Adjusted (Non-GAAP) Earnings Under LDTI

By Paul San Valentin, Benjamin Hanley and Maya Perelman

The Financial Reporter, September 2023

With the arrival of 2023, we have kicked off a new era of reporting under FASB Accounting Standards Update 2018-12, otherwise known as targeted improvements to long-duration contracts (LDTI). As public companies have released their initial quarterly results applying LDTI, a wealth of new information is contained within the required disclosures available to investors. Simultaneously, the introduction of LDTI has led management teams to refine how they depict their company’s performance through various non-GAAP metrics. In the insurance industry, as in many others, the non-GAAP earnings metric (aka adjusted earnings, core earnings, or operating income) serves as a starting point for other key performance indicators (KPIs) that are tracked by management.

Adjusted Earnings Framework

The income statement contains a collection of information about recent company profitability and the underlying key drivers. However, focusing on reported net income alone may obscure certain realities about a company’s performance. Therefore, financial analysts often look to other information included in the disclosures to get a better story of how profits were achieved. From a high-level perspective, the goal of adjusted earnings is to showcase the financial performance of the core business functions. It represents the primary activities that the company must successfully execute to sustain profitability. However, the boundary of core operating versus nonoperating activities is not strictly defined and varies widely across industries as well as within. In an industry as complex as insurance, this definition can become particularly nuanced.

In practice, most insurers calculate adjusted earnings by beginning with their bottom-line net income and removing components that they deem are unrelated to core firm activities, such as the effects of market volatility, restructuring, or other one-off expenses. The specific adjustments made to derive adjusted earnings are a subject of particular interest, as the definition of “adjusted earnings” varies due to it being a non-GAAP measure. Factors such as product offerings, company history, and senior leadership perspectives influence the items included or excluded, as well as how they are communicated. With the recent implementation of LDTI, many companies re-evaluated the adjustments they were making, comparing them to industry peers and taking into account any changes in management’s viewpoint.

