Minding the MediGap: Modeling Considerations for a Complex Product

By Tyler Armstrong, Randy Beams and Robert Eaton

The Modeling Platform, July 2021

Modeling Medicare Supplement (Med Supp) insurance is a complex task. Insurers dedicate extensive resources to establish and maintain models that incorporate multifaceted assumption sets, accommodate various policy types, and can report across numerous accounting regimes and regulatory standards. Modeling for Med Supp insurance is evolving quickly. Regulations, new accounting standards, and technological advancements, just to name a few areas of influence, have all contributed significantly to the ever-changing insurance modeling landscape.

Traditional spreadsheet-based approaches for Med Supp modeling often fall short in managing model risk; they lack efficiency and ease of use. An ideal modeling solution will have an effective risk governance framework, efficient assumption management, logical inputs, and the capability of modeling complex variable interactions. Along with easily customizable formulas and report templates, these features make a modern actuarial modeling software (AMS) platform the preferred solution for Med Supp modeling.

Model Risk Management

Traditional spreadsheet-based approaches lack sufficient model risk management features, increasing the likelihood of model error and adverse financial impacts. Modern AMS contain a host of risk governance features to more effectively manage model risk. These features include:

- Restricted user permissions: AMS allow for user access to be limited to read-only, read/run-only, input write access, or full input/database access.

- Documentation of model change: AMS track last change date and user.

- Model backup and restore capabilities: AMS facilitate model backups for preservation and future restoration if needed.

Key Modeling Assumptions and Inputs

Modeling Med Supp often requires a large set of assumptions such as rate increases, claim costs, commissions, and others. Additionally, multiple sets of each assumption are often required for different bases (best estimate, STAT, GAAP, tax). In more traditional methods, assumption implementation and on-going management can become overly complex, confusing, and time consuming. In contrast, dedicated AMS contain built-in assumption inputs covering various bases and organizational tools to make implementation and management of assumption sets simple and intuitive.

Below is a sample of key assumption inputs often contained in modern AMS for Med Supp.

- Rate Increases

- Cumulative Historical (approved)

- Projected Calendar Year

- Projected Policy Anniversary

- Morbidity

- Morbidity Curve (usually by age)

- Could be derived from a Loss Ratio

- Area Factors

- Medical and Aging Trend

- Seasonality

- Morbidity Curve (usually by age)

- Commissions

- Commissionable Premium (adjusted for deductibles)

- Durational Factors

- Chargebacks on Death and Lapse

- Acquisition Expenses

- Terminations

- Total Terminations

- Deaths

- Lapses

AMS provide the option to link to external data sources such as spreadsheets. The variety of input methods and available partitions between assumption sets allow for flexibility of assumption structure, preservation of historical assumption sets, and efficient updating. Most AMS allow for multiple assumption bases to be set up simultaneously, and to toggle between the various assumptions. This is especially helpful for multipurpose models such as those used in pricing, cash flow testing, and valuation.

Modeling Complex Interactions

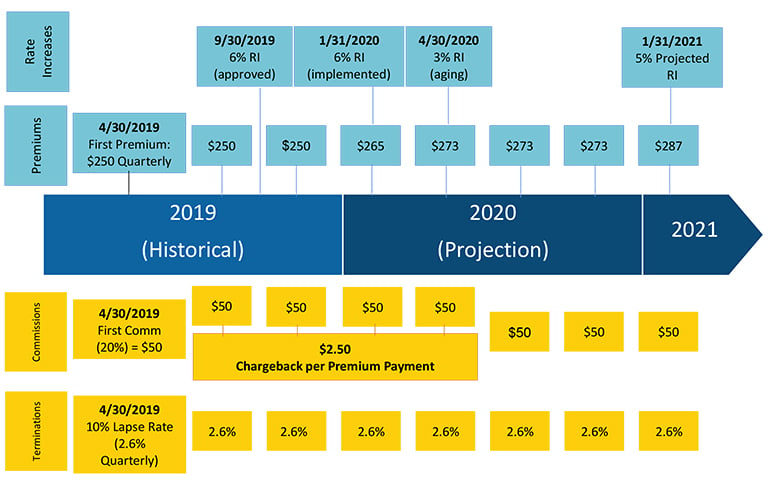

Modeling Med Supp through traditional spreadsheet approaches may force users into simplified assumptions, timing, and cashflow calculations. The example in Figure 1 shows the complexity of a single policy’s assumptions and cash flows. This illustrative example is for a quarterly pay, attained age rated policy that was sold on April 30, 2019. The projection starts on Jan. 1, 2020.

