State Pensions in Germany, Austria, Belgium, and France

By Paul Donahue

Retirement Section News, October 2024

This article is the third in a series intended to provide context and analysis relevant to reform of the design and financing of social security retirement income benefits in the United States. The first article analyzed the adequacy of US social security benefits,[1] and the second discussed pension reform in Sweden, which I believe provides the most significant paradigm for design and financing reform in the United States. This article comments more briefly on pension design, financing and reform, and elder poverty, in Germany, Austria, Belgium, and France, with a view to providing additional context relevant to US social security design and financing reform.

Basic Pension Economics

It is useful to frame what follows by a brief description of basic pension economics: “The only way that people can continue to consume after retiring is to consume goods and services produced by the working population.”[2] Without increases in productivity, contributions to support a “pay as you go” pension system with a declining worker to retiree ratio must rise, or benefits must fall: The test of any reform is the extent to which it increases national output.[3]

Germany

Demographics

The number of workers supporting recipients of a state pension depends on many factors. One key factor is fertility, the number of children each woman has on average.[4] Fertility has plummeted around the world, first in the developed world, but followed by the developing world. In the former West Germany, the total fertility rate fell from 2.54 in 1964 to 1.45 in 1975.[5] OECD data puts the number at 1.53 for 2022, projected to rise to 1.57 in 2040 and 1.59 in 2060.[6] All of these more recent numbers are well below the rate of 2.1 needed to sustain current population.[7] This is offset to a limited extent by positive inbound migration of .8%.[8] (see Table 1)

Another key factor is the age at which workers leave the workforce. In Germany in 2022, the average age for men leaving the work force was 63.7 years and for women 63.4 years.[9] The average life expectancy in Germany at labor market exit is 18.1 years for men and 22.5 years for women.[10] The overall result of these factors is that the old-age to working-age ratio[11] is expected to rise from 38.0 in 2022 to 59.1 in 2052 and to 64.8 in 2082. The corresponding numbers in Sweden are 35.9, 46.0, and 60.4, substantially better from the perspective of financing of state pensions than in Germany.[12]

Benefit Calculation[13]

The benefit accumulation and payment formula is based on the average annual wage. A year’s contributions for a person earning the average annual wage (43,142 euros in 2023) accumulates one pension point.[14] At the maximum contribution level (87,600 euros in 2023), a person accumulates 2.03 pension points.[15] The points for each year of work are added together. At retirement, the accumulated pension points are multiplied by an “entry factor,” one for retirement at normal retirement age, reduced by .3% per month for each month of early retirement and increased by .5% per month for each month of late retirement. For persons born in 1964 or after, the normal retirement age is 67.[16] Early retirement is first available at age 63. For those with 45 years or more of insured coverage, early retirement is available without reduction in the amount of the benefit.[17] The net wage replacement percentage for a person retiring at normal retirement age is not currently permitted to fall below 48%.[18] In 2023, the average replacement rate for Germany was 43.9% compared to an OECD average of 42.3%.[19] Based on most recent OECD data, 8.6% of men, and 12.7% of women, live in poverty in Germany.[20]

In Germany, once retirees begin to receive their pensions, they are adjusted annually based on a blend of price inflation (70%) and wage inflation (30%).[21], similar to the US social security COLA adjustment.[22]

Benefit Financing

The primary source of benefit financing is a wage tax on wages up to the contribution ceiling of 9.3% on both employer and employee, for a total of 18.6%.[23] In addition to the wage tax, 28.9% of total benefits are financed from general tax revenues and 5.5% are financed from other tax revenues.[24] (see Table 2)

Automatic Adjustment Mechanism

The Automatic Adjustment Formula for Germany is[25]

The value of a pension point changes from year to year based on three factors. The first is the rate of change in average earnings. When average earnings rise, other things equal, the contributions collected will rise and the value of a pension point rises. The second factor is the wage tax rate. Again, other things equal, when the wage tax rate rises, contributions collected rise and the value of a pension point rises. There is a change in contribution rate only by legislation, and the current German government’s coalition agreement promised no increase above 20% and no decrease in the minimum replacement rate below 48% during the life of the coalition.