Typical Adjustments to Net Income

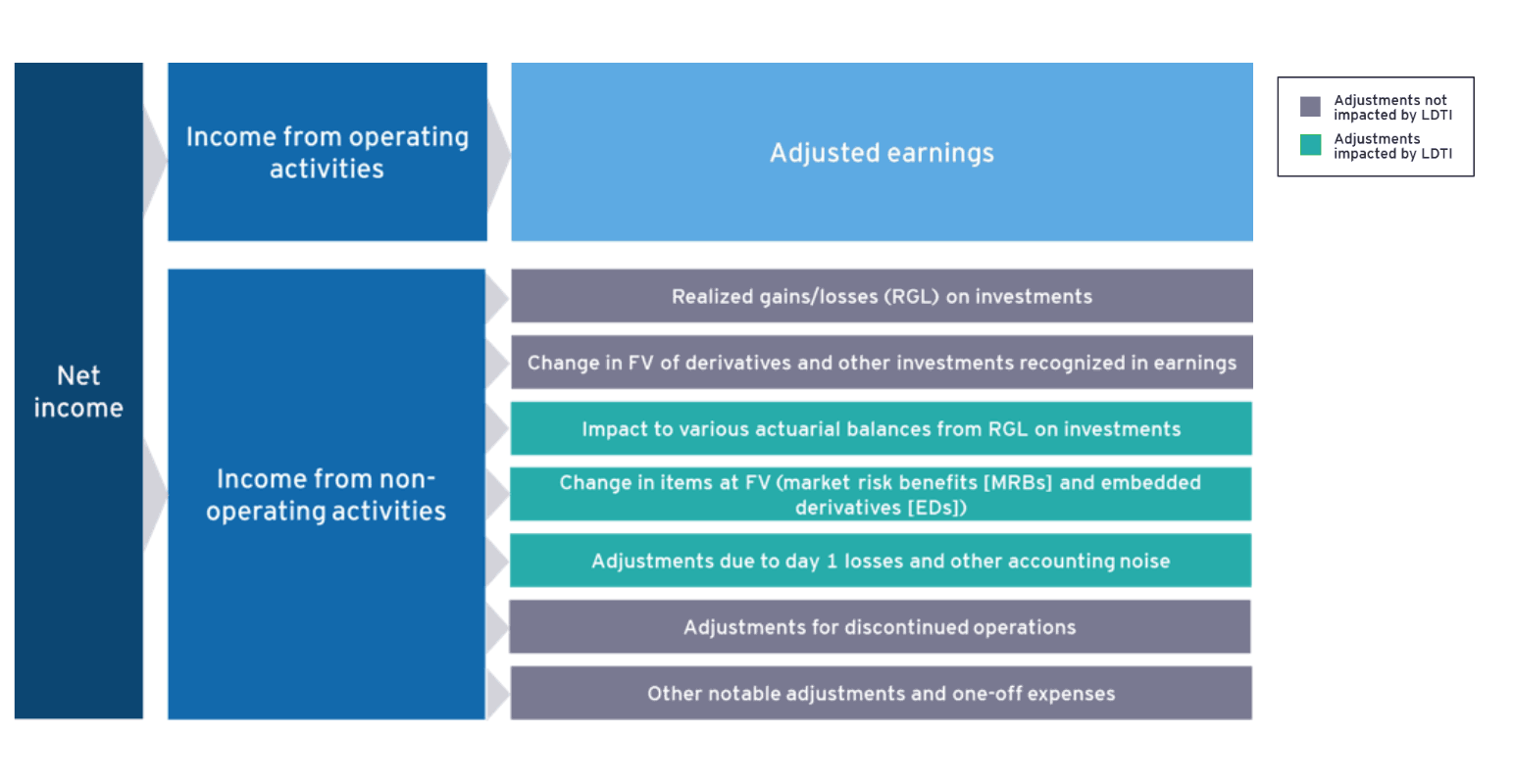

In May 2023, public companies began disclosing stand-alone US GAAP LDTI results for the first time through their 2023 Q1 10-Q filings. We selected a sample of public insurers in the US and examined the adjustments they are making to net income, both before and after the implementation of LDTI, to derive adjusted earnings. For the purposes of this article, our analysis bucketed the various adjustments into general categories to facilitate comparability. The typical adjustments to net income (see Figure 1) from nonoperating activities can be split into two groups: (1) adjustments to balances not impacted by LDTI, and (2) adjustments to balances impacted by LDTI.

