Infusing Systems Science in Risk Management: Part 2 – Understanding Complexity, Emergence, and Interdependence

By Bryon Robidoux

Risk Management, June 2024

Part 1 of this article aimed to rethink the concepts of risk, equilibrium, shocks and their limitations, critical concepts in actuarial science and economics. This article gives you a different way to think about economics from a system science perspective and introduces concepts such as complexity, emergence, and interdependence. The concepts allow better conformity to the behavior of the markets and policyholder behavior. I will start by explaining what systems science is, then define disorganized and organized complexity and describe the power of including interdependency in financial models.

Why Systems Science?

As the world gets ever more complex and uncertain, there is a tendency to specialize and dig deep into problems. Humanity is at the point in its evolution where solving issues to is rarely solved by digging deeper within specialized silos. As we think about solving the problems ahead, we must look at the big picture. We must find commonality among issues from many disciplines because actuarial science is not a standalone discipline but a conglomeration of business, finance, mathematics, computer science, psychology, and ecology. Just think of all the different topics actuaries get involved in. It is hard to define us and put us in a box.

According to Principles of System Science, "System science undertakes the understanding of systems. It investigates the useful attributes, dynamics, characteristics, and behaviors of systems as systems – including key differences among subclasses of systems such as linear, nonlinear, closed, open, complex, etc." Systems science does not care whether systems are ecological, social, physical, or chemical, but the commonality among these systems.[1] As actuaries delve into areas such as climate change, it will help draw connections between economic and ecological systems.

The Problem

But as I see it, there is a problem: Economics, risk management, and actuarial science, at the heart of our profession, greatly oversimplify how the economy works to their detriment. Economics likes to build its theories from axiomatic first principles.[2] Making mathematics tractable starts with the assumption that it makes the economy linear. Linear systems are systems where the sum equals its parts, so you can understand them by dissecting them into their independent pieces. The behavior that emerges from aggregating the independent pieces.[3] Furthermore, linearity allows for easy prediction of future behavior, which is the reason for its preference in economics. The economy becomes a predictable machine like the heavenly bodies that float around our solar system, which requires no coordination or organization to run correctly.

Disorganized Emergence

The economy is always throwing random events our way. The emergence of behavior from the sum of independent random events is called an additive process, such that ![]() where each Xi is an independent and identically distributed random variable. Additive processes are the home of the law of large numbers and the central limit theorem, which are first- and second-order approximations of the additive processes, respectively. Informally, the law of large numbers says that Sn is well approximated by its mean µ, which is the expected value of Xi. Furthermore, all the randomness of Sn has disappeared and is only a function of n and its mean

where each Xi is an independent and identically distributed random variable. Additive processes are the home of the law of large numbers and the central limit theorem, which are first- and second-order approximations of the additive processes, respectively. Informally, the law of large numbers says that Sn is well approximated by its mean µ, which is the expected value of Xi. Furthermore, all the randomness of Sn has disappeared and is only a function of n and its mean ![]() [4]

[4]

The central limit theorem is a second-order correction term that captures the randomness of the additive processes. Given that the variance of Xi is finite, it states that ![]() where

where ![]() is the error and approaches the Gaussian distribution on the order of

is the error and approaches the Gaussian distribution on the order of ![]() Combining the law of large numbers and the central limit theorem says that the additive process, Sn, can be approximated by

Combining the law of large numbers and the central limit theorem says that the additive process, Sn, can be approximated by ![]() [5]

[5]

There are convenient features with additive processes. The random variables do not have to be Gaussian distributed for this to happen. The random variables Xi can be distributed in many ways. The only requirement is that they are independent and identically distributed, which is amazing. This requirement is called disorganized complexity because there is no coordination or dependency among events. [6]

Furthermore, as n increases, additive processes head exponentially toward the mean, meaning significant outliers are rare. If there are enough substantial events, good outcomes counteract significant, bad outcomes, and they will cancel each other out. This scenario creates negative feedback because it will cause a system to come to a stable equilibrium approximately at its mean. [7] These additive processes are the foundation of our risk management and hedging models, which is unfortunate because the 2008 financial crisis would have never happened if the economy had been anywhere near an additive process. Nassim Nicholas Taleb in his book, The Black Swan, warns about economic models that rely upon additive processes to model market dynamics and advocated using Mandelbrot's theories.[8]

