Prevalence of Supplemental Benefits in the Medicare Advantage Marketplace: 2017 to 2021

By Julia M. Friedman and Mary G. Yeh

Health Watch, Special Edition, March 2021

Overview

In an increasingly competitive Medicare Advantage (MA) marketplace,[1] supplemental benefits are one of the primary ways Medicare Advantage organizations (MAOs) can differentiate their plans from competitors’ plans. A supplemental benefit is an additional benefit MAOs cover for their members, but which is not covered under traditional fee-for-service (FFS) Medicare. MAOs offer these benefits to attract Medicare-eligible individuals to their plans. Supplemental benefit coverage can either be mandatory, meaning all members in a particular plan receive coverage, or optional, meaning all members in a particular plan can elect to receive coverage for an additional premium.[2] Due to recent Centers for Medicare And Medicaid Services (CMS) demonstration programs and expansions in supplemental benefit flexibilities,[3],[4],[5] MAOs may also limit mandatory supplemental benefits to plan members who meet certain conditions, such as having a diabetes diagnosis. These types of benefits are only offered to a specific subset of a plan’s population, and therefore are not part of this analysis. This analysis focuses on mandatory supplemental benefits offered by general enrollment plans and Dual Eligible Special Needs Plans (D-SNPs) from 2017 to 2021. We measure prevalence of the benefit based on September 2020 enrollment as a proxy for 2021 enrollment in MA plans.

Supplemental benefits are particularly important for D-SNPs for a few key reasons:

- Cost sharing for dual-eligible individuals is generally covered by Medicaid, so lowering traditional Medicare-covered cost sharing does not have an impact on a dual-eligible individual’s out-of-pocket cost. Therefore, D-SNPs typically do not enhance Medicare-covered benefits.

- D-SNPs typically target a $0 premium after government premium subsidies, and there is minimal competition on premium for dual-eligible members.

Because D-SNPs cannot attract members by enhancing Medicare-covered benefits or reducing member premium, supplemental benefits are the key distinguishing plan design factor in the D-SNP market.

Key Takeaways

- For general enrollment plans, comprehensive dental coverage has increased significantly over the last five years, with about 65 percent of members covered in 2021, but this remains low compared to preventive dental, hearing, and vision benefit prevalence for this plan type.

- Supplemental benefit prevalence can vary quite a bit between national and regional D-SNP carriers. The widest gap in benefit prevalence for core benefits in 2021 is for preventive dental coverage, where 96 percent of national D-SNP carriers versus 63 percent of regional carriers offer preventive dental coverage.

- Coverage of over-the-counter (OTC) drug cards and meals has risen significantly in both the general enrollment and D-SNP markets over the last five years.

- In 2021, there is 77 percent and 99 percent penetration of OTC cards for general enrollment and D-SNP markets, respectively. This benefit may soon be considered a core benefit along with dental, vision, and hearing mentioned above, given the penetration levels observed for both plan types.

- Meals are 56 percent and 74 percent penetrated in the general enrollment and D-SNP markets, respectively, having grown from just over 20 percent penetration in both markets in 2017.

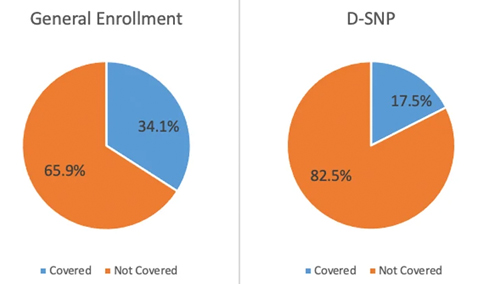

- COVID-19: 34.1 percent of general enrollment plan members and 17.5 percent of D-SNP members are covered by a COVID-19 supplemental benefit in 2021.