Figure 1

Typical Adjustments Made to Net Income

Adjustments to Net Income Not Impacted by LDTI

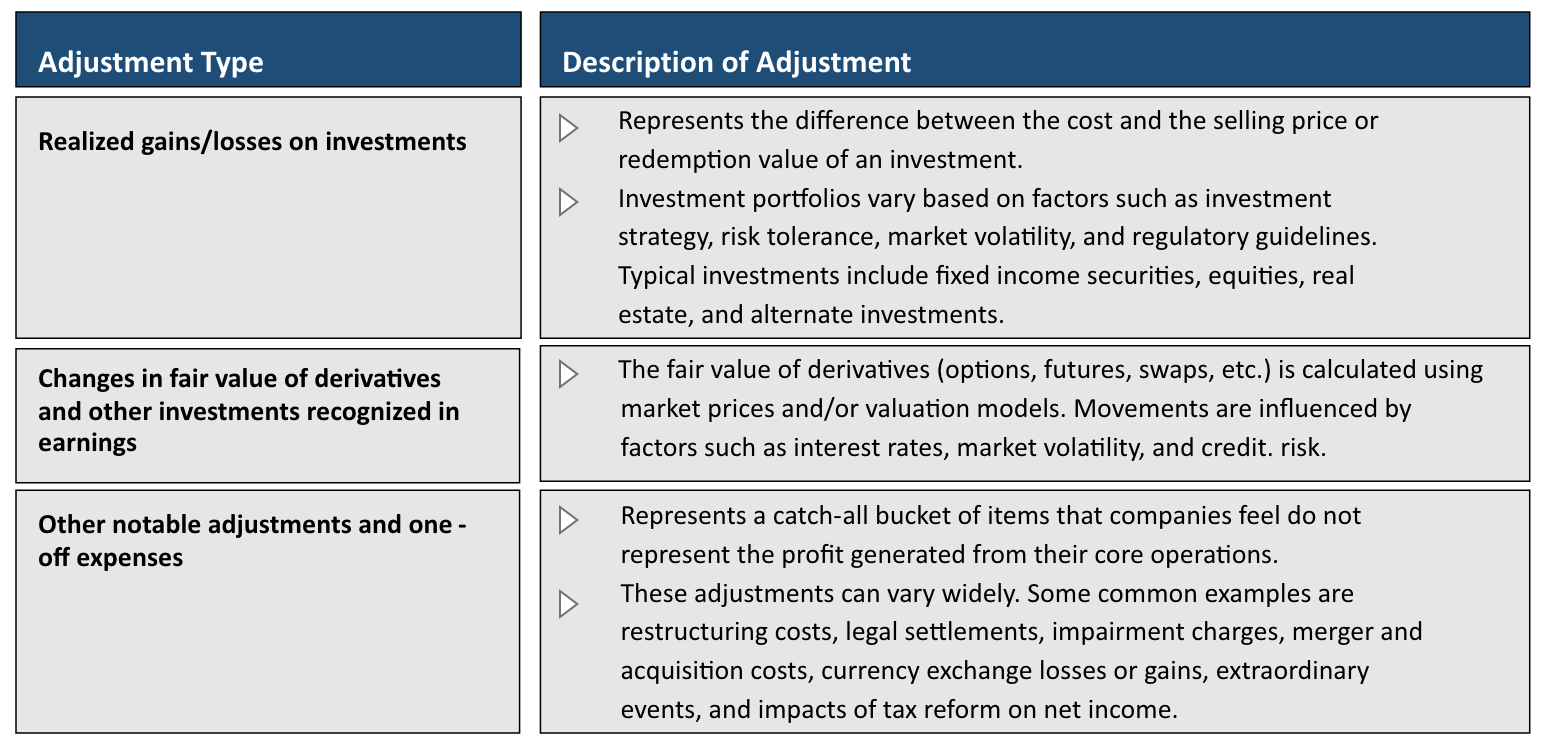

We categorize the adjustments that are typically removed from net income but were not impacted by US GAAP LDTI, as seen in Figure 2.

Figure 2

Net Income Adjustments Not Impacted by LDTI

Adjustments to Net Income Impacted by LDTI

Our review has indicated changes in both existing, as well as new, insurance-specific adjustments resulting from the introduction of US GAAP LDTI. To some extent, LDTI has introduced additional “accounting noise” that, if not adjusted, can obscure the core performance within the pre-LDTI operating income framework. In some cases, the accounting noise from the previous GAAP was removed under LDTI, and therefore no longer needs to be adjusted. The following categories of LDTI-specific adjustments were identified during our analysis:

I. Impact to Various Actuarial Balances from Realized Gains (Losses) on Investments

This adjustment represents the impact that realized gains and losses on investments and changes in the fair value of derivatives have on actuarial balances that use the company’s current period profits or assessments as an input to the calculations. These include the previous deferred acquisition cost (DAC) model driven by gross profits and the model used for additional liability for annuitization, death, and other insurance benefits (i.e., SOP 03-1), where the benefit ratio calculation is impacted by gross assessments.

As expected, we have observed a substantial decrease in this adjustment in the new LDTI filings for most companies. Prior to LDTI, this line item held significance as both DAC and SOP 03-1 balances were affected by the company’s investment performance, and these effects were removed from net income since they were commonly considered unrelated to core business activities. Under LDTI, SOP 03-1 reserves on annuity products have been shifted to being accounted for as market risk benefits, leaving only SOP 03-1 balances on universal life products. DAC amortization (and other similar balances) has been simplified and no longer relies on expected gross profits (EGP).

II. Changes in Items Recorded at Fair Value (MRB and Embedded Derivatives)

Changes in items recorded at fair value have been a significant adjustment to insurers’ net income in the pre-LDTI world. We have observed that the market impacts of annuity products with embedded guarantees continue to be excluded from net income. In addition, MRBs are recorded at fair value and are being included in this bucket.

For the purposes of adjusted earnings, we have observed some companies completely exclude the change in the fair value of MRBs. This is the simplest approach operationally and is easily understandable for stakeholders. Other insurers have adopted a more nuanced approach, wherein they identify specific components of the change in MRB that they consider to be within management’s control and include them in adjusted earnings. Common components we have observed companies include in adjusted earnings are changes in MRB resulting from new business, terminations, and the portion of fees attributed to the calculation of MRB. Changes in the fair value of MRBs resulting from market impacts were mostly excluded. However, it is evident that nearly every company has distinct perspectives on MRBs, and a standard practice has not yet been established.

III. Adjustments Due to Day One Losses

We have also observed companies adjusting their net income results to account for any losses upon contract issuance driven by LDTI accounting. This adjustment was observed in the case of large writers of pension risk transfer and structured settlement business, where a block may have been priced using a discount rate assumption that is considerably higher than the current yield on A-rated bonds for that period, which is required to be the discount rate under LDTI. Some companies consider this an accounting loss that does not accurately reflect the profitability of the block. As a result, they exclude the loss and solve for a rate that will amortize the day one effect over the expected duration of the contract.

