Managing Longevity Risk: A Solution to Consider

By Paul Song, Patricia Nguyen, Rey Malile and Mark Spong

Reinsurance News, February 2023

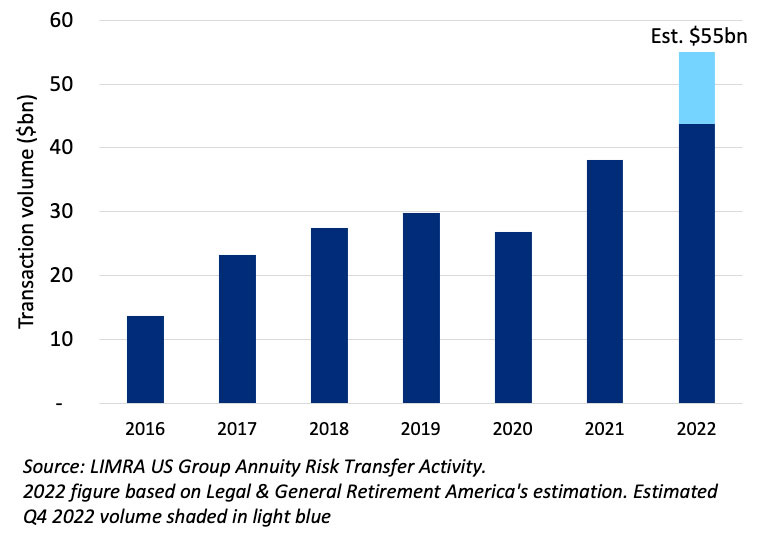

2022 is shaping up to be another record-breaking year for the US pension risk transfer (PRT) market. The market is growing rapidly both in terms of size (see Figure 1) and complexity, and if the evolution of the UK and European PRT markets are any indication, an uptick in demand for longevity reinsurance solutions may soon follow.

Figure 1

U.S Historical PRT Market Volume

Up until now, most longevity reinsurance transactions have been UK-based. Solutions are commonly offered by global reinsurers (e.g., RGA, Prudential), who view longevity risk as the natural hedge to their existing blocks containing mortality risk. Although capital market providers are less common, they represent another avenue for risk transfer as reinsurers become more concentrated. This is similar to how the catastrophe bond market developed—insurers were able to offer investors the opportunity to earn an attractive, uncorrelated return on their investment in exchange for assuming tail-end insurance risks.

The first longevity swap made public in the US was provided by RGA in 2018, and since then discussions around longevity swaps have only become more common, with a second transaction announced in late 2022. Our goal in this article is to dive deeper into the role longevity swaps could play in the US PRT market by drawing comparisons to the UK and highlighting recent commercial developments that can jump start the US market’s need for longevity reinsurance.

How a Longevity Swap Works

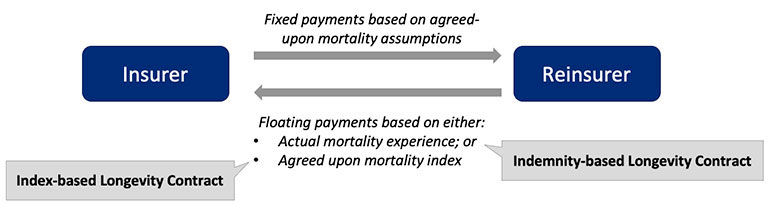

In a longevity swap, the insurer pays a fixed monthly premium to the reinsurer based on an agreed upon longevity assumption, plus an amount for profit and expenses, in exchange for the actual monthly pension payment. Longevity swaps can be split into two categories: Indemnity-based and index-based (see Figure 2).

Figure 2

Two Categories of Longevity Swaps

In an indemnity-based longevity swap, payments from the reinsurer are made based on the true population of the covered block. Indemnity-based swaps are resource-intensive to price and as a result, transactions of this type are mostly for high volumes (i.e., more than $500 million present value of benefits).

