Regulatory Capital Adequacy for Life Insurance Companies

By Janine Bender and Ben Leiser

The Financial Reporter, May 2024

In 2022, the Corporate Finance and Enterprise Risk Management (CFE) Exam Committee engaged Risk & Regulatory Consulting, LLC, to research and create an Excel-based tool that compares the regulatory capital adequacy for life insurance companies for four key regulatory capital regimes. These regimes were: Risk-based capital (RBC, United States); Life Insurance Capital Adequacy Test (LICAT, Canada); Solvency II (European Union (EU)); and the Bermuda Insurance Solvency (BIS) Framework, which describes the Bermuda Solvency Capital Requirement (BSCR). The research paper and Excel-based tool compare and contrast the four regulatory capital regimes and highlight the differences amongst them. This article provides a summary of the research paper and Excel-based tool that can be found on the SOA’s website at Regulatory Capital Adequacy for Life Insurance Companies: A Comparison of Four Jurisdictions | SOA. See the endnotes within the research paper itself for references to the source materials used.

While there are several types of capital, RRC’s focus was on regulatory capital, which can be described as the amount of capital regulators require a life insurance company to maintain for policyholder protection purposes and use as a key signal for when to step in.

The methodology to determine regulatory capital is defined for each regime with key terms defined and formulas provided. The Excel-based tool provides an illustrative application of each approach using a baseline scenario as well as a comparison of the four capital regimes using two alternative scenarios. This is discussed below.

While there are similarities between the approaches (e.g., specific risks identified for which measurement methodologies are prescribed), there are also key differences, such as the accounting method (e.g., statutory, generally accepted accounting principles (GAAP) or economic), model or factor-based, and the applicability of standards at the group versus entity level. None of the regulatory approaches discussed are strictly model-based or strictly factor-based; all use a combination of the two in determining regulatory capital.

As discussed in the research paper, most jurisdictions have established a level of required capital that corresponds to some type of corrective regulatory action. As a result, companies typically target holding an amount greater than the level set by the regulatory jurisdiction to avoid any possibility of attracting regulatory action.

This article reflects information as of the publication date of the research paper, but not necessarily beyond.

US Capital Requirements—NAIC RBC

The National Association of Insurance Commissioners (NAIC) developed RBC requirements that are generally formulaic (factor-based), rather than model-based, although certain market risk factors are calculated using model-based components. The research paper notes that additional model-based calculations may be added in the future.

The life insurance company RBC formula provides four categories of risk:

- Asset risk (C-1)—Risk of default of the company’s investments or other non-performance of the assets.

- Insurance risk (C-2)—Risk that the company’s mortality/morbidity/lapse assumptions prove incorrect.

- Interest rate and market risk (C-3)—Risk that asset values and policy cash flows change due to market movements.

- Business risk (C-4)—Risk of operational loss.

In addition, the RBC formula includes a provision for default of an affiliated company and off-balance sheet items such as derivative instruments (C-0). The interest rate and market risk (C-3) category calls for a model-based approach for products with long-dated interest rate guarantees such as variable annuities, certain fixed annuities, and single premium life insurance policies. The calculation includes correlation adjustments (covariance) and adjustments for federal taxes.

The Authorized Control Level (ACL) RBC is as follows:

![]()

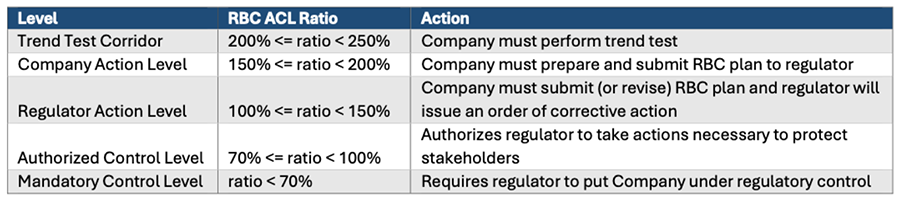

The following table summarizes the actions that will be taken by the company or the regulator as a company’s RBC ratio is reduced to each of these levels:

US Regulatory Actions

Table 1

Actions Taken by Company or Regulator

Canadian Solvency Requirements—LICAT

In Canada, the Office of the Superintendent of Financial Institutions (OSFI) regulates insurance companies. To determine required capital under LICAT, stress events are applied to a starting economic-based balance sheet (determined in accordance with Canadian GAAP). The life insurer’s minimum capital requirement, referred to as the Base Solvency Buffer (BSB), aims to be aligned with the 99% conditional tail expectation (CTE99) over a one-year period. The BSB is the sum of the capital requirements for each of the following five risk components:

- Asset default risk—Risk of loss resulting from on-balance sheet asset default and off-balance sheet items (labeled as credit risk in the BSB calculation); loss of market value of equities and corresponding loss of income (labeled as market risk in the BSB calculation).

- Mortality/morbidity/lapse risks—Risks that the company’s assumptions prove incorrect.

- Change in interest rate risk—Risk of loss resulting from changes in the interest rate environment other than asset default.

- Segregated funds risk—Risk of loss arising from guarantees embedded in segregated funds.

- Foreign exchange risk—Risk of loss from fluctuations in currency exchanges.

There are two ratios that are calculated and analyzed based on the results: Total Ratio, and the Core Ratio. At a minimum, insurers are required to maintain a Total Ratio of 90% or a Core Ratio of 55%.

The Total Ratio, shown below, focuses on policyholder and creditor protection:![]()

The Core Ratio focuses on financial strength:![]()

OSFI has established a Supervisory Target Total Ratio of 100% and a Supervisory Target Core Ratio of 70%. The Supervisory Targets are intended to 1) provide cushions above the minimum requirements, 2) provide a margin for other risks, and 3) facilitate OSFI’s early intervention process. When the ratio decreases to near the Supervisory Target Ratios, OSFI will assess the necessary company actions to be taken to remediate the Core Ratio.

European Union Solvency Requirements—Solvency II

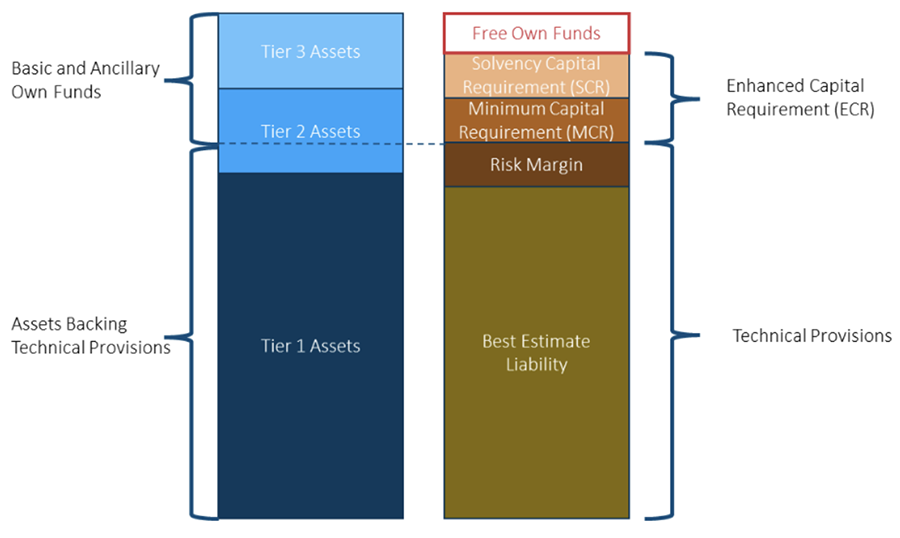

Within the European Union (EU), each country regulates companies domiciled within that country. The organization of European Insurance and Occupational Pensions Authority (EIOPA) is an independent advisory body to the European Commission, the European Parliament, and the Council of the European Union and provides guidance regarding Solvency II calculations and related technical processes. The solvency capital requirement (SCR) is the level of capital a company is expected to hold in order to be solvent over the next year with a 99.5% (1-in-200) probability. The minimum capital requirement (MCR) is the level of capital under which the regulator would have to intervene and is set at a level above which the company would be expected to remain solvent over the next year with 85% probability. When a company approaches the minimum capital levels, it is required to submit a plan to remedy the situation. Each EU supervisor has latitude related to the remedy and further actions.