The “sustainability factor” in the formula adjusts the pension point value for changes in the ratio of pensioners to contributors. If the ratio increased by 1, the pension point value would decrease by one-quarter of one percent. We noted above that the ratio of pensioners to workers was expected to rise from 38% in 2022 to 59.1% in 2052. With no other changes, that would mean that the sustainability factor adjustment would reduce pensions (21.1/4) or 5.275% over those 30 years.

Given the existing constraints on maximum contribution and minimum benefit, the true balancing mechanism in the German system is the contribution from general tax revenues.

Introduction of Partial Funding

German Finance Minister Christian Lindner announced in January 2023 plans to modify pure pay-as-you-go pension financing by introducing a reserve fund that would be invested in equities.[26] In August 2023, the government reportedly increased the initial target for the size of the reserve fund from €150 billion to €200 billion, to be funded over the next 12 years.[27] The aim of the reserve fund would be to limit increases in contributions and to decrease funding from general tax revenues, which reached €100 billion in 2022.[28]

Political Environment for Reform

The pension provisions were a point of contention in the negotiation of the current coalition, and its term ends in late 2025. In my personal opinion, pension reform seems a likely point of discussion in the runup to the next election, and any meaningful additional reform before then seems unlikely.

Austria

Austria provides contrasts in important respects.

Demographics

In Austria, post-WWII fertility peaked in 1965 at 2.78, fell to a low of 1.38 in 2005, and rose slightly thereafter.[29] Table 1 below shows that the number was 1.47 in 2022. The OECD projects that fertility in Austria will rise to 1.55 in 2042 and 1.59 in 2062,[30] close to the projections for Germany. As in Germany, low Austrian fertility is partially offset by positive inbound migration of 1%.

In Austria, the normal retirement age for men is 65, but the effective age at exit from the labor market is 61.6. For women, the corresponding numbers are 60 and 60.9.[31] The remaining life expectancy for men at retirement is 21.6 years and for women 25.5 years, significantly higher than in Germany.[32] The overall result of these factors is that the old-age to working population ratio is expected to rise from 32.5 in 2022 to 59.0 in 2052 and 66.0 in 2082.[33] The demographic comparison between Germany and Austria is mixed.

Benefit Calculation

The pension benefit for persons born in 1955 or later is based on the value of their pension account.[34] Each year, 1.78% of a person’s gross earnings up to the earnings cap of €6,060 monthly[35] is credited to that person’s pension account. The credits for past years are adjusted for changes to the overall growth in earnings.[36] The accumulation period is up to 40 years.[37]

Benefit Financing

The primary source of benefit financing is a wage tax on wages up to the contribution ceiling of 12.55% on employers and 10.25% on employees, for a total of 22.8%.[38] This is 4.2% higher than in Germany and 10.4% higher than in the United States. Even with the higher wage tax, a comparatively higher portion of total benefits (36.5%) is also financed from general tax revenues, in addition to 5.8% from other tax revenues.[39]

No Automatic Adjustment Mechanism

Austria has no legislated mechanism to balance pension expenditures and revenues. Apparently, general tax revenues fill any gap between expenditures and other sources of revenue.

Political Environment for Reform

I have been unable to identify any discussion of pension reform in Austria.

Belgium

Demographics

In Belgium, OECD data estimates 2022 fertility at 1.59, 2042 at 1.65 and 2062 at 1.67. These rates are higher than for Germany or Austria, but still well below what is required for a stable native population. As in Austria and Germany, the low fertility rate is partially offset by positive inbound migration of 1%.