Figure 1

Assumptions and Cash Flows

Figure 1 demonstrates the complexity of cash flow timings that arise for a typical policy. Note that this graphic shows only one possibility of timing of rate increases, approvals, and issue dates. Many other combinations may arise in actual practice. Accurately modeling these cash flow timings can be a daunting task for a traditional spreadsheet model, particularly when run across large blocks of policies. Modern AMS allow for more granular calculations and analysis, using an industry tested framework. This limits the need for simplification and can increase model accuracy without the expense of significantly increased runtime or model risk.

Incorporation of Accounting and Regulatory Regimes

Companies may report Med Supp financial results under many accounting regimes: statutory, GAAP (or IFRS 17), tax, etc. Modelers prefer an approach that allows for each assumption input for variable formulas to be set specific to the accounting regime. This reduces the customization and complexity of modeling after the initial model is developed.

As an example, if a company models premium deficiency reserves (PDR), those assumptions may be set separately from the statutory assumptions underlying the active life reserves.

Statutory

The Valuation Manual points to the Health Insurance Reserves Model Regulation[1] (HIRMR) for statutory reserving guidance. The HIRMR prescribes that the minimum contract reserve be calculated using the 2-Year Full Preliminary Term methodology. The HIRMR also prescribes assumptions for terminations and interest rates. The model needs to be capable of handling this reserve methodology and calculating statutory cash flows separately from best estimates or other accounting regimes.

The software also may need to handle legacy standards, say for varying the interest rate by issue year or issue “era,” as the maximum statutory valuation rate for discounting future cash flows is different based on the issue year, per the HIRMR.

GAAP: Legacy GAAP Standards (e.g., FAS60), LDTI, Purchase GAAP (P-GAAP)

The ever-changing GAAP landscape is challenging to keep up to date with, particularly with the ongoing transition to long duration targeted improvements (LDTI) standards. Med Supp will see an impact to GAAP reporting from this update. The model needs to be prepared for this transition.

Tax Treatment

Tax accounting can add some modeling complexity that can be tricky to handle. Tax accounting may be necessary for capital planning or financial reporting, in which case the model needs to handle tax impacts to the bottom line of the financial statement.

Sensitivity Testing and Capital Planning

Sensitivity testing is an important aspect of capital planning and asset management. The actuary should consider the financial impact of assumption uncertainty. Some key assumptions to stress test include:

- Lower than expected approved rate increases,

- lower lapse or termination rates, and

- higher than expected medical trend.

Sensitivity testing can assist in-force management, specifically relating to the riskiness in assumption uncertainty.

Modeling Software

For our Med Supp modeling needs, we rely on our in-house actuarial software Integrate®. It is natural to use in-house software, and certain features make Integrate® particularly useful for Med Supp modeling, such as:

- Customizable formula database that allows for the modeling of unique product designs and features;

- customizable report templates;

- highly flexible and user-friendly debugging features; and

- balances the benefits of a closed-modeling system (efficiency, governance) with an open-modeling system (flexibility for unique product features and regulatory interpretations, providing the ability to lock down for governance controls).

In general, modelers want the capability for a single model to produce CFT and other projections as well as calculate both regulatory rules-based and company-specific principles-based reserves. Modern AMS provides these capabilities along with adaptability required for complex Med Supp products.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Tyler Armstrong, FSA is an actuary with Milliman based in Tampa, FL. He can be reached at tyler.armstrong@milliman.com.

Randy Beams, ASA is an actuary with Milliman based in Tampa, Fla. He can be reached at randy.beams@milliman.com.

Robert Eaton, FSA, MAAA is a principal with Milliman based in Tampa, Fla. He can be reached at robert.eaton@milliman.com.