Figure 1 shows a Solvency II Balance Sheet.

Figure 1

Solvency II Balance Sheet

As shown in Figure 1 above, assets are categorized by tiers, based on availability to absorb losses. Tier 1 assets are the highest quality, and Tier 3 lowest (for example, subordinated debt). The best estimate liability is the cash flows valued using best estimate assumptions excluding explicit margins.

Bermuda Capital Requirements—BSCR

In Bermuda, life insurance companies are overseen by the Bermuda Monetary Authority (BMA) and the capital requirements are prescribed by the Insurance Act. There are two accounting frameworks used in Bermuda to define available capital:

- “Bermuda Statutory” financial statements, and

- “Economic Balance Sheet” (EBS) financial statements.

The Bermuda required capital is the Enhanced Capital Requirement (ECR) which is the greater of the Bermuda Solvency Capital Requirement (BSCR) and the minimum margin for solvency (MSM). The BSCR is based on the standard BSCR model or an approved internal capital model. The BSCR formula aggregates various risks calibrated to a 1-in-200 risk level using a correlation matrix. There are four risk factor categories used to determine the BSCR:

- Market Risk—The risk arising from fluctuations in values of, or income from, assets or from fluctuations in interest rates or exchange rates. This risk covers fixed income, equity, interest, currency and concentration risks.

- Long-Term Risk—The risk arising from fluctuation in values of long-term liabilities. This includes mortality, stop loss, morbidity, longevity, variable annuity and other long-term insurance risk.

- Credit Risk—The risk of loss arising from an insurance group’s inability to collect funds from debtors.

- P&C Risk—The risk arising from fluctuations in values of property and casualty insurance. This includes premium, reserve and catastrophe risk.

The ECR is used to set the target capital level (TCL), which is 120% of the ECR. While companies may use an approved internal proprietary capital model to calculate BSCR, the focus of the research paper was on the “standard model.”

For the purposes of measuring solvency:

- The MSM’s definition of available capital is based on the Bermuda Statutory financial statements, and

- the TCL’s definition of available capital is based on the EBS financial statements.

Under worksheet “3d. Bermuda” of the Excel-based tool that accompanies the research paper found on the SOA’s website, there are two graphs that are required by the BMA. The solvency capital distribution chart in the tool displays the relative contribution of each risk charge to the BSCR prior to the adjustment for correlation. The regulatory action level graph in the tool shows available statutory capital and surplus relative to BMA’s regulatory action guidelines. The ECR is considered as Regulatory Action Level 1 whereas the TCL is Regulatory Action Level 2 where Regulatory Action Level 2 is more of an early warning indicator and insurance companies are expected to hold eligible capital sources to cover the TCL. For Regulatory Action Level 1, the BMA would determine the appropriate course of action and appropriate allocation of resources. The BMA determines the appropriate course of action and appropriate allocation of resources. The greater the level of risk detected, the more supervisory review that is required.