Analysis

We utilized publicly available data from CMS for this analysis. The 2017 through 2020 membership is based on February plan enrollment, and the 2021 membership is based on September 2020 plan enrollment crosswalked to 2021.[6] Benefit data for all years was summarized from the plan benefit packages (PBPs) published by CMS for each year.[7]

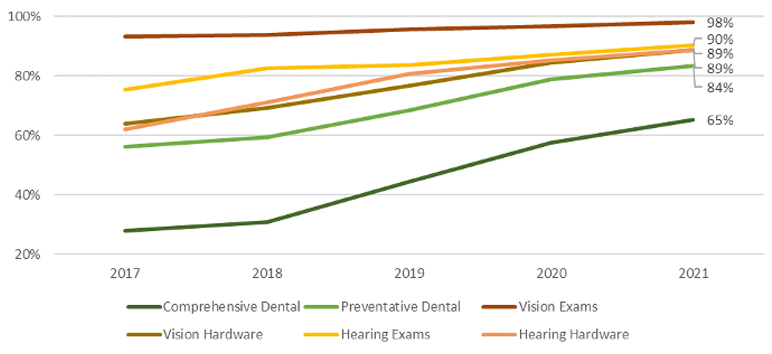

Vision, hearing, and dental benefits are among the most common supplemental benefits historically offered by MA plans. Figures 1 and 2 show the percentage of members in general enrollment plans and D-SNPs, respectively, from 2017 to 2021 with coverage for these benefits.

Figure 1

Percentage of General Enrollment Members With Benefit Coverage of the Most Common Supplemental Benefits

General enrollment plans with these benefits include an increasing percentage of members from 2017 to 2021. Vision exams are available to almost all members, while preventive and comprehensive dental coverage continue to increase in prevalence. MAOs tend to offer dental and hearing aid benefits with some level of member cost sharing, while the hearing exam, vision exam, and vision hardware benefits tend to have little to no cost sharing. Across all of these benefits from 2017 to 2021, the average member copays have been decreasing, and plan coverage limits have been increasing, meaning that these benefit offerings have become richer while also covering a larger portion of general enrollment members.

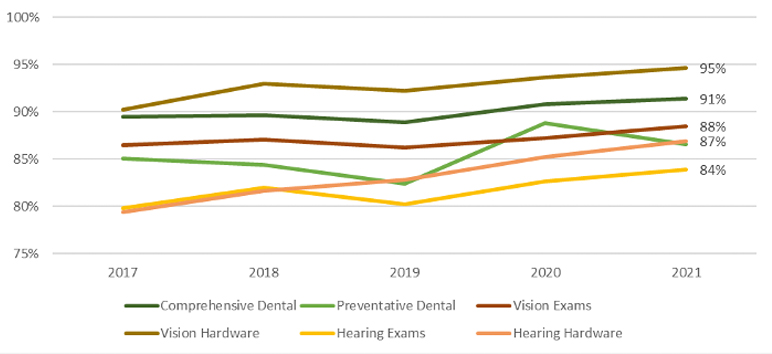

Figure 2

Percentage of D-SNP Members With Benefit Coverage of the Most Common Supplemental Benefits

MAOs offered these benefits to a very high percentage of D-SNP members from 2017 to 2021 with modest increases in coverage over the five years. With the exception of vision hardware, which is available to 95 percent of members, the remainder of these benefits have approximately 85 percent to 90 percent prevalence in the 2021 marketplace for D-SNP plans.

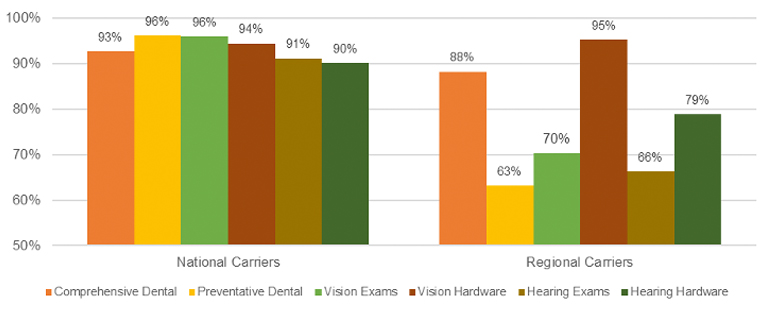

For D-SNPs, supplemental benefit prevalence varies significantly between national and regional MAOs. National players are defined as those that have more than 250,000 members in total (including all plan types),[8] and regional players are the remainder. There was a decrease in 2019 and large increases in 2020 and 2021 of preventive dental offerings driven by the national players, which now have 96 percent prevalence for preventive dental benefits in the D-SNP market. Regional players, on the other hand, saw a marked decrease in members covered by this benefit in 2021 with only 63 percent of membership covered by this benefit. The reduced prevalence of preventive dental coverage is a divergence from all other common supplemental benefits for regional players, which continued to see increased penetration in 2021 relative to 2020, though still less penetration than the national players, with the exception of vision hardware. The notable difference in benefit coverage between national and regional players for D-SNPs in 2021 is evident in Figure 3.

