Impacts and Considerations of Statistical Bias in LTC Due to Benefit Reductions

By Jeff Anderson, Joe Neary and Courtney Williamson

Long-Term Care News, August 2024

It’s no secret that long-term care insurance (LTCI) carriers have been exploring ways to manage in-force blocks of business over the last two decades. Carriers initially pursued premium rate increases and more recently have explored offering additional innovative reduced benefit options such as cash buyouts and coinsurance. Many carriers have also begun utilizing first principles assumptions, which allows them to analyze the risk of their LTCI blocks on a more granular level. By evaluating past experience, LTCI carriers understand which policy and benefit characteristics are associated with higher risk. Using this information, carriers have developed assumptions and requested premium rate increases that often vary by these characteristics to more accurately reflect future expectations for their blocks of business. However, without consideration for how benefit levels have changed over time, this process may produce statistically biased results.

LTCI policyholders elect a variety of benefit characteristics for their policies at the time of issue. However, policyholders can generally reduce these benefits any time after purchase (subject to state minimums). These benefit reductions can be driven by changes in the perceived need for long-term care (LTC) coverage (e.g., a family member living nearby), but they are often driven by the affordability of coverage, especially following a premium rate increase. Policyholders often make the following benefit changes to mitigate the impact of a rate increase:

- Reduce daily or monthly benefit amount;

- Reduce the benefit period or maximum benefit pool;

- Increase the elimination period;

- Reduce or eliminate inflation protection; and

- Eliminate optional riders.

This article explores the impacts these benefit reductions have on assumption development and a block’s lifetime loss ratio, specifically when evaluating assumptions and experience by benefit characteristic cohorts.

Experience Study Impacts and Considerations

LTC assumptions often vary across a wide range of characteristics. It is widely recognized that mortality and incidence rates vary by attained age and gender. In addition, many carriers vary assumptions across benefit characteristics that policyholders select and can reduce over time. Certain characteristics directly influence assumptions, such as the length of the elimination period before the carrier makes its first claim payment. Others have an indirect impact due to incentives for policyholders to ration limited benefits. For example, policyholders with short benefit periods may wait to file a claim or utilize fewer benefits to extend the availability of their benefits. Finally, some characteristics may not directly impact behavior but are indicative of policyholder affluence, which can influence behavior and/or results.

Consider four hypothetical LTCI policyholders: John, Paul, George and Ringo. All four policyholders were issued identical policies from the same LTCI carrier 15 years ago. John and Paul both selected unlimited benefit periods, while George and Ringo selected three-year benefit periods. Five years ago, their LTCI carrier implemented a rate increase that was 100% for policies with unlimited benefit periods and 25% for policies with three-year benefit periods. Paul, George, and Ringo accepted the increased premium, but John reduced his benefit period from unlimited to three years.

This hypothetical scenario exemplifies a situation that occurs on a wide scale across blocks of LTCI. On that larger scale, policyholder behavior can influence experience and the assumption development process. When analyzing historical experience and developing assumptions, it is important to consider how benefit characteristics may impact policyholder behavior and how these characteristics may have changed over time.

Given that most in-force LTCI policies were issued years ago, policyholders generally have a better expectation of their near to midterm future LTC needs than the LTCI carrier. Policyholders use this understanding when determining whether to reduce benefits. Those who expect to need care soon are incentivized to retain their full benefits, while others are more likely to consider reducing benefits. As such, policyholders who have downgraded their benefits (e.g., John) may behave differently from both policyholders with richer benefits who have not reduced their benefits (e.g., Paul) and policyholders who selected leaner benefits at issue (e.g., George and Ringo). Actuaries should consider how behavioral differences may impact the assumption development process.

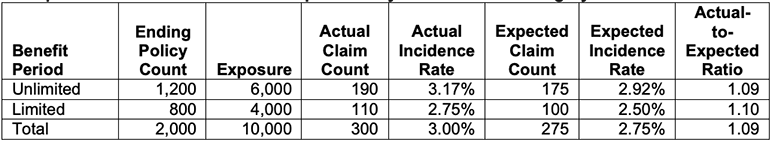

Carriers often assume that claim incidence is higher for policies with unlimited benefit periods compared to policies with limited benefit periods (e.g., three years). Table 1 summarizes hypothetical historical claim incidence experience for a block of 2,000 policies over a five-year period, split between unlimited and limited benefit periods. While lacking full credibility (and assuming 100% persistency), the comparison of actual and expected claim counts suggests the underlying assumption should be increased for each benefit period category by roughly 10%.