In Belgium in 2022, the “normal” retirement age for both men and women was 65,[40] but average age for men to leave the workforce was 61.1 and for women it was 61.3.[41,42] The remaining life expectancy at labor market exit was 22.2 for men and 25.2 for women.[43] The overall effect is that old-age to working population ratio is expected to rise from 34.0 in 2022 to 52.2 in 2052 and to 63.9 in 2082.

Benefit Calculation

The maximum pension benefit is based on career average earnings up to ceiling over a period of 45 years. The pension payment is 60% of the career average,[44] with the earnings for past years of service, as well as benefits in pay status, adjusted for price inflation.[45] This amounts to a pension accrual of 1.33% per year (60%/45 years).

Benefit Financing

Currently 70.6% of benefit financing comes from contributions, 8.4% from general tax revenues, and 21% from other tax revenues.

2023 Pension Reform

On April 4, 2024, the Federal Parliament approved a pension reform bill, with key features that had been hammered out after contentious debate by the seven party Belgian coalition government in 2023.[46] The dynamic for the 2023 reform included a powerful push for pension reform from the European Union. The EU had made improvement in the Belgian pension system’s financial sustainability a condition for release of additional funding from the EU’s pandemic recovery fund.[47]

The key elements of the reform were:

- Changing minimum pension rules

The reform tightened the requirements to qualify for a minimum pension. In addition to 30 years of paid or credited service, qualification now also requires 20 years of “effective service.” The key difference is that periods of “ordinary” unemployment (looking for work but not finding it), which count toward the 30-year requirement, do not count toward the 20-year requirement.[48] To reduce the negative effect, primarily on women, “effective work” also includes maternity and paternity leave, adoption leave, and some caregiving.[49]

- Capping benefits for civil servants

Civil servants currently receive a “top-up” based on changes in civil servant wages in addition to standard cost-of-living increases. The reforms cap this adjustment at .3% per year, non-cumulative.[50]

- Doubling the solidarity contribution

An additional contribution on high earners levied on any excess of total private and public pensions over the maximum civil service pension will double from 3% to 6% on Jan. 1, 2028.[51]

- Pension bonus for longer work careers

People who work beyond the age at which they quality for early retirement will receive a pension bonus at retirement. The bonus will accrue for every day worked, up to a maximum of three years, and will be payable as an annuity or as a lump sum. The maximum amount will be €22,645 after deductions.[52]

The Belgian government estimated that these reforms would reduce pension cost by .5 percent of GDP through 2070.[53]

Political Environment for Further Reform

It is difficult for me to discern much political will for further changes given the challenges and recency of the just-enacted reforms.

France

Demographics

The fertility rate in France is significantly higher than in Germany, Austria, Belgium and even Sweden, at 1.79. Further, the OECD projects very slight decreases, to 1.78 in 2042 and 1.76 in 2062. Both projections are also markedly higher than for those other countries we have reviewed.[54]

The average age at which workers leave the workforce in France is 60.7 for men, the lowest of our comparison group, but 62.2 for women, lower than for Sweden or Germany, but higher than for Austria or Belgium.[55] The average life expectancy in France at labor market exit is 23.3 years, the highest in the OECD, and 26.1 for women, fourth highest in the OECD and the highest of our comparison group.[56] The overall result of these factors is that the old-age to working age ratio in France is expected to rise from 39.2 in 2022, already tied with Greece for the highest in the OECD, and the highest in our comparison group, to 57.1 in 2052 and to 68.4 in 2082. The 2052 projection is far higher than for Sweden, but comparable to the other countries in our comparison group. The 2082 projection is the highest of the group, and 9.2% higher than Sweden.[57]

The average income of those over age 65 compared to the average income of the total population was 99.8% in 2020, the highest of our comparison group.[58] The percentage of those over age 65 living in poverty, defined by the OECD as less than 50% of the average income, was only 4.4%, lower than the rate for the total population, 8.4%. This was by far the lowest of our comparison group.[59]

Benefit Calculations[60]

I discuss the benefit calculation for the major pension program, Agirc-Arrco (A-A). The A-A covers private and agricultural workers.

