitigate MRB volatility and can introduce additional costs and risks.

- Non-GAAP objectives—When companies set hedge targets that focus on complete “economic” cash flows or downside capital protection rather than focusing on MRBs, GAAP volatility may be increased.

- Hedge effectiveness—Hedge program inefficiencies include basis, market, liquidity, counterparty, and operational risks.

- Inherent cost—When companies enter into options and bespoke hedges, the counterparty charges explicit derivative premiums to assume the market risk. Even when they fit perfectly, the market-traded static and dynamic hedge programs introduce cost by removing inherent market risk premiums.

Reinsurance

Forms of reinsurance that transfer market and behavior risks shine under most facets. However, the reinsurer introduces its risk and profit margin, increasing cost. Also, while reinsurance usually reduces non-performance risk volatility, reinsurance can also introduce some volatility because the direct policy MRB is based on the company’s credit rating and the non-performance risk flow through OCI. In contrast, the reinsurance offset is based on the reinsurer’s credit rating and the full impact flow through net income including non-performance risk.

Methodology

There is a wide variety of methodology decisions. Once made, these decisions are set for all new liabilities with consistent facts and circumstances. In many cases, one of the most important decisions is the option or non-option approach valuation.[3] Under the non-option approach, fees are attributed so that the initial MRB (issuance in Exhibit 1) is zero. Under the option-based method, the initial MRB is non-zero and will vary based on market conditions and assumptions.

Product Design

Companies can reduce MRB volatility by limiting the market exposures of product design. For example, a company can:

- Promote volatility-controlled fund;

- introduce cap, floor, or buffer to base contract fund returns;

- link guarantee benefit bases to host contract crediting rates; and

- reduce the richness of the market-related guarantees.

The list is not exhaustive but does illustrate a few ways to lower MRB volatility. Companies need to consider meeting customer needs and market competitiveness with their desire to reduce GAAP volatility.

Conclusion

Over the two retrospective restatement years, 2021 and 2022, MRB volatility was caused by various factors. While financial markets produced the most significant reduction to MRB in both years, non-performance risk changed the most between the years, and assumption updates offset the impact of the variance between the expected and actual policyholder behavior.

Hedging programs are often helpful in mitigating MRB volatility caused by financial markets exposure. However, the programs can also introduce cost and other forms of volatility. We recommend that companies also make thoughtful methodology decisions, consider reinsurance, and review their product designs.

The views or opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of Oliver Wyman, the Society of Actuaries, or the newsletter editors.

Tina Guo, ASA, is a consultant at Oliver Wyman. She can be reached at Tina.Guo@oliverwyman.com.

Su Su, FSA, MAAA, is a senior manager at Oliver Wyman. She can be reached at Su.Su@oliverwyman.com.

Jeffrey Mu, FSA, MAAA, is a principal at Oliver Wyman. He can be reached at Jeffrey.Mu@oliverwyman.com.

Robert Winawer, FSA, MAAA, is a partner at Oliver Wyman. He can be reached at Robert.Winawer@oliverwyman.com.