IV. Other Adjustments

Some companies also adjusted for income impacts arising from in-force reinsurance transactions, as the assumptions used in these transactions might not fully align with those used in the valuation under LDTI. Furthermore, we have seen that some companies present a normalized view of adjusted earnings, which excludes the effects of assumption unlocking.

The above items are what we have observed based on recent filings. However, insurers need to adhere to the guidance on non-GAAP measures. With other new accounting standards, the SEC has taken a position that non-GAAP measures that unwind the adoption of a new accounting standard may be viewed as individually tailored accounting principles, which are prohibited by the SEC staff guidance.

Key Themes from LDTI Disclosures

LDTI introduced additional volatility to the GAAP income statement, as evidenced by the comparative period disclosures spanning 2021 and 2022, which were released by the public companies in early 2023. On the other hand, the adjustments to net income enable companies to present what they consider to be their core financial results under LDTI. LDTI impacts to adjusted earnings will vary for each company, depending on the specific business mix and fact pattern. Here are a few themes we observed based on the Q1 disclosures:

- Decrease in adjusted earnings levels and volatility driven by liabilities that were previously SOP 03-1 and now classified as MRBs—For example, annuity writers with significant SOP 03-1 balances prior to LDTI might experience a significant change in their net income results, as most of the MRB change in reserves is now excluded under adjusted earnings. These impacts are further emphasized due to the changing interest rate environment and large claim variances in 2021 and 2022. In the previous accounting model, these adjusted earnings can be affected by actual experience and changes in assumptions, whereas under LDTI most changes in MRBs are excluded (i.e., placed below the line).

- Increase in adjusted earnings for companies that were adversely affected by COVID-19-related claims in 2021 due to the impacts of the cumulative catch-up adjustment in the liability for future policyholder benefits (LFPB) calculations—Prior to LDTI, the COVID-19 excess claims adversely impacted writers of life insurance policies while they positively impacted the earnings for disability income (DI) and long-term care (LTC) writers. Several large life writers experienced a significant increase in their 2021 post-LDTI GAAP income shown in the comparative financials due to the net premium reserve (NPR) mechanism absorbing a substantial portion of the COVID-19 losses. On the other hand, writers of long-duration health products with high claims reserve balances (e.g., from disability or LTC claims) didn’t have a significant NPR offset.

- Decrease in adjusted earnings volatility arising from DAC (and similar balances) unlocking—Prior to LDTI, the annual assumption unlocking exercise for DAC and similar balances created volatility in adjusted earnings. With LDTI’s simplified amortization approach for DAC and similar balances, we now observe a more stable and predictable amortization for these balances. However, the previous DAC amortization approach included a mechanism to offset large claim variances for universal life-type contracts through retrospective unlocking. Under LDTI, the simplified DAC amortization will no longer have the same mechanism to offset these claims variances.

- Changes in adjusted earnings volatility due to LFPB remeasurement and assumption updates—We observed additional volatility arising from the remeasurement of LFPB due to future assumption updates. We expect this volatility to persist, especially as we move away from the transition date and as companies continue to refine their best estimate assumptions.

Conclusion

Insurance companies have made certain revisions to their methodology to adapt to the new accounting standard, while taking care to ensure that the adjustments will not violate SEC guidance on non-GAAP measures. Since adjusted earnings is a non-GAAP measure, inconsistencies in methodology and terminology will persist. However, the overarching goal remains the same: to provide the readers of financial statements a view of what management believes to be the core financial results of the firm.

The views expressed in this article are solely the views of Paul San Valentin, Benjamin Hanley, and Maya Perelman and do not necessarily represent the views of Ernst & Young LLP or other member firms of the global EY organization, the Society of Actuaries, or the editors of The Financial Reporter. The information presented has not been verified for accuracy or completeness by Ernst & Young LLP, the Society of Actuaries, or the editors of The Financial Reporter, and should not be construed as legal, tax, or accounting advice. Readers should seek the advice of their own professional advisors when evaluating the information.

Paul San Valentin, FSA, MAAA, is a senior manager at Ernst & Young LLP. He can be reached at paul.sanvalentin@ey.com.

Benjamin Hanley, FSA, MAAA, is a manager at Ernst & Young LLP. He can be reached at ben.hanley@ey.com.

Maya Perelman, FSA, CERA, is a consulting senior at Ernst & Young LLP. She can be reached at maya.perelman@ey.com.