Addendum to Accounting for Ceded Reinsurance Under LDTI—Constraints

By Steve Malerich

The Financial Reporter, June 2023

In the July 2022 issue of The Financial Reporter, I presented a framework for measuring the reinsured portion of losses recognized from constraints on the traditional liability for future policy benefits.

Since then, I have learned that one formula (nLFPBt) will produce an inappropriate result in some circumstances. In this addendum, I present a correction of that formula along with a restatement of all other formulas as presented in the original article.[1] I also include one example of how this can translate into formulas for reinsurance recoverable or cost of reinsurance.

Framework Formulas

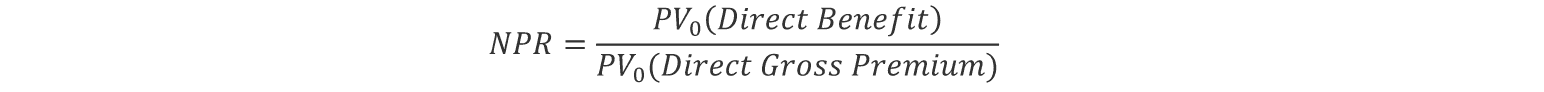

To measure the direct liability before flooring:

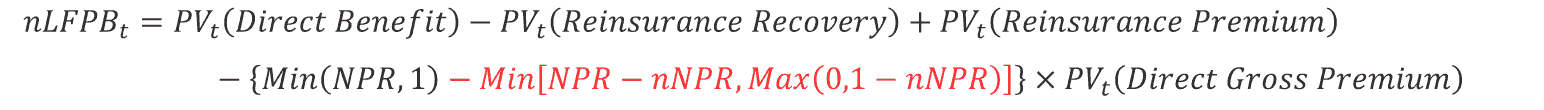

To measure the net liability before flooring:

When there is a type 2 loss, the original article’s capping of nNPR in the nLFPBt formula overstates the type 2 gain if nNPR is greater than NPR and greater than one. The added complexity in this formula’s NPR multiplier corrects this error.

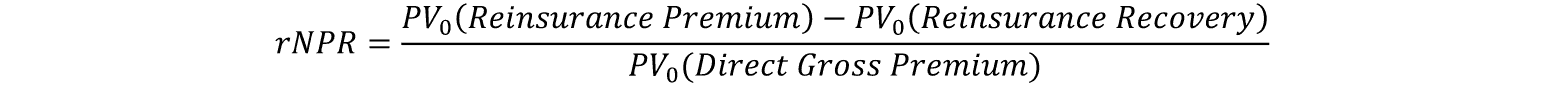

To measure direct loss and reinsurance gain from capping the net premium ratio:

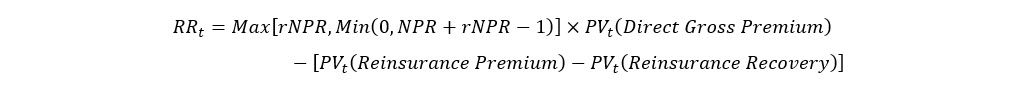

To measure the direct loss and reinsurance gain from flooring the liability:

Reported Balances

How this framework translates into reported balances depends on the methods used to measure those balances. If the net of reinsurance premiums and recoveries is accrued or amortized on direct premiums (known as the “net cost” or “integrated” method) and valued as an asset (or liability, if negative) then:

Once adjusted for constraints, reported values will be:

I would like to thank Thomas Bruns, FSA, for bringing this issue to my attention and helping to find the solution.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the authors’ employer.

Steve Malerich, FSA, MAAA, is a director at PwC. He can be reached at steven.malerich@pwc.com.