Table 1

Example Historical Claim Incidence Experience by Benefit Period Category

As an alternative, consider a scenario where, midway through the experience period, 200 policies downgraded their benefits from unlimited to limited benefit periods. As mentioned earlier, policyholders who reduce benefits may not expect to require LTC services in the near term. As a result, the reclassification of their experience between the unlimited and limited benefit period cohorts will move exposures but will likely move few, if any, actual claim events.

As part of analyzing historical experience, an important consideration is how these 200 policyholders should be categorized. Because the underlying expectation varies between unlimited and limited benefits and the proportion of exposures versus claim counts being reclassified is likely inconsistent, the results may vary materially depending on the selected approach. Tables 2 and 3 illustrate this variation.

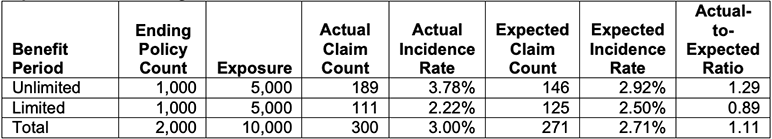

Table 2 summarizes experience where all 200 downgraded policies are included in the limited benefit category for the full experience period. This effectively assumes that all policyholders who downgraded behave similarly to those who selected limited benefit periods when the policies were originally issued.

Table 2

Experience with Downgrades Classified as Limited Benefit Period From Issue

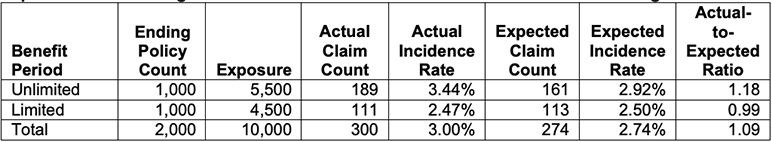

Table 3 bifurcates the experience for the downgraded policies based on their benefits available at each point in time (i.e., the experience prior to downgrade is included in the unlimited category and the experience after downgrade is included in the limited category). This effectively assumes that policyholders who downgraded behaved similarly to those with unlimited benefit periods prior to downgrading and then similarly to those with limited benefit periods after downgrading.

Table 3

Experience with Downgrades Classified as Limited Benefit Period at Time of Downgrade

While the unlimited benefit period experience suggests increases in the incidence assumption in both Table 2 and Table 3, the magnitude of the incidence increase varies depending on the categorization of the experience for policies with downgrades. The total actual claim count, total actual incidence rate and expected incidence rate by benefit period category have not changed between the two tables. However, the reweighting of the results due to the varying treatment of the downgrade experience produces different conclusions.

When analyzing historical experience on a block with downgrades, it is important to consider how policyholders are expected to act going forward. Will those who downgraded benefits behave like policyholders who originally selected the reduced benefits or like policyholders who selected the same original benefits but did not downgrade? If you believe policyholder behavior changed over your experience period, did it change at the point of downgrade election or at a different time? While there are no perfect answers to these questions, many actuaries opt for an approach similar to that illustrated in Table 3. In any case, an actuary should consider the intended use of the assumptions and use judgment to decide the most appropriate approach, recognizing the potential for the categorization of policies with downgrades to inject statistical bias into the result.

Impacts on Lifetime Loss Ratios and Cohort Evaluation Considerations

In addition to a notable impact on experience studies, benefit reductions can also statistically bias lifetime loss ratio (LLR) evaluations split by benefit characteristics. Based on the most recent Milliman LTC rate increase survey, over half of surveyed carriers had pursued rate increases that varied by benefit levels and most often varied by benefit period and/or inflation option.[1] In developing the rate increases, carriers may directly use the LLRs in their analyses to determine the rate increase request. However, carriers need to demonstrate compliance with regulatory minimum loss ratios and, if asked, must be prepared to show regulators those demonstrations split into cohorts by which the rate increase varies.

Typically, these cohort-specific LLR analyses are based on each policyholder’s benefit level at the time of the analysis. However, if a policyholder reduces benefits, then a subsequent analysis with the same approach would reflect that the policyholder’s entire historical experience shifted into the benefit cohort of their new benefit level. The policyholder’s historical premiums would still correspond with their actual benefits at various times (i.e., historical premiums are not modified when a policyholder reduces benefits). This shift in benefit cohorts can compound over time and change the results of the underlying analyses, all else being equal. The following provides an illustrative example of the impact on the LLRs due to benefit period reductions for a hypothetical block of business.

