S&P Global’s Revised Capital Model Change Proposal and its Implication to U.S. Life Insurance Companies

By Yiru (Eve) Sun and Brian Spadaccino

The Financial Reporter, November 2023

Since S&P Global issued the initial proposed changes to their insurer capital adequacy methodology and assumptions via the first Request for Comment (RFC) in December 2021, the insurance industry has provided a lot of feedback. With these, S&P reissued a revised proposal via the second RFC in May 2023.[1] S&P Global suggested these proposed changes may become effective at the end of third or fourth quarter 2023.

Previously we published a paper in The Financial Reporter newsletter in September 2022,[2] to compare the S&P Global’s initial proposed capital model changes to the current S&P rating criteria released in 2010. This is a follow-up paper in which we highlight the notable changes between the current capital model criteria and the proposed model. We also discuss major changes from the first RFC (RFC1) and the second RFC (RFC2), as well as several key items that still require enhanced guidance and clarification. Our analysis is based on information gathered from S&P's public comments, conversations with industry participants, and publications released by S&P Global as of July 2023. Most U.S. life insurers are rated by S&P using their U.S. Life Statutory Capital model, while other insurers use the GAAP/IFRS Capital Model. Statutory financials will remain the starting point for U.S. life insurers under the proposed model, however there will be additional adjustments made to these numbers in an effort to create consistency and comparability with other accounting and solvency regimes. Therefore, it is important to view the following discussion in this statutory context, unless otherwise stated.

Total Adjusted Capital

Total Adjusted Capital (TAC) is the metric used by S&P Global to assess a company's capital available for meeting its capital requirements. In RFC2, S&P Global made changes to the components used in calculating TAC and also indicated the extent of adjustments that can be made to TAC. They provided some clarity on how they plan to adjust the reported assets, liabilities, and equity/surplus of U.S. life insurers to account for differences in valuation methods across accounting standards, such as when statutory book value inputs are used. These additional revisions in RFC2, along with the proposed changes in RFC1, are expected to have a mixed (possibly slightly positive) impact on the TAC position of U.S. life insurers.

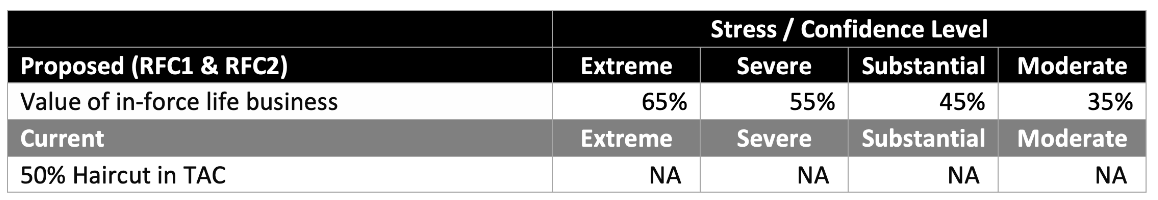

The current IFRS/GAAP model applies haircuts to asset and liability adjustments, but these will be eliminated under the proposed changes. Life deferred acquisition costs (DAC), value of business acquired (VOBA) and life value-in-force (VIF) will receive up to 100 percent credit, compared to the current model deducting 50 percent of DAC/VOBA and giving only 50 percent credit for VIF. The current statutory derived models usually do not recognize any credit for life value-in-force (VIF) or GAAP life deferred acquisition costs (DAC). However, under the proposed methodology, these items will be given full credit in the TAC calculation, even for TAC calculations based on statutory inputs. Yes, this means that there is potential for U.S. life insurers to include GAAP DAC or other VIF-like items in their statutory derived capital model. On the other hand, the required capital calculation will now include a capital charge against life DAC, VOBA and certain VIF-like items, which can offset some of the positive impact on capital adequacy.

Another significant change from the current model is the proposal to include U.S. life insurers' off-balance sheet unrealized gains/losses in the balance sheet and make a corresponding "life reserve valuation adjustment" to the reserves for these unrealized gains/losses. This is likely an effort to align with other financial reporting and solvency frameworks by using a market value framework instead of a book value framework for inputs into the capital model. S&P has not specified whether there will be limitations on the reserve valuation adjustments to account for embedded options on the liability side. Without limitations, there may be instances where the adjusted reserves are significantly lower than the cash surrender value.