The Solution

The economy is by no way made of independent events. Look no further than COVID-19 to witness how the world is massively interconnected. This interconnectedness means there is a dependence among events. These interdependent events lead to nonlinear multiplicative processes like fractals and power-laws. In his book, The (Mis)Behavior of Markets, Mandelbrot argues that market theory should adopt fractals and power-laws of organized complexity.[9]

Organized Emergence

According to Paul Fieguth, "The meta-behavior of the system, induced by nonlinear coupling of many elements, is an emergent phenomenon. An emergent behavior is the classic 'whole greater than the sum of the parts' idea."[10] Emergent behavior is nearly impossible to model analytically because of the many reactions. Simulation is possible, but the predictive power of simulation can be challenging because the results are highly dependent on the initial condition.[11]

A complex system is a system that exhibits nontrivial emergent and self-organizing behaviors.[12] With organized complexity, the interactions are interdependent and reinforce each other through positive feedback. Organized complexity exists in systems that evolve, adapt, and self-organize. Organized complexity happens in stock market crashes, riots, traffic jams, bank runs, earthquakes, floods and fires[13]—the uncertain perils insurance promises to cover.

Organized complexity is understood by aggregating the interdependent pieces to know how the macro system works. It is why chemistry is not just applied physics, biology is not applied chemistry, and ecology is not applied biology.[14]

Emergence Of Efficiency and Stability

As I reported in “Adam Smith and Evolutionary Economics,” mainstream economics assumes that the robustness and stability of markets are as dependable as gravity and exist due to disorganized complexity.[15] In part 1 of this article, I explained that there are two types of equilibrium: Bad and good. Bad equilibrium, death, is the only guaranteed equilibrium. Good equilibrium is homeostasis, but it is never guaranteed to happen. Nonlinear, interconnected systems emerge with different behaviors close to equilibrium versus far away.[16]

Adam Smith articulated and complex adaptative systems (CAS) showed that equilibrium is an emergent property of the cooperation and collaboration of heterogeneous skills at many levels searching in a parallel fashion, which achieves market stability and efficiency, which is what Adam Smith perceived as the invisible hand. (This interpretation is vastly different than mainstream economics' interpretation of the invisible hand.) During the parallel search, interconnected market participants provide signals based on the current environment to reassess what is vital to explore. Simply put, the algorithm that market participants use to search for profits is no different than the algorithm ant colonies use to search for food.[17]

Interdependence

In The New Evolutionary Microeconomics: Complexity, Competence and Adaptive Behaviour, Jason Potts distinguishes mainstream from evolutionary economics regarding how the two differentiate the relationships between market participants.[18] Mainstream economics assumes that people live in a field or integral space, which means all relationships are 100% fungible and homogenous, so there is no reason to model the networks. The focus is on independence and individualistic pursuits. Evolutionary economics assumes a non-integral space, so networked interactions and relationships vary and of primary importance. Because its foundation is complexity theory, its focus is interdependence among market participants and how they collaborate. Just like ecology, the view is that everything is connected to everything, and heterogeneity is crucial for systems to work properly.[19,20]

Behavior Contagions by Interconnected Market Participants

In Change: How to Make Big Things Happen, Damon Centola explains simple and complex contagions in networked environments.[21] Simple contagions are viruses and rumors because they only take simple contact with other people to spread quickly through weak connections. A weakly connected network resembles a fireworks display. Complex contagions are political and social movements people resist and spread through strong connections. A strongly connected network resembles a fishing net with many redundantly coupled relationships.

The point at which the complex infection spreads is called the tipping point. When a new infection or idea arrives within a strongly connected network, the redundancy between the links creates immunity to new ideas and contagion through the negative feedback from existing ideas.[22] This immunity is another source of market stability. Only once the network becomes saturated beyond 25% does it tip, and the infection spreads energetically with positive feedback, fostering new emerging behaviors. The resulting change is much stickier and quicker than in a weakly connected network,[23] which is the source of market dislocations and crashes. Positive feedback can easily have adverse outcomes.

My premise for this paper is that risk management's reliance on additive processes is an unrealistic oversimplification. If this is correct, then why does it appear that the markets are stable most of the time, as additive processes appear to predict? Market crashes appear as infrequent, unique, one-off events with additive processes.