The amount of the pension is determined by three factors:

Average Yearly lncome (RAM)

Average yearly income is the gross earnings on which contributions have been paid. RAM is calculated based on a participant's 25 highest earnings years.

Payment Rate

The maximum rate of 50% is payable to individuals with between 166 & 172 quarters (depending on year of birth), who have attained age 67 (for persons born after 1955), reduced by a percentage determined by the difference between the number of quarters credited and the number of quarters required to receive the maximum rate.

Benefit Calculation[61]

The amount of the pension is determined by three factors, Average Yearly Income (RAM), Payment Rate, and Credited Service.

Average Yearly Income (RAM): Average yearly income is the average gross earnings on which contributions have been paid based on the member's 25 highest earnings years.

Payment rate: The maximum rate of 50% is payable for individuals born after 1965 with 172 quarters of covered service, fewer for people born earlier, as well as for retirement at age 67 or later. Fewer quarters of covered service reduce the benefit proportionately, but not below 37.5%.

Covered service: Covered service includes periods of covered employment, with additions for childcare, and with additional service for care for a disabled child.

Benefit Financing

Contributions provide 78.8% of the funding for French old-age pensions.[62] (see Table 2) Wages up to the social security ceiling are subject to an employee tax of 3.15% and an employer tax of 4.72%, for a total of 7.87% (compared to a point accrual percentage of 6.2%). For wages above the social security ceiling up to eight times the ceiling, employees pay a rate of 8.64% and employers 12.95%, a total of 21.59% (compared to a point accrual percentage of 17%).[63] General tax revenues provide the balance, 21.2%.[64] (see Table 2)

Political Environment for Further Reform

I cannot do better to introduce this topic than this quote from Hervé Boulhoi and Monika Queisser: "Pension reform is never easy but in some countries it seems to be particularly difficult. Over the past months, France saw widespread protests against planned reforms."[65] The major element of the reform, and the most vigorously resisted, was the increase in the retirement age for a full benefit (with the required number of participation quarters) from 62 to 64.[66] The current OECD average is 64.4 for men and 63.6 for women is projected to rise to 66.3 for men and 65.8 for women for individuals entering the labor force in 2O22. The path for further reform in France is hard to see.

Conclusions

International comparisons drive home that achieving financial sustainability for state pension systems is a daunting challenge. Paradoxically, they also show that one is hard pressed to say the United States has much of a social security financing problem! I shall have much more to say along those lines in the next article in this series, which will discuss my recommendations for US social security design and financing.

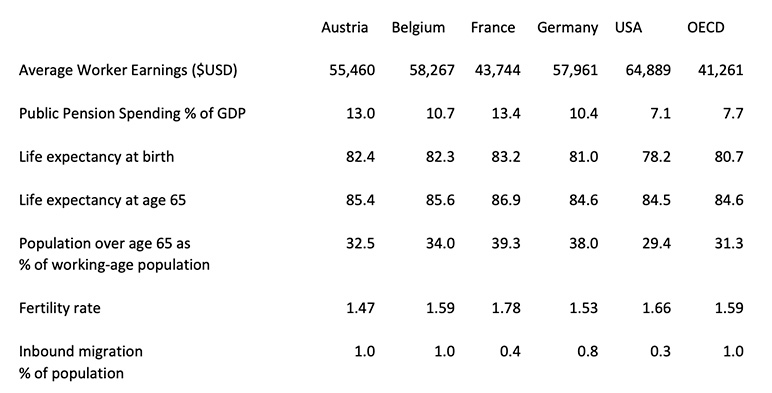

Table 1

Key Pension System Indicators

The statistics in this table are all OECD data. Average worker earnings, public pension spending, life expectancy at birth and population over 65 as a percentage of working age population come from the country profiles of Pensions at a Glance 2023. The fertility rates come from Pensions at a Glance 2023, and the migration data from OECD's International Migration Outlook 2023.