Index-based longevity swaps are designed so that the payments from the reinsurer to cedant are based on an agreed-upon population index. The structure of index-based longevity swaps are largely standardized, which means lower need for due-diligence but also a greater degree of basis risk due to differences between the actual and index populations. According to Erik Pickett, actuary & chief content officer, Club Vita: “A key concern [of indexed-based longevity swaps] is the hedge-effectiveness of an instrument tracking the national population, especially in light of multiple pieces of recent research showing distinctly different longevity improvement trends between defined benefit pensioners and the general population, and between different socio-economic groups within the population.” The development of more relevant or more granular indices (as Club Vita is doing) as an alternative to coarse-grained general indices (such as US general population mortality experience) is crucial to the viability of index-based longevity swaps. There have not been many index-based longevity swaps to date, but their low cost and ease of transaction make them an attractive option for small portfolios who want to take a first step at de-risking.

In contrast to coinsurance, longevity swaps for either category do not cover any asset-related risk. However, for plans with indexed benefits, such as cost of living adjustments, longevity swaps can be structured to offset both longevity and longevity-related inflation risk. This makes the longevity swap popular for insurers looking to retain their assets but still reduce longevity risks.

UK Longevity Reinsurance Market

The UK remains the most developed and active longevity reinsurance market in the world. Out of seven longevity swaps made public in 2022 thus far, six were for UK-based pension schemes. A majority of transactions are longevity swaps provided by global reinsurers with low appetite for asset risk. There are a few major reasons why the UK is ahead in the longevity reinsurance cycle compared to the US, despite US pension liabilities being many times the size of the UK’s and many major UK reinsurance providers (such as Prudential and RGA) being US companies:

- Aligned understanding of longevity risk,

- recognition of longevity risk mitigation solution in Solvency II, and

- capital constraints in an active PRT market.

Aligned Understanding of Longevity Risk

The UK actuarial community has relatively easy access to credible mortality data and mortality improvement studies (e.g., the UK CMI model). Accessibility to quality population mortality data is crucial to balancing the information asymmetry between insurers (who have relatively smaller, more volatile portfolios) and global reinsurers (who have the capability to perform credible longevity studies with their large data repository and carry significant volumes of offsetting mortality risk from group life, catastrophe and other business). This free flow of information has created an unprecedented level of alignment of views on longevity risk among all UK PRT market participants, which in turn has helped the industry in setting an effective “market price” for that risk via longevity swaps.

Recognition of Longevity Risk Mitigation Solution in Solvency II

Under Solvency II, reinsurers are able to reflect significant diversification benefits from holding both mortality and longevity risk on their balance sheets. At the same time, the longevity risk margin introduced under Solvency II creates high capital requirements for longevity risk, making it increasingly expensive for insurers to retain longevity risk. The combined effect of these provisions results in lower cost of capital and more attractive pricing for UK insurers.

Capital Constraints in an Active PRT Market

Despite recent market volatility, UK private pension schemes are collectively well-funded. As of October 2022, the average UK defined benefit pension plan’s aggregate funding level was 103 percent. In the absence of full interest rate hedging, increasing bond yields mean reduced present value of future liabilities, which will further put plan sponsors in a great position to de-risk. With so much market activity, many UK insurers have found themselves in a capital-constrained position where engaging in longevity reinsurance transactions is the most feasible option to allow them to keep writing business.

US Longevity Reinsurance Market

While the UK longevity reinsurance market has been active for over a decade, activity in the US market is muted by comparison. There are a few main reasons why this has been the case and why those same reasons may soon be catalysts for change:

- Historical issues surrounding data quality;

- no explicit statutory guidance on reserve and capital credit, but changes are expected; and

- no statutory capital requirements until recently.

Historical Issues Surrounding Data Quality

Data quality has long been an issue in the PRT market for deals between pension plans and insurance companies, so it is no surprise that similar issues exist when looking to price reinsurance deals on those same blocks of business from an insurer’s books. Issues with data quality hinder longevity deals because reinsurers need to price-in additional margins to account for deficiencies in data, leading to less attractive quotes and therefore less incentive for potential cedants to transact. In comparison to the UK, where detailed underwriting characteristics as well as national death records are readily available, data quality in the US has historically been poor. Nevertheless, the industry has seen a push over the last several years to improve pension plan data quality driven by an increase in industry education around both the actual risk associated with longevity, as well as the importance of having clean data from a transactional perspective. These improvements in data have led to increased underwriting sophistication from both insurers and reinsurers, leading to lower frictional costs associated with transactions.

