Survey of Emerging Risks - Risk Combinations

By Max J. Rudolph

Risk Management, December 2022

The 15th Survey of Emerging Risks continues a series trending risk manager views annually as well as asking pertinent questions about current risk practices. In addition to the full report, a user’s guide has been created to aid practitioners when reviewing the material.

The survey asked questions in November 2021 about current risks, emerging risks and combinations of emerging risks. Risks interact with each other. Sometimes it matters, with higher-order interactions resulting in tipping points that generate regime shifts to a new distribution. The risk combination question allows practitioners to see what their peers think is important going forward. Nearly as interesting is to look at the risk combinations that no one chooses as potential contrarian views, where the reader identifies a group of risks they think are more likely to be important than their peers. These can then be qualitatively monitored over time.

These risk combinations, sometimes called risk clusters or compound risks, can occur concurrently or sequentially.

Results for risk combinations are accumulated in two ways. In the first, each of the 23 suggested risks is aggregated individually. This tells us which risks matter most in combination with other risks and could be termed “threat multipliers.” Think about another risk and how it interacts with these top five ranked risks. You’ll find that they make nearly every other risk worse (in some cases, for example, a combination of disruptive technology and chronic diseases, both risks could have positive impacts) than the risk would be by itself. The top five risks are:

- Climate change (11 percent)

- Cyber/networks (9 percent)

- Financial volatility (8 percent)

- War (7 percent)

- Disruptive technology (6 percent)

The top five are not as dominant as are some of the other results, with a total adding up to just 41 percent. Comparable results for the other questions are current risk 68 percent, top five emerging risks 42 percent and top emerging risk 62 percent.

The bottom five risks are:

- Natural catastrophes: Earthquakes (0 percent)

- Natural catastrophes: Tropical storms (2 percent)

- Liability regimes/regulatory framework (2 percent)

- Weapons of mass destruction (2 percent)

- Emergent nation destabilization (2 percent)

Arguments can be made for why each might receive higher weights in the future. A single event can quickly convert an off-the-radar risk to front and center.

When risk managers are thinking about risks, cognitive biases that focus on recent risks often come into play. For example, in 2022, a survey of current risks would be expected to see a surge in the risk of War as one that is relatively more important than the 2021 survey. We saw that in 2020 with Pandemic/infectious diseases. An approach that incorporates foresight will improve proactive responses.

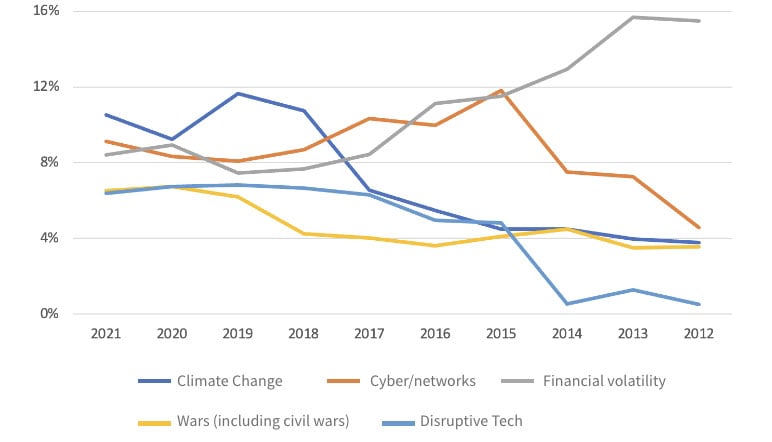

The top five risks are shown in Figure 1 over the last 10 years. The trends vary, with Financial volatility falling as time elapses since the Global Financial Crisis and Disruptive technology initially increasing and then stabilizing. The report includes an appendix with all the data so the reader can reach their own conclusions about the drivers of results.

Figure 1

Top Risk Combinations, 10-Year Trend for Top Five Responses

For example, climate change increasingly disrupts our daily lives through weather extremes, but it indirectly impacts other risks like Wars, Regional instability, Pandemics/infectious diseases and Natural disasters: tropical storms.

In the survey, two risks are selected for up to three combinations. The top combinations selected were:

- Cyber/networks and Disruptive technology

- Asset price collapse and Financial volatility

- Pandemics/infectious diseases and Chronic diseases/medical delivery

- Climate change and Loss of freshwater services

- Climate change and Natural catastrophe: severe weather

- Terrorism and Cyber/networks

No risk manager can identify every single emerging risk that happens, but not everything is a black swan. Train yourself to think with a longer time horizon, strategically, and in a way that allows risks to interact in combination with one other. The companies that encourage this are more likely to survive and make better decisions that allow them to thrive.

The current (16th) cycle of the Emerging Risk Survey will include both a November full survey and May flash survey. Thanks in advance for participating!

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Max J. Rudolph, FSA, CFA, CERA, MAAA, is a principal at Rudolph Financial Consulting, LLC, and can be reached at max.rudolph@rudolph-financial.com.