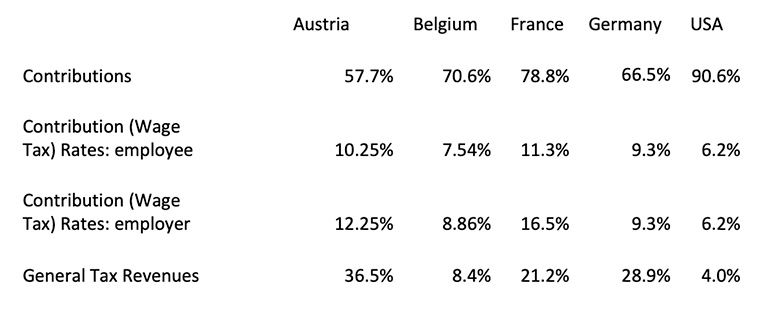

Table 2

Sources of Funding

The contribution rate data comes from OECD 2023, p. 209. The other data for Austria and Germany come from the reports for each country “Financing Social Protection” of the European Social Policy Network of the European Union, 2019. The daa for France comes from “Pension Projections for the 2021 Ageing Report of the Ministry of Economy and Finance, March, 2023.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Paul Donahue, FSA, is a lawyer and actuary who works in New York City. Paul can be contacted at pauljdonahuefsa@aol.com.

Endnotes

[1] Adequacy of Social Security in Meeting Consensus Goals, Retirement Section News, October, 2023

[2] Fabian Mushövel and Nicholas Barr, Pension Reform in Germany—A Market Solution? Feb. 7, 2023. This much is obvious, but the limits of “working population” are not. From the perspective of financing a state pension, limiting the population to workers subject to tax to support the state pension system and later entitled to receive it makes sense. From the perspective of an individual saving personally for retirement, it does not. Personal investment and revenues can reach beyond national boundaries. A German investor can be consuming goods and services financed the investor’s capital and by the labors of workers in other countries.

[4] OECD (2023), Pensions at a Glance 2023: OECD and G20 Indicators, OECD Publishing, Paris,

https://doi.org/10.1787/678055dd-en, p. 181

[5] Martin Werding, Is Pension Reform Needed in Germany, CESifo Forum 2/2022 (March, vol. 23).

[6] Cf. OECD (2023), Pensions at a Glance 2023: OECD and G20 Indicators, OECD Publishing, Paris,

https://doi.org/10.1787/678055dd-en, p. 180 for a more precise definition. In Sweden, the numbers are 1.67 for 2022, 1.68 for 2042, and 1.83 for 2062. I use Sweden for comparisons because as I observed in an earlier essay, the Swedish state pension system is financially stable and sustainable. All these estimates have fallen sharply since the 2021 edition of Pensions at a Glance.

[7] Cf. https://www.wri.org/research/achieving-replacement-level-fertility for an explanation of the 2.1 “replacement rate.”

[8] See Table 1. This means that Germany in 2022 had permanent immigration inflows of almost 1% of its population.

[9] Ibid., p. 191. This compares to 68.3 for men and 67.0 for women in Japan, arguably the result other aging populations must achieve for state pension financing stability. Of more immediate relevance, across the North Sea from Germany in Sweden the results are 65.5 for men and 64.5 for women. While in general labor market exit ages have risen appreciably since 2020, in Sweden they declined.

[10] This was a decline from 20.1 for men and 23.1 for women in 2020. Both the initial and continuing effects of Covid could have a material effect on pension outlays.

[11] This ratio is equal to individuals age 65 or older, as a percentage of individuals under age 65.

[13] This discussion addresses only the base benefit, the equivalent to US social security retirement benefit.