Figure 3

Percentage of D-SNP Members With Benefit Coverage in 2021, by Regional and National Carriers

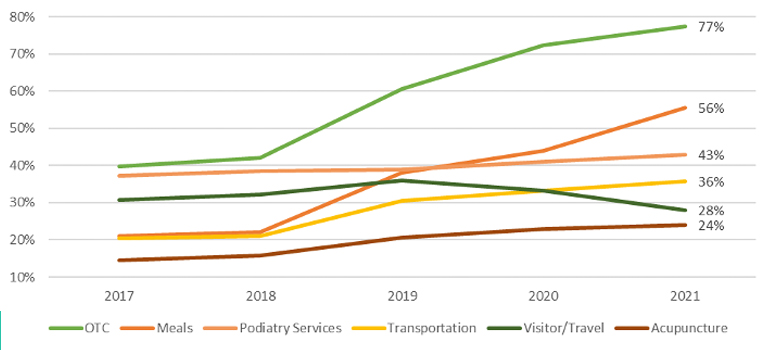

MAOs can offer numerous additional supplemental benefits beyond vision, hearing, and dental. Figures 4 and 5 show the percentage of members in general enrollment and D-SNPs, respectively, from 2017 to 2021 with coverage for other common supplemental benefits, including over-the-counter (OTC) drug cards, meals, podiatry services, transportation, visitor/travel benefits, and acupuncture.

Figure 4

Percentage of General Enrollment Members With Benefit Coverage of Various Other Supplemental Benefits

OTC drug card and meal benefit coverage both grew about 35 percent from 2018 to 2021. Other benefits steadily increased with the exception of visitor/travel, which was relatively flat across the entire time period. The coverage of the visitor/travel benefit in 2021 at approximately 28 percent is due to a decrease in visitor/travel benefit coverage in 2021 by health maintenance organization (HMO) plans. Just under 70 percent of membership is covered by the visitor/travel benefit in preferred provider organization (PPO) plans.

Average copays for podiatry and acupuncture decreased from 2017 to 2021 by about $6 and $4 in total, respectively. Meals, transportation, and visitor/travel benefits are typically offered without member cost sharing. The average OTC monthly drug card limit has increased from about $16 in 2017 to about $22 in 2021.

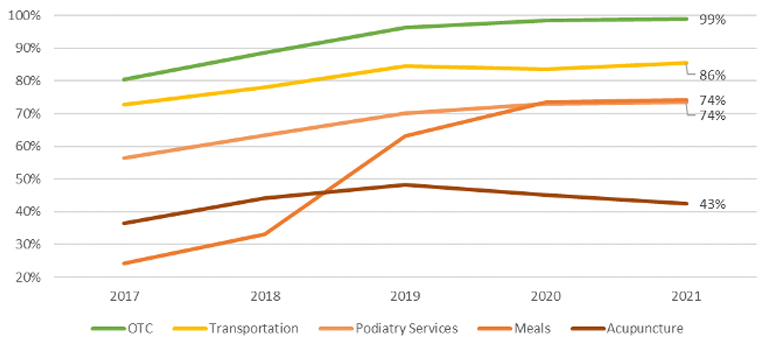

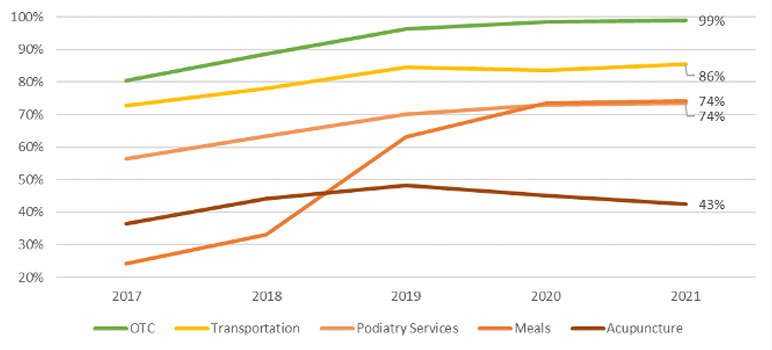

Figure 5

Percentage of D-SNP Members With Benefit Coverage of Various Other Supplemental Benefits

OTC drug card coverage has grown from 80 percent of D-SNP members in 2017 to nearly 100 percent in 2021. Meal benefit coverage grew about 50 percent from 2017 to 2021, with most of those gains happening between 2018 and 2019, and near 75 percent penetration of this benefit in 2021. Podiatry has seen slower gains in member penetration, but increased nearly 20 percent to nearly reach 75 percent penetration in 2021. Transportation and acupuncture experienced lesser increases in coverage over the last five years, but transportation is approaching 90 percent member coverage.