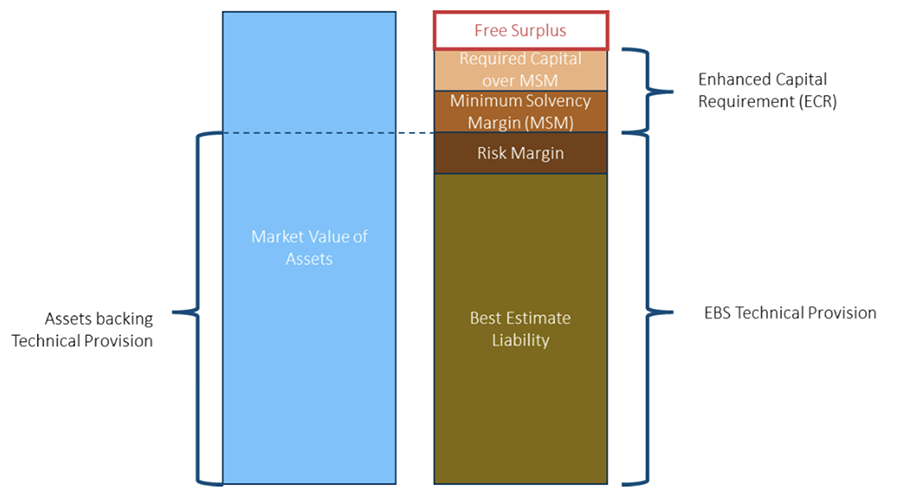

Figure 2 below is a chart showing the Bermuda balance sheet, which is very similar to the Solvency II balance sheet shown in Figure 1.

Figure 2

Bermuda Balance Sheet

Excel-based Tool

In addition to the research paper, an Excel-based tool was built to:

- Calculate an approximation of the capital requirements for each jurisdiction,

- compare regulatory capital approximations using identical portfolios for both assets and liabilities,

- illustrate the required capital calculation methodology differences, and

- illustrate the impact to required capital if 1) riskier assets were purchased or 2) the liability mix was more heavily weighted to annuities.

In order to achieve this, several modeling simplifications were employed:

- The insurance company in this example is a life and annuity insurance company. We assumed there are no non-life and health entities included.

- The insurance company only operates in the jurisdiction that is being analyzed and is not a multi-national company. For example, when looking at calculating required capital for the United States (US), then the company only operates in the US. For Canada, the company only operates in Canada, etc.

- All assets and liabilities are denominated in the jurisdiction being modeled and, therefore, currency risk capital is zero.

- All liabilities were issued in the jurisdiction being modeled, and there are no cross-border risk profile differences.

- Two products were used and were approximately equally weighted in terms of reserves:

- Term insurance, and

- payout annuities.

- Assets consist of two non-callable bonds of differing durations, mortgages, real estate and equities.

- No reinsurance is assumed.

- Two alternative scenarios considered:

- Riskier assets, and

- liability mix is more heavily weighted to annuities.

Any conclusions made regarding capital differences among the different jurisdictions are specific to the asset and liability mix selected as well as the simplifications made.

The base scenario shows that interest rate risk is dominant for Solvency II, LICAT and BSCR capital requirements. If the asset mix is changed to have a heavier weighting on riskier assets, the required capital amounts for all four jurisdictions increase resulting in decreases in capital ratios. In some cases, this requires action by the company such as a submission of a plan to improve capital.

Overall, changes to asset or liability mix will generally change the required capital in each jurisdiction. The direction of the changes is generally the same for all four jurisdictions.

Conclusion

It is important to recognize that each jurisdiction has its own set of capital requirements, and the capital ratios will depend on the insurance company’s mix of assets and liabilities, underlying assumptions, methodologies and models. The research paper demonstrated various similarities and differences of the four jurisdictions.

The Excel-based tool uses a simplified model that demonstrated that changes in asset or liability mix resulted in a relatively similar change in regulatory capital across jurisdictions. Different products and assumptions would presumably result in different outcomes, even by jurisdiction. The model results presented in the paper illustrate how a company’s capital (required and available) may change based on changes in product or asset mix. We note that capital requirements are higher when assets carry more risk, but regulators in different jurisdictions view the risk of particular assets (or asset management practices) differently.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Janine Bender, ASA, MAAA, is a senior associate at Risk & Regulatory Consulting, LLC. She can be reached at janine.bender@riskreg.com.

Ben Leiser, FSA, MAAA, is an actuarial director at Risk & Regulatory Consulting, LLC. He can be reached at ben.leiser@riskreg.com.