[14] https://www.simplegermany.com/pension-in-germany/ Where values differ between the former East

[15] Public Pension in Germany: Everything you need to know, Chris Mulder, Nov. 25, 2022, updated Sept. 21, 2023, https://pensionfriend.de/en/public-pension-germany.ap

[16] In 2023, the “entry factor” was 37.6 €. A person who worked for 40 years at slightly above the average wage and accumulated 42 pension points who retired at age 67 would get a pension of 1579.2€. Cf. https://www.simplegermany.com/pension-in-germany/ Sample Pension Calculation.

[17] German Government State Pension website, https://www.deutsche-rentenversicherung.de/DRV/EN/Leistungen/leistungen_node.html.

[22] Retiree pensions in Austria, Belgium and France are adjusted for price inflation only. OECD 2023, p. 32.

[24] Werding, p.59, n. 7. See also table 2. It is worth noting that total wages taxes are 6.2% more than in the United States, and that the amount of general tax revenue as a percent of benefits that would be needed to maintain current benefits when the trust fund is exhausted would be 7% less (23% vs. 30%) than currently in Germany.

[27] Luigi Serenelli, German government moves to boost first pillar equity pension fund to €200bn, IPE, Aug. 8, 2023.

[28] Ibid. Obviously the reserve fund would need to grow to be much larger than €200 billion to make a dent in actual general revenue annual subsidies of €100 billion. Equally obvious to me is that if there is to be funding at all, it should be invested in equities, as I shall discuss more fully in a subsequent article.

[29] Aaron O’Neill, https://www.statista.com/statistics/1033474/fertility-rate-austria-1860-2020/, June 21, 2022.

[34] https://www.oesterreich.gv.at/en/themen/arbeit_und_pension/pension/2/1/Seite.270132.html, Federal Ministry of Social Affairs, Health, Care and Consumer Protection, Jan. 17, 2023.

[35] https://www.bdo.at/en-gb/insights/people-organisation/the-expected-social-security-contributions-2025

[37] https://www.oesterreich.gv.at/en/themen/arbeit_und_pension/pension/2/1/Seite.270132.html., cited above.

[38] Fink, Marcel (2019). ESPN Thematic Report on Financing social protection – Austria,

European Social Policy Network (ESPN), Brussels: European Commission, p. 18.

[40] That increases to 66 for those retiring after between Jan. 1, 2025, and Dec. 31, 2029, and to 67 for those retiring on or after Jan. 1, 2030. I assume those increases are factored into the estimate for old age to working population estimates.

[41] OECD (2023) p. 191. The other data for Belgium comes from Océane Bertrand et Sarah Scaillet, Fonctionnement actuel du système de pension belge,31-32 Pyramides 2019, Revue de Centre d’Ėtudes et de Recherche en Administration publiques, paragraph 35, Table 6.

[44] Pensions at a Glance: Country Profiles – Belgium (OECD 2023), p. 2.

[46] Fitch Ratings, Fitch Wire, April 15, 202

[47] Social Security Administration, International Update, Belgium Announces Pension Reform Agreement, September, 2023, https://www.ssa.gov/policy/docs/progdesc/intl_update/2023-09/index.html. Hereafter “SSA International Update.”

[48] 2023 Pension Reform: the Four Pillars, https://www.vanbreda.be/en/insights/2023-pension-reform-the-four-pillars.

[49] SSA International Update.

[60] I have taken the discussion which follows from The French Social Security System III – Retirement (Systèmes nationaux de sécurité sociale > France > Version anglaise, https://www.cleiss.fr/docs/regimes/regime_france/an_3.html. Cited as CLEISS below.

[61] This section paraphrases https://www.cleiss.fr/docs/regimes/regime_france/an_3.html “How pensions are calculated.”

[65] The 2023 France Pension Reform, Hervé Boulhol, Monika Queisser, Intereconomics 2023, No. 3: https://www.intereconomics.eu/contents/year/2023/number/3/article/the-2023-france-pension-reform.html#:~:text=The%20minimum%20legal%20retirement%20age,in%202027%20instead%20of%202035.