Multiple supplemental benefits fall under the 14c “preventative” benefit category in the PBP. Figures 6 and 7 show the percentage of members in general enrollment and D-SNP plans, respectively, from 2017 to 2021, with coverage for some of the most prevalent 14c benefits: health education, fitness, remote access technologies (RAT),[9] and smoking cessation.

Figure 6

Percentage of General Enrollment Members With Benefit Coverage of Various PBP 14C “Preventative” Benefits

Fitness coverage has steadily increased from 2017 to 2021 and is offered to 92 percent of general enrollment members in 2021. All other benefits in Figure 6 have decreased in membership covered over this period. These benefits are most commonly offered without cost sharing.

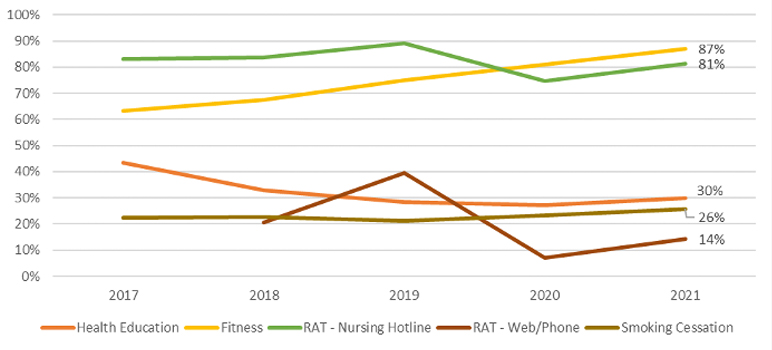

Figure 7

Percentage of D-SNP Members With Benefit Coverage of Various PBP 14C “Preventative” Benefits

Fitness and smoking cessation coverage have increased from 2017 to 2021, while all other benefits in Figure 7 have decreased in membership covered over this period.

The definition of “primarily health related benefits”[10] was expanded starting in the 2019 bid cycle to cover services used to:

- Diagnose

- Compensate for physical impairments

- Ameliorate the functional/psychological impact of injuries or health conditions

- Reduce avoidable emergency and healthcare utilization

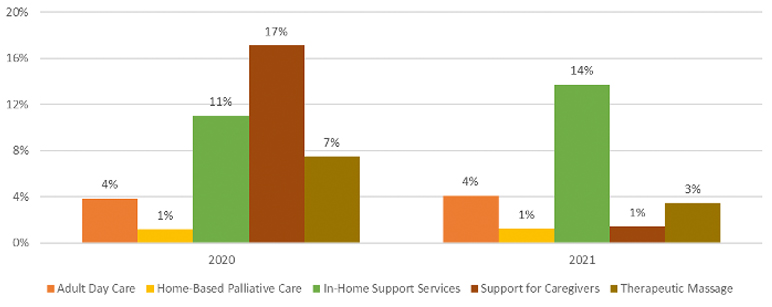

This includes adult day care, home-based palliative care, in-home support services, support for caregivers, and therapeutic massage (for pain management). The percentages of members in general enrollment and D-SNP plans with coverage for these expanded primarily health related benefits in 2020 and 2021 are displayed in Figures 8 and 9, respectively.

Figure 8

Percentage of General Enrollment Members With Expanded Primarily Health Related Benefit Coverage, Comparison of 2020 to 2021

Compared to other supplemental benefits discussed above, MAOs provide these services to a relatively low percentage of members, with modest changes from 2020 to 2021. These benefits are generally offered without member cost sharing.

