Accounting for Ceded Reinsurance Under LDTI—Unique Concerns

By Steve Malerich

The Financial Reporter, April 2021

Author’s note: This is the fourth in a series of articles looking at accounting for ceded reinsurance under GAAP’s Targeted Improvements to the Accounting for Long-Duration Contracts (LDTI).[1]

This article examines some unique concerns that arise from the relationship between ceded reinsurance and the underlying contracts. As in the previous articles, the focus is on long-duration reinsurance of products that require net premium reserves and on objectives of compliance, performance and simplicity.

Though compliance remains necessary, most of the concerns addressed here are more subtle and detailed than any formal guidance. Compliance, therefore, is loosely defined and opinions about these concerns may vary. Given the lack of clear guidance, this article relies on performance objectives to guide interpretation. Simplicity remains an optional, but desirable objective.

Performance objectives are two-fold: (1) constant margin and (2) remeasurement of the reinsurance aligns with remeasurement of the direct liability to the extent that cash flows are reinsured. Simplicity includes the ability to apply a technique consistently to a variety of products and reinsurance contracts.

Cohorts

Reinsurance recoverable “shall be recognized in a manner consistent with the liabilities … relating to the underlying reinsured contracts” (ASC 944-40-25-34). In addition to the methods of calculating reinsurance recoverable (addressed in the earlier articles), consistent manner has unique implications for the level at which it is measured and for some of the inputs to its measurement.

Grouping

Among the implications of the consistency requirement, the American Institute of Certified Public Accountants (AICPA) advises in its Life & Health Insurance Guide (Audit Guide), that “a ceding entity should use cohorts … consistent with those of the underlying reinsured direct policies.”[2]

I understand this to mean that ceded reinsurance can be grouped at a lower level than the underlying contracts but not at a higher level. For example:

- Two treaties covering business within a single direct cohort may be grouped together as a single reinsurance cohort or measured as separate reinsurance cohorts.

- A treaty covering contracts in multiple direct cohorts must be measured in multiple cohorts that align with the underlying direct cohorts.

If measurement techniques are chosen to achieve both performance objectives, the decision to group reinsurance at the same level as the underlying contracts or at a lower level should not affect the aggregate results.

Accrual Basis

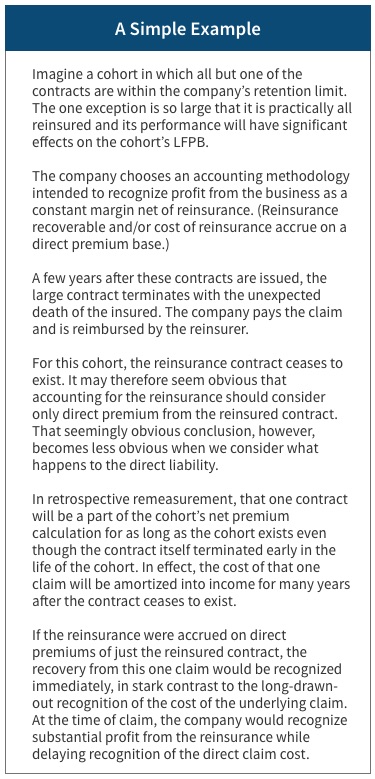

To consistently achieve performance objectives, either or both reinsurance recoverable and cost of reinsurance must be measured on a direct premium base. When reinsurance covers only a subset of contracts in a cohort, this raises the question of whether the direct premium base for reinsurance should include premiums from contracts in the direct cohort that are not reinsured.

To consistently achieve performance objectives, either or both reinsurance recoverable and cost of reinsurance must be measured on a direct premium base. When reinsurance covers only a subset of contracts in a cohort, this raises the question of whether the direct premium base for reinsurance should include premiums from contracts in the direct cohort that are not reinsured.

If we believe the consistency requirements in GAAP are meant to achieve the performance objectives described in these articles, then the direct premium base for reinsurance should include premiums from all contracts in the direct cohort. To see why, consider both parts of the performance objective.

The liability for future policy benefits (LFPB) accrues in proportion to direct premiums for the entire cohort. If reinsurance costs and benefits are to be recognized consistently with direct benefit expense, then reinsurance must accrue or amortize on that same base.

Remeasurement of the LFPB for actual experience and for changes in expected experience depends on the amount of historical premium as a proportion of total expected lifetime premium. That proportion depends on all premium for the cohort, even when remeasurement relates to reinsured benefits. If remeasurement of the reinsurance is to align with remeasurement of the LFPB, then it must use the same direct premium base as the LFPB. (See the sidebar for a simple example.)