No Explicit Statutory Guidance on Reserve and Capital Credit

Another reason for the lack of longevity reinsurance transactions in the US is the absence of statutory guidance on the reserve and capital treatment for these transactions. As opposed to quota-share reinsurance, reinsurance risk transfer requirements for longevity-only reinsurance are not explicitly outlined in statutory accounting principles and insurers need to confirm their proposed accounting treatment with their regulator in advance of any transaction. That being said, longevity reinsurance is proposed to be in-scope for the upcoming VM-22 principle-based reserving guidelines, which are expected to provide more explicit guidance for insurers and remove the ambiguity around accounting treatment.

No Statutory Capital Requirements Until Recently

Until the 2021 filing, the NAIC RBC formula lacked a C-2 risk component to incorporate longevity risk. This meant that companies had less incentive to manage longevity risk on their balance sheets, because there was no statutory capital requirement associated with the risk. The new C-2 longevity factors mean that with the regulatory changes mentioned above underway, longevity reinsurance can be used to improve an insurer’s capital ratio. This is in stark contrast to UK and European regulations, where for years Solvency II ensured companies are adequately capitalized for longevity risk.

Signs of What’s to Come

Despite the reasons for limited activity, there have been recent developments in the longevity market that point to a potential rise. In addition to the ongoing improvements in data quality and significant regulatory changes mentioned above, the following drivers may also spur activity:

- Continued growth in the PRT market,

- increased attention and research focused on mortality and mortality improvement, and

- innovative solutions for longevity-focused deals.

Continued Growth in the PRT Market

The US PRT market has continued to grow rapidly over the past several years. 2021 was a record-breaking year in terms of premium transferred from PRT transactions at $38 billion, even surpassing 2012 which marked the year of the landmark GM and Verizon transactions (approximately $33.5 billion of premium combined between the two deals). As insurers continue to take on pension liabilities, the growth in exposure may lead to insurers seeking reinsurance in order to balance their mortality and longevity risk profiles. This could especially be the case for asset-specialized insurers, who may have less appetite to retain longevity risk.

Increased Attention and Research Focused on Mortality and Mortality Improvement

The COVID-19 pandemic has forced insurers and reinsurers to think about mortality improvement trends differently than ever before. Industry-wide, companies are examining mortality trends in much greater detail and putting effort into having an informed view of not just an ultimate mortality trend, but also what excess mortality will look like over the next 10 years. This is a new focus on short-term mortality rates and is indicative of the general increased attention that mortality trends are receiving. Recent research by Mark Spong and Lisa Grieco at Oliver Wyman demonstrated and quantified that mortality improvement differences across age, gender, socioeconomic and other variables are distinct trends that can be considered for forward-looking assumption setting. The increased attention paid to refining excess mortality in the short term and reflecting customized mortality improvement assumptions over the long term may open the door to longevity risk mitigation techniques like longevity swaps that may not have been otherwise considered.

Innovative Solutions for Longevity-focused Deals

As a result of the drivers mentioned above, the US PRT industry has seen an influx of innovation over the last few years that could help spur growth in the longevity market. For example, the use of “sidecar” structures allows companies to expand their boundaries beyond traditional reinsurance and transfer risk to capital markets as well, at a competitive price. Innovation through technology platforms is also shaping the way in which longevity transactions may take place in the future. For example, last year a Bermuda-based company named Longitude Exchange was announced, with the goal of commoditizing longevity risk and facilitating transactions through an online marketplace.

Conclusion

Activity in the US PRT market continues to accelerate and if we observe how the UK and European markets developed, the longevity reinsurance space is primed to follow suit. Longevity swaps are an effective solution for insurers looking to tailor their exposure to increasing lifespans, while being able to retain the assets associated with the risk. With numerous trends pointing toward more longevity reinsurance transactions to come, now might be the time for insurers to consider whether this solution meets their needs.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Paul Song, FSA, FCIA, CFA, is a manager with the Actuarial Practice of Oliver Wyman. He can be contacted at paul.song@oliverwyman.com.

Patricia Nguyen, FSA, CERA, ACIA, is a consultant with the Actuarial Practice of Oliver Wyman. She can be contacted at patricia.nguyen@oliverwyman.com.

Rey Malile, FSA, MAAA, is a senior manager with the Actuarial Practice of Oliver Wyman. He can be contacted at rey.malile@oliverwyman.com.

Mark Spong, FSA, CERA, MAAA, is a senior manager with the Actuarial Practice of Oliver Wyman. He can be contacted at mark.spong@oliverwyman.com.