The Role of Actuarial Audits in Performing Due Diligence

By Louise Gates

In The Public Interest, May 2022

This article first appeared in the October 2020 issue of GRS Perspectives. It is reprinted here with permission.

Over the past several years, public sector defined benefit retirement plans have been receiving a great deal of attention. Some significant reasons for the increased attention may include:

- The aging of the U.S. population and a greater focus on financial security in retirement;

- growing criticism of public sector retirement plans by think tanks and other ideological organizations; and

- periods of dwindling tax revenue and reductions in state and federal revenue sharing have put tremendous pressure on governmental budgets making it difficult for employers to contribute the full actuarially determined amounts to their retirement plans.

Public sector retirement plan governance is a responsibility shared by several stakeholders, including the retirement system board of trustees. The retirement board of trustees are fiduciaries tasked primarily with retirement system administration. With the increased focus on public plans, there is a heightened awareness of the need for due diligence on the part of retirement plan trustees in performing their fiduciary duties. Trustees have a duty to select plan service providers prudently, and once selected, to monitor the quality of their work.

This article discusses actuarial audits as a due diligence tool for plan trustees to help manage retirement plan risk. High quality actuarial work can do much to ensure the long-term financial strength of a retirement plan. Similarly, low quality actuarial work, when left undiscovered, can undermine a plan’s financial security in a relatively short time period.

What is an Actuarial Audit?

An actuarial audit is the scrutiny of one actuary’s work by another qualified actuary. The goal is to ensure that: 1) Actuarial valuations are performed correctly; 2) the methods and assumptions used are reasonable; and 3) the advice given is sound. Actuarial audits provide assurance to plan trustees and other interested parties that the financial condition of the plan is accurate, as stated by the plan’s actuary.

How Often Should Actuarial Audits be Performed?

The Government Finance Officers Association (GFOA) recommends that actuarial audits be conducted at least every five years unless there is a change in actuary.[1] In some plans, audits are performed regularly based on the retirement board’s policy or state law. In other plans, they are performed when danger signs appear in the financial structure of the plan.

Some examples of danger signs include:

- Retired life liabilities being less than fully funded with no significant progress toward full funding;

- A protracted period of decline in the funded ratio or increases in computed contributions without adequate explanation; and

- An inconsistent relationship among the various valuation assumptions (sometimes difficult for an untrained person to notice).

What are the Benefits of an Actuarial Audit?

The outcome of the actuarial audit reveals whether the procedures used in the actuarial valuations of the plan are technically sound and if plan objectives are being met. Equally important, this type of review helps to generate a sense of security among those concerned with plan financing. The value of such knowledge may make the cost of the audit incidental.

The dialogue generated by the audit process usually has educational value. The basic funding principle of paying for a benefit when it is earned may be easy to grasp. However, the implementation of the concept is often confusing, particularly if the plan includes a Deferred Retirement Option Plan (DROP) or other complicated features. The proper utilization of qualified advisors provides an opportunity to get a good look at the forest rather than getting lost among the trees of technicalities.

If the advice a plan has been receiving is inaccurate or inappropriate, the actuarial audit should bring this to light so that remedial action can be initiated. Finally, we may all benefit from someone looking over our shoulder occasionally. The mere possibility that a fellow practitioner may analyze an actuary’s work can result in additional care being taken in the valuation process.

What are the Different Types of Actuarial Audits?

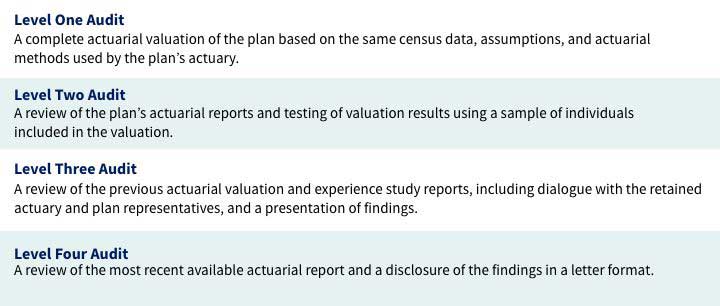

There are different types of actuarial audits that can be classified depending upon the level of audit desired. The types of actuarial audits are described below as Levels One through Four (with Level One being the most comprehensive and Level Four being the least comprehensive). (See Table 1)

Level One

A Level One audit is a complete actuarial valuation of the plan based on the same census data, assumptions and actuarial methods used by the plan’s actuary. The goal is to replicate the results of the most recent valuation, which is sometimes called a replication audit. Generally, there is some testing of plan experience as part of the review, and also dialogue among the retirement plan representatives, the retained actuary, and the reviewing actuary. A detailed report and presentation of the findings in a meeting with plan representatives is standard.

Level Two

A Level Two audit includes a review of the actuarial reports of the plan and a test of the valuation results using a mathematical model of plan activity or sampling (as opposed to performing a complete replication of the retained actuary’s valuation of the plan). As in a Level One audit, there is dialogue with the plan’s actuary and plan representatives. A detailed report and presentation of the findings would be included. An auditing actuarial firm with broad public plan experience and technical capability can usually verify the retained actuary’s previous results reasonably well with a Level Two audit. If results cannot be verified or explained, it may be necessary to expand the scope of the audit to Level One. This would be recommended before any action is taken as a result of the audit.