Lastly, S&P has expanded items that can be included in the TAC calculation. These items include interest-maintenance reserves (IMR), Asset Adequacy Testing (AAT) results and other reserve redundancies beyond XXX and AXXX.

Risk-Based Capital

The impact from the changes in the risk-based capital (RBC) risk charge rates will be mostly negative to U.S. life insurers, while the level of diversification benefit is expected to increase. Higher risk charge rates are mostly because these charges are recalibrated to higher confidence levels, and S&P Global introduced additional risk categories such as pandemic and longevity risks. In S&P Global’s RFC2, most of the risk charge rates, definition, and categorization stay the same as in their RFC1, which we discussed in our first paper.[2] Here we will focus on the major changes from RFC1 to RFC2.

Confidence Levels

For the confidence levels that S&P Global uses to calibrate the risk charges, RFC2 continues to use the same definition as revised in RFC1, which are enhanced from the current S&P capital model as the following: From 97.2 percent to 99.5 percent (moderate stress), from 99.4 percent to 99.8 percent (substantial stress), from 99.7 percent to 99.95 percent (severe stress), and from 99.9 percent to 99.99 percent (extreme stress), respectively.

Mortality Risk and Pandemic Risk Capital Charges

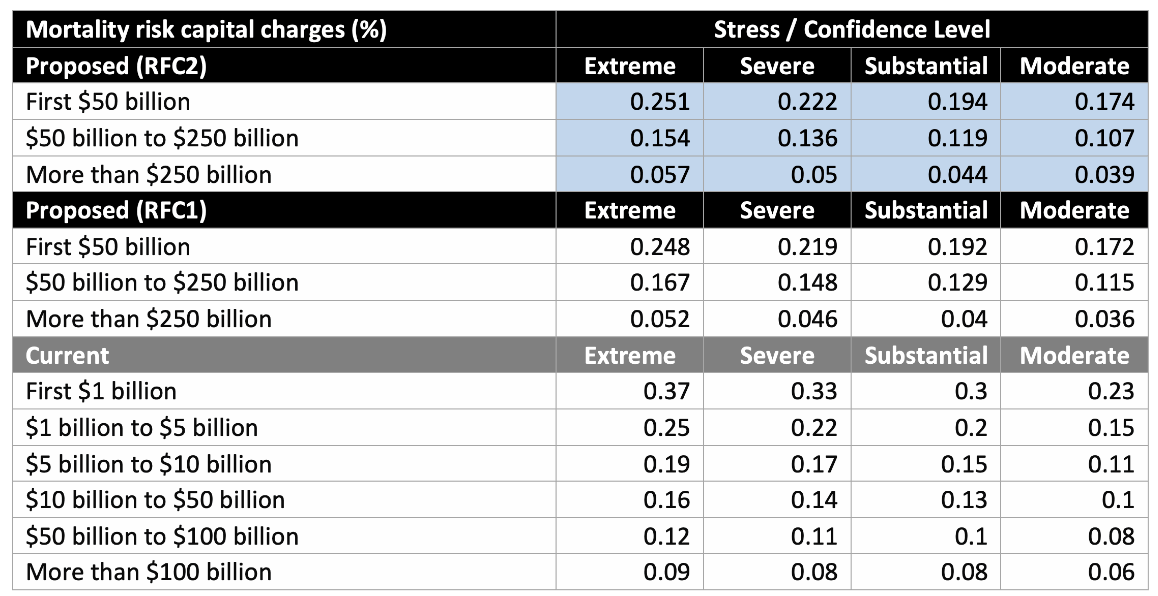

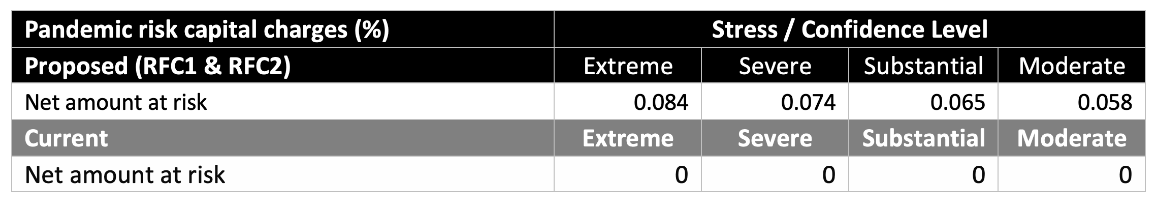

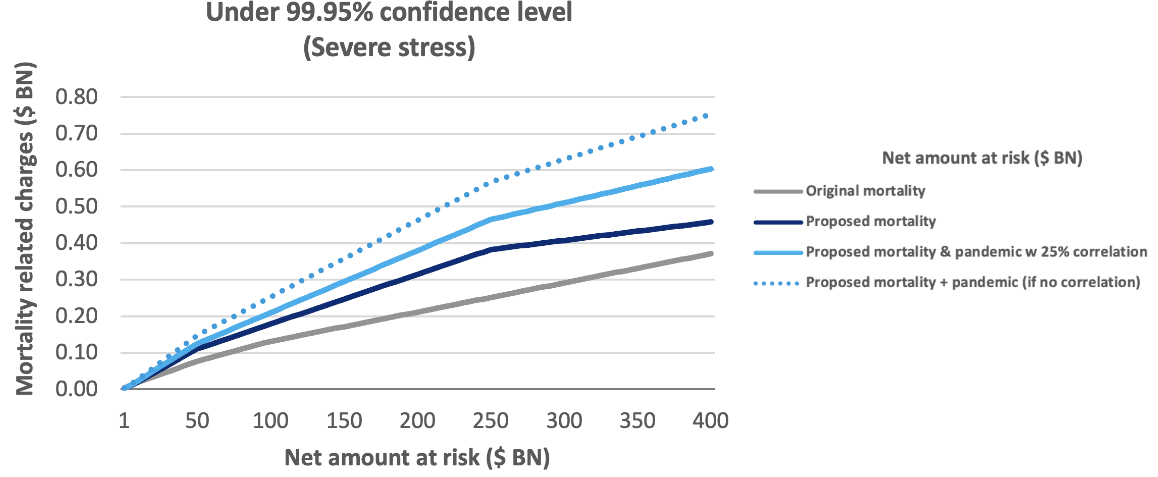

The RFC2 applies similar mortality risk charge rates as in RFC1, with slight differences (Table 1). The tier structure of these rates remains the same as in RFC1. Both RFCs proposed much higher rates than in the current S&P capital model for the insurers with $5 billion or more in net amount at risk (NAR). Both RFCs introduced new pandemic risk charges that use rates around half of the mortality risk charge rates that are on the tier of $50 to $250 billion NAR (Table 2). But the diversification correlation factor between mortality and pandemic risks was reduced from 50 percent in RFC1 to 25 percent in RFC2. On average, the combined mortality and pandemic risk charges, with 25 percent correlation factor, are around 67 percent higher than in the current S&P capital model (Fig. 1)

Table 1

Proposed Versus Current Mortality Risk Capital Charge Rates

(Blue highlighted cells indicate where RFC2 has difference from RFC1)

Table 2

New to S&P Model—Pandemic Risk Capital Charge Rates

Figure 1

Proposed Versus Current Mortality Risk Capital Charges for Highly Developed Life Markets