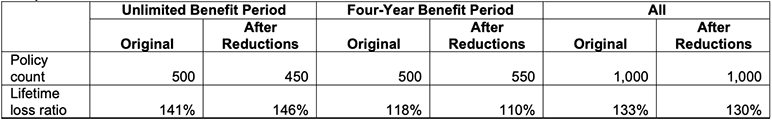

Table 4 shows the change in the LLRs by benefit period cohort and in aggregate for a hypothetical block of business at the originally elected benefit period and after benefit reductions. In this example, a portion of the policyholders who originally elected an unlimited benefit period decide to reduce benefits to a four-year benefit period. Their historical premium moves with them, but their future benefit expectation is lower relative to their original benefits.

Table 4

Impact on LLRs

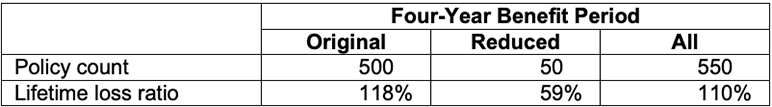

Table 5 shows the breakdown of the four-year benefit period LLR experience after benefit reductions between those who originally selected this benefit and those who reduced from unlimited to four-year.

Table 5

Breakdown of Four-Year Benefit Period Cohort Distribution after Benefit Reductions

We assume that policyholders who have been or are on claim will feel a greater need for their remaining benefits and, therefore, would not reduce benefits. Those on claim also have little incentive to avoid premium increases as most LTCI policies waive premium when on claim. Thus, the LLRs in Tables 4 and 5 assume that the policyholders who reduce benefits had not previously gone on claim. As mentioned earlier, historical premiums for policyholders who reduced their benefits are not modified and move with them as they switch cohorts. The low historical claims (i.e., none) and higher historical premium (relative to benefits after reduction) for these policyholders drive down the LLRs for the “reduced” cohort shown in Table 5. Conversely, those who remain in the unlimited benefit period cohort have higher LLRs, as seen in Table 4, as a portion of the historical premium was moved to a new cohort, but with no historical claims.

This impact is magnified in blocks that have had significant benefit reduction elections. Over time, healthier policyholders are more likely to downgrade to limited benefit periods, which would cause the LLR for those who remain in the unlimited benefit period cohort to increase. To combat the increase in the LLR a carrier may request additional increases, which may lead to additional benefit reductions.

When evaluating LLRs for different benefit cohorts over time, one should consider the historical skewing of the LLRs due to benefit reductions and consider making adjustments to any analysis. There are several ways to update an analysis to align with current benefit levels (i.e., after benefit reduction), including but not limited to:

- Updating historical premiums to reflect the current benefit levels;

- Adjusting target LLRs so they are on the same basis as current experience; and

- Adjusting prior pricing expectations to reflect current benefits.

In some cases, multiple adjustments may be required. Regardless of whether any adjustments are made, the entire block (i.e., in aggregate) should be evaluated to ensure compliance with minimum LLR requirements.

An alternative to LLR analyses would be a prospective approach, which eliminates the historical premium disparity and assists in measuring future deterioration over time. Such approaches include using the Prospective Present Value (PPV) method (also known as the Texas method) outlined in the Multistate Rate Review Framework[2] or future profit or gross premium valuation calculations. However, these analyses may not be straightforward. For example, when using the PPV method, it is important that the prior assumptions reflect a policyholder’s current benefits so projected experience under current and prior assumptions reflect consistent benefits. This can be difficult if prior assumptions were built on a seriatim basis, as they may need to be redeveloped for the current benefit level. Even if a prospective approach is utilized in evaluating a block, LTCI regulations have minimum LLR requirements and, as mentioned previously, many regulators require these demonstrations by cohort if a rate increase request is not uniform.

Conclusion

Benefit reductions can present challenges when developing assumptions and analyzing experience on blocks of LTCI business. An important aspect of this work is to consider how to track benefit reductions and categorize the experience when developing assumptions. As seen in our illustrative examples, the categorization of historical experience can influence the results of experience analyses and LLR calculations. As part of the overall analysis, it is important for actuaries to consider how benefit reductions may impact their analysis and then apply appropriate adjustments, where necessary, to avoid unintentional statistical bias and potential misstatement of projected results.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Jeff Anderson, FSA, MAAA, is a principal and consulting actuary at Milliman. Jeff can be reached at jeff.anderson@milliman.com.

Joe Neary, FSA, MAAA, is an actuary at Milliman. Joe can be reached at joe.neary@milliman.com.

Courtney Williamson, ASA, MAAA, is an associate actuary at Milliman. Courtney can be reached at courtney.williamson@milliman.com.