But market crashes are not unique, one-off events; they are entirely normal! Understanding the stability of the markets means understanding how information infects markets and becomes contagious. Participants in markets are highly connected with many redundancies, which give prices immunity to information and the appearance of stability. The more robust and liquid the market, the more stable it will be and immune to infectious propaganda. Market instability happens when new information infects the market, causing it to hit its tipping point; while positive feedback suddenly moves the market in a new direction far away from its expected value.

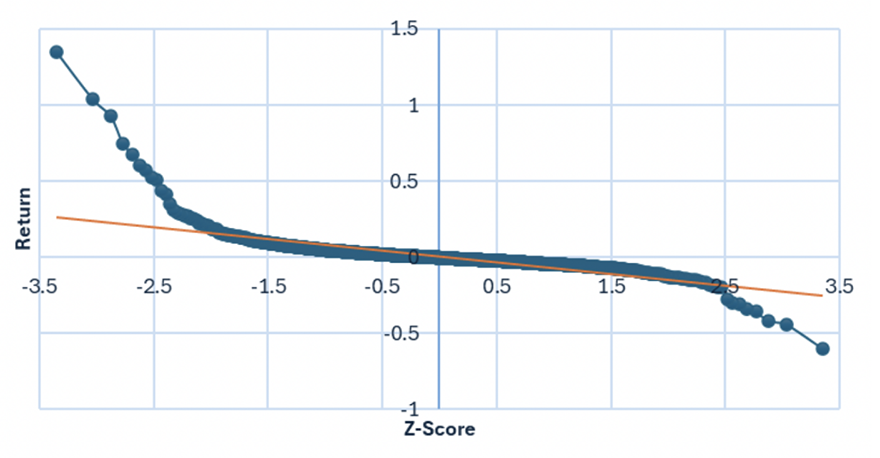

Meme stocks, such as GameStop and AMC Theaters, have wild price swings which are easily explained through these network dynamics but are baffling through the lens of additive processes. The graph below shows GameStop's QQ plot. If the returns were from a Gaussian distribution, the returns in blue should line up with the orange trend line. As you can see in Figure 1, this is nowhere near the case.

Measuring Interconnectedness

In mainstream economics, the measure of the influence of one variable on another generally would be through covariance. Covariance is a function of correlation and volatility.[24] Correlation is not a measurement of connection strength. It is 1(-1) when there is a complete positive(negative) linear relationship. It is zero when there is no relationship. Correlation is a linearity measurement [-1,1] and is "notoriously unstable."[25] But why?

As cognitive science explains, we do not think alone or form expectations in isolation. We constantly look to our peers for confirmation and knowledge to interpret events' meaning and create expectations that mandate that they are nonlinear interactions.[26] As opinions change, especially around the tipping point, the behavior of the interconnected market participants will change,[27] which explains the correlation's instability.

Before the network's tipping point, the correlation would be stable because heterogeneous market participants create negative feedback. As the network approaches the tipping point, the correlations get extremely erratic because the group is directionally confused. As the group synchronizes their behavior after breaching the tipping point, there will become a strong relationship between variables, giving off a strong signal of linearity, which implies that the correlation should be close to 1 or -1. This anecdote explains why the correlations spike when the market crashes.

Mainstream economics generally assumes an integral space and 100% fungibility,[28] which implies all contagions are simple and would immediately spread. If this were the case, the markets would have no stability or robustness and immediately tear themselves apart with whiplashing prices. By assuming only negative feedback exists—magically leading to equilibrium—mainstream economics can ignore this contradiction. A good example of this would be illiquid markets because the markets' participants are weakly connected and not ample enough for stability to emerge, so prices vary widely. Therefore, incorporating positive feedback and organized emergence into the current economic models is insufficient to infuse systems science into risk management.