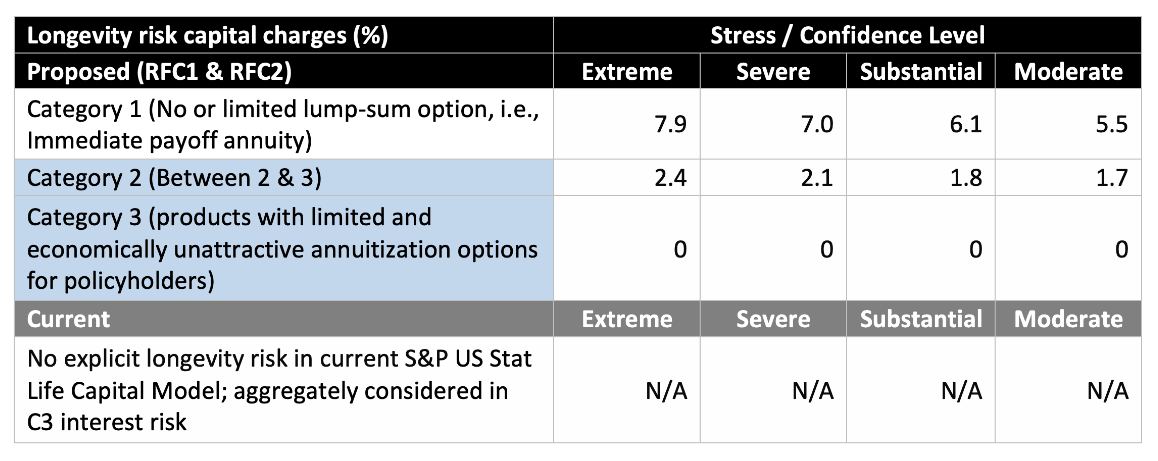

Longevity Risk Capital Charges

The current S&P U.S. statutory life capital model does not have explicit longevity risk charge. It is aggregately considered in C3 interest risk. The RFC1 introduced explicit longevity risk capital charges. Both RFC1 and RFC2 use the same longevity risk charge rates and categorize products to three levels (Table 3). Two notable changes from RFC1 are consideration for reserve adequacy and a change in the categorization of products. RFC2 now creates the ability to have charges reduced for reserve adequacy, with the reduction varying based on the confidence level of the reported reserves for products exposed to longevity risk, i.e., if the confidence level is 90 percent or higher that the reported reserves are in excess of the best estimate, S&P allows for 45 percent reduction in longevity charges, if the confidence level is 70 percent or higher, S&P allows for 25 percent reduction in charges. RFC2 has narrowed the range of products captured in Category 2, therefore more products will enjoy the Category 3 rates (0 percent). Category 1 rates apply to products with no or limited lump-sum optionality for policyholders, i.e., immediate payout annuities and pension risk transfer. In RFC2, the definition of the products included in Category 3 became “products with limited and economically unattractive annuitization options for policyholders,” i.e., fixed deferred annuity and fixed indexed annuity are now included in Category 3. All other products are included in Category 2., i.e., fixed indexed annuity with living benefit riders.

Since the S&P proposed model introduced explicit longevity risk charge, S&P will allow for longevity reinsurance credit, which creates new opportunities for targeted reinsurance solutions.

Table 3

Proposed Versus Current Longevity Risk Capital Charge Rates

Fixed Income Risk Capital Charges

The material change from RFC1 is that notching down of non-S&P rated securities is no longer an issue. When an S&P rating is not available then the regulatory treatment, i.e., by NAIC, will be used. In general, the gross credit risk charges for AA-to-A senior unsecured bonds (Category 2) and A-to-BBB for structured securities (Category 4) are increasing from the current S&P capital model.

As discussed in the TAC section above, S&P proposed making market value adjustments to U.S. life insurers’ book value related capital model inputs. As such, fixed income risk charges will be based on the market value of the bonds, not book value.

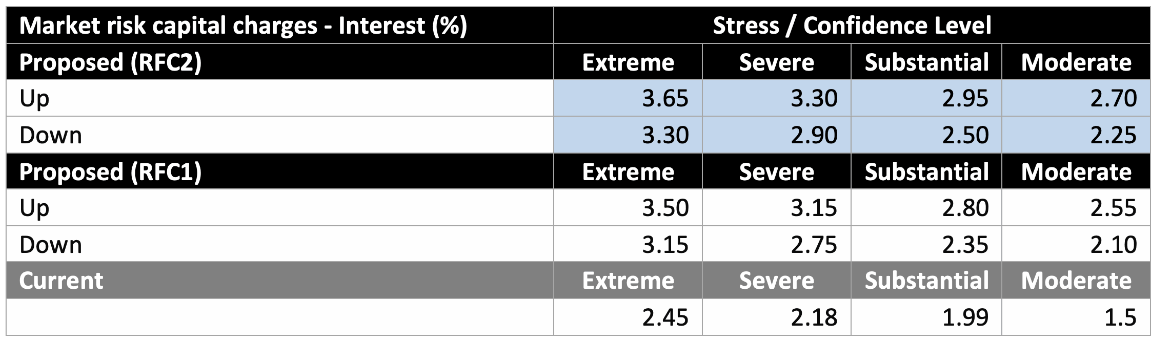

Market Risk Capital Charges—Interest Rate Risk

The current S&P capital model assumes one-year asset liability duration mismatch for U.S. life insurers. The RFC1 proposed to use each company’s modified duration instead of one year. The modified duration measure did not consider the optionality on the asset or more importantly the liability side. This approach ignored things like management’s ability to adjust NGE (non-guaranteed elements). Consequently, RFC2 proposed to use net change in market value (NCMV) or company-specific duration mismatch, both of which incorporates a company's own calculations and potential management actions (i.e., option adjusted duration). The goal is to capture the net impact of changes in interest rates and systemic credit spreads on the market value of assets and proxy market value of liabilities, factoring in risk mitigants such as hedge instruments and the ability to share losses with policyholders (by adjusting crediting rates, policyholder dividends, or bonuses).

