RBC Updates

By Douglas Brown

Small Talk, December 2021

Introduction

The Capital Adequacy (E) Task Force adopted three factor updates related to the determination of Life Risk-Based Capital (RBC) at its June 30, 2021 meeting that will take effect beginning with the 2021 statement. Two of the changes are related to the C1 component (bond factor updates and real estate factor updates), and one is related to the C2 component (longevity risk).

The 2020 RBC statement blank was updated to reflect the structural changes required by the bond factor update and the addition of longevity risk to the C2 component with no change to the prior factors. This update permitted field testing of the proposed factor changes. Individual companies can take advantage of the expanded blank to field test the impact of the changes to their own RBC by simply updating the factors used in the 2020 RBC statement.

Bond Factor Changes

This update has been in the works for several years. The intent is to expand the number of bond designation categories to increase the granularity of the risk factors by credit quality. The number of non-exempt categories has been increased from six to twenty.

Two competing proposals for the bond risk factors were under consideration. One was submitted by the American Council of Life Insurers (ACLI) based on work completed by Moody's Analytics (Proposal 2021-11-L), and the other was developed by the American Academy of Actuaries (Proposal 2021-10-L). The Capital Adequacy (E) Task Force adopted the ACLI proposal with minor updates to the bond size factor during its June 30, 2021 meeting. The new bond factors are shown in Table 1.

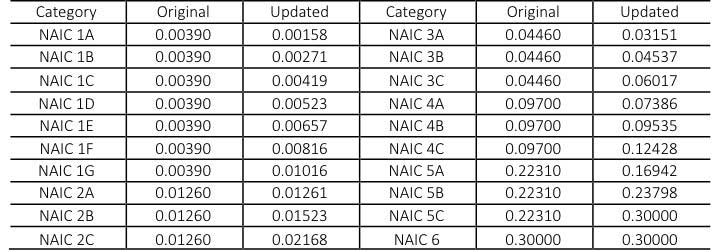

Table 1

Bond Risk Factors

These factors appear on the following pages:

- LR002 Bonds

- LR010 Asset Concentration

- LR014 Hedged Asset Bond Schedule

- LR017 Off Balance Sheet Collateral

The impact of this update will depend on the distribution of bonds by credit quality within each NAIC designation.

NAIC 1: The updated factors are greater than the original factors for all but the highest two rating categories. The average factor for this group is likely to increase unless your NAIC 1 bonds are very highly rated. See Figure 1.

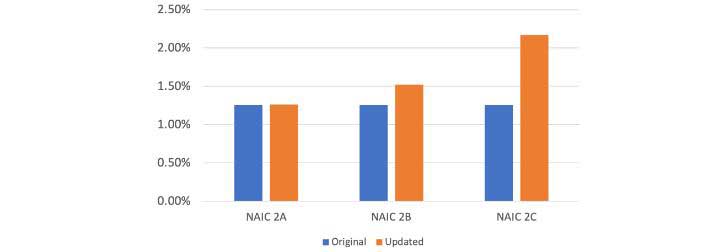

NAIC 2: The updated factors are greater than or (approximately) equal to the original factors for all of the rating categories. Unless all of your NAIC 2 bonds fall in the NAIC 2A category, the average factor for this group will increase. See Figure 2.