When reinsurance measurement is based on direct premiums of the entire cohort, the decision to measure multiple treaties separately or together does not affect aggregate performance.

Constraints

Under LDTI, GAAP places two constraints on measurement of the traditional LFPB and one constraint on any additional insurance liability for universal life-type contracts. Traditional net premiums may not exceed gross premiums (ASC 944-40-35-7A) and the reported LFPB may not be less than zero (ASC 944-40-35-7B). An additional liability for universal life may not be less than zero (ASC 944-40-35-10) but there is no cap on its benefit ratio.

GAAP does not place similar constraints on ceded reinsurance. The AICPA recognizes in its Audit Guide that there are certain circumstances where the same constraints might be applied to reinsurance recoverable. It advises, however, that these constraints cannot be applied consistently to all reinsurance. Instead, reinsurance recoverable can be adjusted to the extent a loss is recognized from applying a constraint to the reinsured portion of the direct contracts.[3]

There is no guidance on how to determine the reinsured portion of such a loss. In some circumstances, it should be obvious. For example:

- If reinsured claims are less than expected but retained claims are greater than expected by enough to produce an immediate loss from either constraint, then the reinsured portion is zero.

- Conversely, if retained claims are less than expected but reinsured claims are greater than expected by enough to produce an immediate loss from either constraint, then the entire loss is reinsured.

For less obvious situations, we may eventually find widely accepted techniques for determining the reinsured portion of a loss. Until then, each company will need to determine an appropriate practice when necessary.

Limited-Payment Contracts

Reinsurance of limited-payment contracts poses two additional challenges—recognition of profit and limited-payment reinsurance.

Profit Recognition

For limited-payment contracts, the objective of recognizing profit in proportion to gross premiums is superseded by the deferred profit liability (DPL) requirement. By itself, calculating a net premium LFPB for limited-payment contracts would result in “income recognition before services have been performed.”[4] To prevent such recognition, GAAP requires deferral and amortization of the premium margin so that it is “recognized over the period that services are provided.”[5]

LDTI does not change the fundamental principle behind DPL. Amounts deferred “shall be recognized in income in a constant relationship with insurance in force (if accounting for life insurance contracts) or with the amount of expected future benefit payments (if accounting for annuity contracts)” (ASC 944-605-35-1).

To achieve performance objectives for reinsurance of limited-payment contracts, the DPL amortization base replaces direct gross premium wherever it would otherwise be used in reinsurance calculations.

Limited-Payment Reinsurance

Sometimes, reinsurance itself is a limited-payment contract. There is no explicit connection between the reinsurance accounting provisions and the DPL provisions. The cost of reinsurance, however, “shall be amortized over the remaining life of the underlying reinsured contracts if the reinsurance contract is long-duration” (ASC 944-605-35-14). Amortizing the cost of limited-payment reinsurance in the same manner and on the same basis as DPL will satisfy this explicit requirement and achieve the performance objectives.

Limited-payment reinsurance may also affect the treatment of reinsurance allowances. The previous “Precedent” article noted an interpretation that would exclude level percent-of-premium allowances from reinsurance asset and liability calculations. In limited-payment reinsurance contracts, allowances that terminate after the premium payment period are non-level even if they’re expressed as a level percent of premium. As non-level allowances, they need to be included in reinsurance calculations, either as an increase to amounts recoverable or as a reduction to reinsurance premiums. How they are applied may affect whether they appear in reinsurance recoverable or in a separate cost of reinsurance, but the choice should not affect the resulting net income.

Alternatives

With little or no formal guidance about these concerns, this article has emphasized the achievement of performance objectives. These objectives may represent GAAP intent, but they are not explicit principles. Other considerations might lead to alternatives to the techniques described so far.

For example, in some circumstances it might be simpler to value reinsurance on a base that includes direct premiums of reinsured contracts only. The results of such a calculation would not precisely achieve the performance objectives, but in many cases the differences are likely to be insignificant.

In another example, coinsurance of varying proportions within a cohort will not achieve performance objectives if valued using the standalone reinsurance recoverable method. Though the performance gap can be closed by amortizing a separate cost of reinsurance asset or liability, the balance needed may be small so that limiting calculations to reinsurance recoverable has no significant effect on results.

In these and other circumstances, such simplifications might be seen as compliant as long as they satisfy all explicit requirements.

In the next article, we’ll look at new reinsurance of previously issued contracts.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Steve Malerich, FSA, MAAA, is a director at PwC. He can be reached at steven.malerich@pwc.com.