The Bottom Line

The bottom line is that the world becomes ever more interconnected as the internet grows. The COVID-19 pandemic made this glaringly obvious. The economics and risk management we use in our daily work are rooted in principles developed long before the modern computer age of the 1950s and 1960s, after World War II. Leon Walras first conceived of the economy at general equilibrium in 1874, but it was Debreu that derived the version of equilibrium at the heart of our economics today.[29] Using linear systems to describe the economy at that time made sense because the calculations did not require computers. Even though Black and Scholes made option pricing theory famous in 1973, Louis Bachelier 1900 first developed Brownian motion theory for markets—a significant component of option theory—in his doctoral thesis. It seems to me risk management theory is equivalent to a Ford Model T; we have to continuously affix aftermarket parts, such as jump processes , to keep it sputtering along.

After computers gained popularity in the 1950s, complexity science began to exist. Complexity science is a subset of systems science that exists today. As I have tried to demonstrate, systems science allows us to study all kinds of systems, such as social, economic, and ecological. It better models the complexity and the different types of feedback mechanics that can exist in the market. Complex systems can be more challenging to use for prediction and require modern computers. However, I believe market predictions based on additive systems give us false security and make us overly optimistic because they assume way too much stability for the market due to only accounting for negative feedback. Markets do not move due to independent, disorganized, singular events. They move due to organized, interdependent, massively parallel, events. Models should reflect the correct dynamics or they will cause incorrect decisions.

As managers, we are responsible for meeting promises made to policyholders. We must ensure that we properly account for market instability, especially when there is highly positive feedback, such as the 2008 financial crisis. In my opinion it can only be accomplished through a better understanding of systems science, especially as our profession moves into new areas, such as helping to manage climate change.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors' employers.

Bryon Robidoux, FSA, CERA, is assistant vice president of Product Development at Constellation Insurance. He can be reached at bryon_robidoux@ConstellationInsurance.com.

Endnotes:

[1] George E. Mobus and Michael C. Kalton. Principles of Systems Science. Springer, 2015.

[2] John H. Miller and Scott E. Page. Complex Adaptive Systems an Introduction to Computational Models of Social Life. Princeton University Press, 2007.

[3] George E. Mobus and Michael C. Kalton. Principles of Systems Science. Springer, 2015.

[4] Nair, Jayakrishnan, et al. The Fundamentals of Heavy Tails: Properties, Emergence, and Estimation. Cambridge University Press, 2022.

[6] John H. Miller and Scott E. Page. Complex Adaptive Systems an Introduction to Computational Models of Social Life. Princeton University Press, 2007.

[8] Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable. Random House, 2016.

[9] Benoit B. Mandelbrot and Richard L. Hudson. The (Mis)Behavior of Markets: A Fractal View of Financial Turbulence. Basic Books, 2008.

[10] Paul Fieguth, Introduction to Complex Systems: Society, Ecology, and Nonlinear Dynamics. SPRINGER, 2021.

[12] Melanie Mitchell, Complexity: A Guided Tour. Oxford University Press, 2011.

[13] John H. Miller and Scott E. Page. Complex Adaptive Systems an Introduction to Computational Models of Social Life. Princeton University Press, 2007.

[14] George E. Mobus and Michael C. Kalton. Principles of Systems Science. Springer, 2015.

[15] Bryon Robidoux, "Adam Smith and Evolutionary Economics," The Actuary, April 2024.

[16] Steve Keen, Debunking Economics: The Naked Emperor Dethroned? Bloomsbury Academic & Professional, 2011.

[17] Adam Smith and Evolutionary Economics

[18] Jason Potts, The New Evolutionary Microeconomics: Complexity, Competence and Adaptive Behaviour. Elgar, 2000.

[19]Fundamentals of Ecosystem Science. Elsevier Science Publishing Co Inc, 2012.

[20] Jason Potts, The New Evolutionary Microeconomics: Complexity, Competence and Adaptive Behaviour. Elgar, 2000.

[21] Damon Centola Change: How to Make Big Things Happen. John Murray, 2022.

[24] Robert B. Litterman, Investment Management: An Equilibrium Approach. J. Wiley, 2003.

[26] Philip Fernbach and Steven A. Sloman, The Knowledge Illusion: Why We Never Think Alone. Riverhead Books, 2018.

[27] Damon Centola Change: How to Make Big Things Happen. John Murray, 2022.

[28] Jason Potts, The New Evolutionary Microeconomics: Complexity, Competence and Adaptive Behaviour. Elgar, 2000.

[29] Steve Keen, Debunking Economics: The Naked Emperor Dethroned? Bloomsbury Academic & Professional, 2011.