The RFC2 further increased the interest rate stress used to calculate the risk charge rates by 15 bps for both up and down stress tests (Table 4). For most U.S. life and annuity Insurers the 2.90 percent down stress is what will be applicable at the 99.95 percent confidence level (AA, Severe stress).

Table 4

Proposed Versus Current Market Risk Charge Rates—Interest

Life Value-In-Force Capital Charges

Table 5 shows the capital charges to the elements of VIF that are included in TAC. The charges are the same as in RFC1. This includes on- and off-balance-sheet VIF, including the life value of business acquired (VOBA), or purchased life VIF, and life DAC. One material update is, RFC1 didn’t mention how to treat the XXX/AXXX reserves, while RFC2 explicitly stated that excess XXX/AXXX reserves fall into “other equity-life reserves,” which does not get capital charge.

Table 5

Proposed Life Value-In-Force Capital Charge

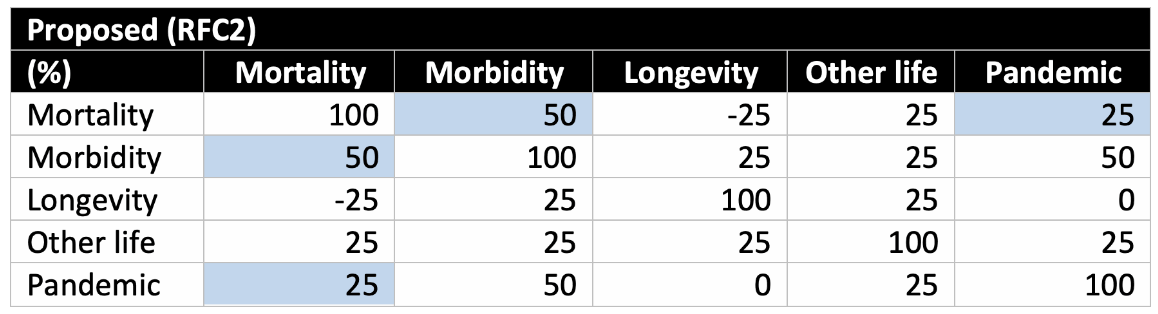

Diversification

Overall, the proposed model is expected to increase the level of diversification benefit, and hence offset the increases in various risk charges. Level 1 diversification is newly introduced to the model, which is within business lines between non-life premium risk and reserve risk. Level 2 is within risk categories, i.e., life technical risk (Table 6) and market risk. From RFC1 to RFC2, the correlation factor between mortality and morbidity risks is lowered from 75 percent to 50 percent. S&P also reduced the correlation factor between pandemic and mortality risks from 50 percent to 25 percent. Level 3 is between risk categories, which was expanded from the current model. These changes will provide larger benefits for insurers with a more diversified portfolio.

Table 6

Diversification Correlation Assumptions—Within Life Technical Risk Category

Items That Need Enhanced Guidance

As noted in our opening, the new capital model has not been finalized at the time of this writing in July 2023 and there are variety of items that need enhanced guidance or clarification. Some notables include:

- Will reserve valuation adjustments be limited to the greater of adjusted reserves or cash surrender value?

- Will addition of GAAP DAC to a stat based TAC calculation be net of the expense allowance embedded in the CRVM/CARVM statutory reserves?

- The results from which scenario(s) of AAT will be included in the TAC calculation?

- Since IMR is included in AAT, will the insurer have to choose which one to include in TAC or will S&P choose? If its S&P, what’s the criteria for choosing? If IMR is chosen, will it be risk charged as VIF?

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Yiru (Eve) Sun, FSA, MAAA, Ph.D., is a managing director at Aon. She can be reached at Eve.Sun@aon.com.

Brian Spadaccino, CFA, is a managing director at Aon. He can be reached at brian.spadaccino@aon.com.