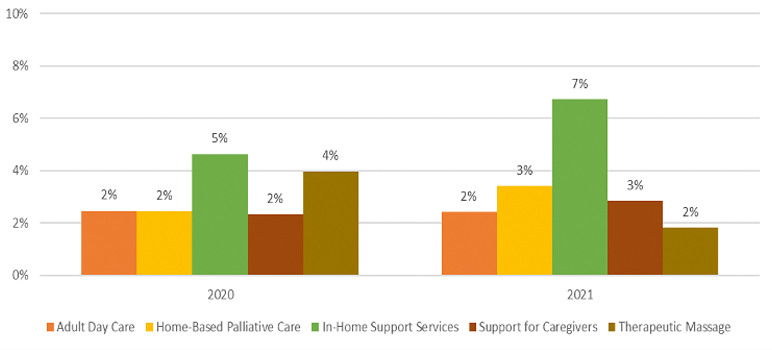

Figure 9

Percentage of D-SNP Members With Expanded Primarily Health Related Benefit Coverage, Comparison of 2020 to 2021

While D-SNPs could provide a subset of these types of benefits prior to the expansion of primarily health related supplemental benefits, D-SNP MAOs provide these services to relatively low percentages of members compared to other supplemental benefits discussed above, though higher than general enrollment plans for adult day care, in-home support services, and therapeutic massage. Support for caregivers of enrollees was the most common expanded primarily health related benefit in 2020, but dropped off considerably in 2021 to be replaced by in-home support services as the leading expanded primarily health related benefit for dual-eligible members.

Many MAOs provided supplemental benefits coverage in 2021 to address the impact of COVID-19 assuming the public health emergency would continue into 2021. These benefits could cover services related to COVID-19, such as personal protective equipment (PPE), testing, or reduced cost sharing on related benefits. The pie charts in Figure 10 show the percentage of members in general enrollment plans and D-SNPs with COVID-19 supplemental benefit coverage in 2021.

Figure 10

Percentage of Members With 2021 COVID-19 Supplemental Benefit Coverage

A larger portion of general enrollment members have COVID-19 supplemental benefit coverage than D-SNP members. D-SNP coverage is driven by nationwide carriers, with 20 percent of their members covered by a COVID-19 supplemental benefit, while only 15 percent of members in regional D-SNPs are covered by a COVID-19 supplemental benefit.

Methodology

In performing this analysis, we relied on the 2021 Milliman MACVAT®. The Milliman MACVAT contains MA plan details and benefit offerings for 2017 through 2021. The Milliman MACVAT uses publicly available data released by CMS, which is then compiled, sorted, and summarized into a user-friendly format. We used the February membership from each applicable year (2017 through 2020), with the exception of 2021, for which we used the September 2020 membership that has been crosswalked to the 2021 plans.

Caveats and Limitations

Julia M. Friedman and Mary G. Yeh are actuaries for Milliman, members of the American Academy of Actuaries, and meet the qualification standards of the Academy to render the actuarial opinion contained herein. To the best of our knowledge and belief, this information is complete and accurate and has been prepared in accordance with generally recognized and accepted actuarial principles and practices.

The material in this report represents the opinion of the authors and is not representative of the view of Milliman. As such, Milliman is not advocating for, or endorsing, any specific views contained in this report related to the Medicare Advantage program.

This report is intended to summarize supplemental benefits offered by MA plans from 2017 through 2021. This information may not be appropriate, and should not be used, for other purposes. We do not intend this information to benefit, and assume no duty of liability to, any third party that receives this work product. Any third-party recipient of this report that desires professional guidance should not rely upon Milliman’s work product, but should engage qualified professionals for advice appropriate to its specific needs.

The credibility of certain comparisons provided in this report may be limited, particularly where the number of plans in certain groupings is low. Some metrics may also be distorted by benefit changes in a few plans with particularly high enrollment.

In preparing our analysis, we relied upon public information from CMS, which we accepted without audit. However, we did review it for general reasonableness. If this information is inaccurate or incomplete, conclusions drawn from it may change.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

© 2020 Milliman, Inc. All Rights Reserved. The materials in this document represent the opinion of the authors and are not representative of the views of Milliman, Inc. Milliman does not certify the information, nor does it guarantee the accuracy and completeness of such information. Use of such information is voluntary and should not be relied upon unless an independent review of its accuracy and completeness has been performed. Materials may not be reproduced without the express consent of Milliman.

Julia M. Friedman, FSA, MAAA, is a consulting actuary at Milliman. She can be reached at

julia.friedman@milliman.com.

Mary G. Yeh, FSA, MAAA, is an actuary at Milliman. She can be reached at mary.yeh@milliman.com.