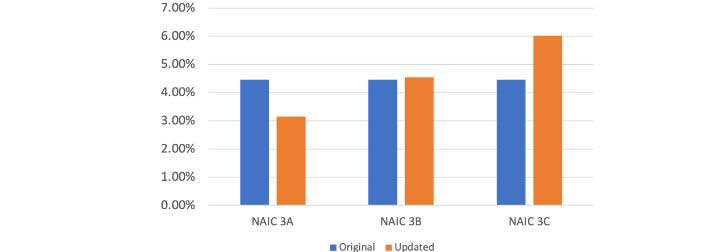

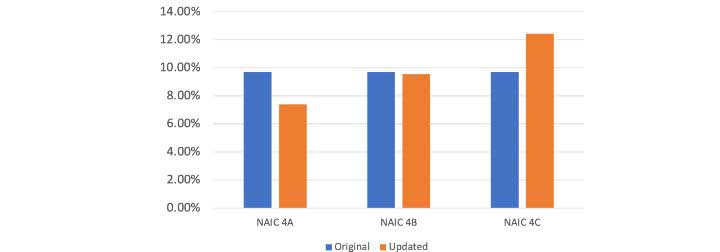

NAIC 3 to 5: The updated factors for the non-investment grade categories follow a similar pattern. The updated factor is lower than the original factor for the highest rating category, approximately equal to the original factor for the middle rating category, and greater than the original factor for the lowest rating category. The average factor could be lower or higher with the new factors depending on the distribution by rating category. See Figures 3 to 5.

Figure 1

NAIC 1 Bond Factors

Figure 2

NAIC 2 Bond Factors

Figure 3

NAIC 3 Bond Factors

Figure 4

NAIC 4 Bond Factors

Figure 5

NAIC 5 Bond Factors

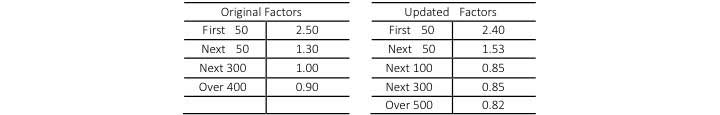

In addition to the risk factors, the bonds size adjustment factors were also updated (see Table 2).

Table 2

Bond Size Factors

The updated factors result in a lower size factor unless the number of issuers is between 71 and 143. The maximum increase in the size factor occurs at 100 issuers where the size factor increases from 1.900 to 1.965 (3.4 percent increase).

For most companies, the new factors are expected to result in a slight increase in the overall Authorized Control Level (ACL) RBC. I encourage readers to conduct their own field test.

Real Estate Factor Changes

The Capital Adequacy (E) Task Force adopted a proposal to update the real estate risk factors to reflect recent experience and analysis (Proposal 2021-06-L).

The base factor for Schedule A real estate was reduced from 15 percent to 11 percent for all categories and the base factor for Schedule BA real estate was reduced from 23 percent to 13 percent.

The original proposal contained an adjustment based on fair value that was not implemented by setting the fair value adjustment factor to zero for 2021.

These factors appear on page LR007 Real Estate.

This change will result in lower ACL RBC for all companies with real estate assets and improves the attractiveness of real estate as an asset class from an RBC perspective.

Longevity Risk Factors

The Capital Adequacy (E) Task Force adopted factors for the longevity risk charge (Proposal 2021-13-L). The longevity risk charge is based on the reserves associated with life contingent annuity benefits, including:

- Single Premium Immediate Annuities

- Deferred Income Annuities

- Structured Settlements with Life Contingent Payments

- Group Annuities Associated with Pension Liabilities (Both Immediate and Deferred Benefits)

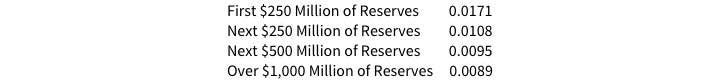

Reserves for deferred annuities where the annuitant has the right but not an obligation to annuitize are not included in the longevity risk charge (see Table 3).

Table 3

Longevity Risk Factors

The introduction of the longevity risk factors will increase the ACL RBC for companies with life contingent annuity liabilities; however, the increase will be moderated by the covariance adjustment.

Conclusion

The impact of the risk factor changes for 2021 could be positive or negative depending on each company’s inventory of assets and liabilities. Many companies are likely to experience a slight increase in their ACL RBC, however, I have seen one example where a company will experience a slight decrease. If you haven’t already examined the impact of the risk factor changes to your company, I strongly encourage you to conduct your own field test using your 2020 RBC statement.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Douglas Brown, ASA, MAAA, is a founding partner of Trilogy Actuarial Solutions. He can be reached at douglas.brown@trilogyactuarial.com.