Level Three

A Level Three audit includes a review of the previous actuarial valuation and experience study reports, dialogue with the retained actuary and plan representatives, and a presentation of findings. At this level, there are no independent calculations. This approach may lead to savings of time and money, but the results may have less value. A Level Three audit may be of interest to smaller plans with limited budgets. Sometimes a plan can benefit by listening to the views of another trained actuary with different experiences and viewpoints than the retained actuary.

Level Four

A Level Four audit includes only a review of the most recent available actuarial report and a disclosure of the findings in a letter format. The actuarial report should state the actuarial findings and identify methods, procedures, assumptions, and data used by the actuary with sufficient clarity that another actuary qualified in the same practice area could make an objective appraisal of the reasonableness of the actuarial work.[2] Since actuaries have a duty to follow actuarial standards of practice, this approach may also be useful although more limited in scope than the other levels.

Table 1

Types of Actuarial Audits

What are the Alternatives?

A small number of people in the public retirement plan community have suggested changing actuaries every three to five years to get the benefit of different viewpoints and possibly savings in actuarial fees. Continuity and consistency in actuarial service providers help to ensure high quality actuarial work and saves time for the retirement system staff since a new actuary does not have to be educated on system practices and plan provisions. Continuity in service providers may be critical during periods of stress or turnover in retirement system staff and trustees. Generally, this continuity helps to reduce retirement system costs through the efficient delivery of services and the historical knowledge of the retained actuary, which are disrupted or lost when there is a change in actuarial service providers.

What Guidelines Should Be Used When Selecting an Auditing Actuary?

The auditing actuary is typically selected through a competitive bidding process (i.e., the use of a Request for Proposal (RFP)). The auditing actuary should have experience with the type of plan being audited and the legislative environment in which the plan operates. In addition, the advice provided should be unbiased and the audit assignment should not be viewed as an opportunity to gain a new client.

An actuarial firm that offers audit services to public retirement systems should have the infrastructure necessary to perform public plan actuarial work, including:

- Valuation software designed to model the wide range of public retirement plan designs without the use of approximations;

- A secure file transfer site necessary to protect plan member data which may be transferred during the course of the audit;

- Robust tools for validating investment return and other key actuarial assumptions;

- A large number of current public retirement plan clients, in particular those with plan design features similar to the plan being audited; and

- Sufficient staff to provide the work promised to the retirement system in a timely manner.

Fees for an actuarial audit can vary widely depending on the complexity of the plan and the extent of the audit. A Level One audit could cost as much as the retained actuary’s annual fees. A Level Four audit could cost as little as a few thousand dollars. In addition, depending upon the scope of the audit, fees may be charged to the system for the additional time spent responding to an auditor’s questions and requests for information. Consider a plan with liabilities of $1 billion and, in this case, a 5 percent mistake is found. The value of that mistake would be $50 million, which makes the fees for the audit seem relatively small.

How are Audit Results Communicated to the Retirement System?

With any type of audit, there should be formal, written communication summarizing the auditing actuary’s findings. Typically, with most types of audits, this would include an audit report. The audit report should provide constructive criticisms of the retained actuary’s work and suggestions for improvement. This information should be listed in the order of relative importance and should clarify the difference between issues that the auditing actuary believes to be large and those that are minor or matters of judgement. Without this form of classification, the audit results may cause unnecessary confusion.

Depending on the type of audit that is performed, the auditing actuary should provide a comparison of their mathematical results to those of the retained actuary. The comparison should discuss whether or not the differences between the two sets of calculations are within reasonable bounds. It should also provide comments on the assumptions and methods used by the retained actuary. The audit should verify that the retained actuary is following Actuarial Standards of Practice.[3] An actuarial audit can include a critique of the plan actuary’s judgment concerning the plan’s exposure to risk.

Generally, in actuarial work, there is no unique, correct answer, but rather a range of reasonableness. Commonly, no two actuaries will ever agree exactly on the results of an actuarial valuation. In light of this, one might wonder what constitutes an actuarial mistake. In our experience, there are two basic types of errors: 1) Actuarial results that fall outside of a reasonable range; and 2) actuarial results that are in a reasonable range, but contain math errors, show poor judgment or are based on false premises or bad data. The second type of mistake is more common than the first.

An actuarial valuation is a complex process involving many assumptions, methods and calculations. If the reviewing actuary believes that the plan has been getting good advice, this should be stated as part of the findings that are communicated to the retirement system. If areas of concern are discovered during the audit, the reviewing and retained actuary should ideally work together to resolve any concerns. If errors are found, these errors should be corrected in a professional manner. Furthermore, the next audit should verify that the corrections have been made.

Conclusion

An actuarial audit is an important process with a goal of sound financial management of public employee retirement plans. An actuarial audit is an important tool available to plan trustees in fulfilling their fiduciary duties. It is in everyone’s best interest to ensure that the retained actuary is following the Actuarial Standards of Practice, providing sound advice and accurate financial measurements to enable the system to meet its financial obligations today and in the future.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Louise Gates, ASA, FCA, MAAA, is a senior consultant with Gabriel, Roeder who has more than 30 years of public pension and retiree health plan consulting experience. She can be contacted at: louise.gates@grsconsulting.com.

The author thanks Brian Murphy and Mary Ann Vitale for their review and helpful comments.

Endnotes

[1] GFOA Best Practices Procuring Actuarial Services https://www.gfoa.org/materials/procuring-actuarial-services

[2] Actuarial Standard of Practice No. 41, Section 3.2 http://www.actuarialstandardsboard.org/wp-content/uploads/2014/02/asop041_120.pdf

[3] http://www.actuarialstandardsboard.org/standards-of-practice/