Thinking About Transformation? Time to Choose a Path

By Romina Egan, Winston Hall, Matt Heaphy and Matt Wininger

Actuary of the Future, May 2024

Numerous articles assert emerging technologies, particularly generative artificial intelligence (Gen AI), will disrupt and negatively impact countless professions. Gen AI promises to be more disruptive than past technological developments, such as spreadsheets, low-code data and dashboarding tools, and cloud computing.

Emerging technologies are usually most disruptive to professions and organizations that passively wait for an outcome. Those who embrace change with an opinionated strategy are most likely to thrive. Our profession provides a necessary public good, and to thrive we should be assertive. We see two practical paths for actuaries to embrace emerging technology:

- Business Acumen Path—Actuaries as business partners: Actuaries focus on building business acumen and domain knowledge. We use technology developed and sustained by our IT partners to provide actionable insights and forward-looking analysis to help the organization grow and succeed.

- Hybrid Path—Actuaries as developers: Actuaries sit at the intersection of business subject matter and technology expertise. By continually honing both skill sets, we harness modern technology to flexibly develop custom solutions. We partner with IT for tasks where they have an obvious advantage in expertise, such as infrastructure, security and data engineering.

Next, we’ll illustrate each path’s rationale and specific actionable steps you can take to help your organization’s journey. We believe that the organizations that clearly commit to one path and invest in recruiting, infrastructure, and learning and development will be best positioned to succeed and thrive. Although the authors differ on which path to take, we all agree they are paths to the same destination: The actuarial modern value proposition.

We propose the following actuarial modern value proposition:

Without this value proposition as our “north star” we are subject to competing agendas, biases, and external forces. We call the profession to action: Take agency over emerging technology and lead our organizations to intentionally choose a path forward. Retaining control of our profession’s course is vital. We have the greatest leverage and opportunity now, and realizing it requires individual and collective action.

Change Management

No matter which path you choose, we recommend engaging with change management professionals and jointly establishing program goals and objectives, success metrics and a strategic communication strategy. Actuaries leading the change must first evaluate what's possible given the organization's leadership and culture. Is your organization open to a bold change in direction?

A prerequisite for either path is an actuarial community ready and willing for change. Actuaries leading the change must make a compelling case for change: What's in it for their organization and individual actuaries? What's the specific vision for the actuarial community? Actuaries must deliberately choose a path and commit to it.

Before beginning an organization change, actuaries leading the change must obtain:

- Buy-in from actuarial leadership on the vision and value proposition for the actuarial community. This is the why.

- Agreement from senior actuaries that if we continue to work the way we do today, we will not deliver on the organization’s vision and that the solution is to deliberately choose either the business acumen or the hybrid path.

- Senior IT leaders buy into the vision and division of responsibilities with the actuarial function.

- Your organization’s executive leaders agree on the broad vision and responsibility assignments, and you address their needs about continuity, cost and skill leverage.

Launching this change must go beyond basic change management. Change leaders must inform, engage, equip and empower each individual actuary. Change leaders should constantly promote the why-case for change and specific vision for the actuarial community.

Then explain how. Change leaders set a strategy for transformation: It must be concise, memorable and cover the full scope of the transformation. Next, decide the starting point for transformation and the roadmap to conclusion.

Finally, build the specific steps to transform the actuarial function. This is the what, and covers:

- Goals and metrics;

- success standards;

- organizational design methodology;

- management structure; and

- which functions to centralize (e.g., modeling, support, financial analysis, infrastructure); consider the actuarial community as its own “function.”

The Business Acumen Path

The goal for this path is actuaries spending most of their time providing forward-looking analysis and producing actionable insights. Today, actuaries in areas like valuation seem to spend most of their time calculating reserves and little time producing value-added analysis. Usually, this happens “just in time” with overtime required for management or audit inquiries. This path looks to maximize the actuary’s time analyzing results, recommending actions, and tying analysis and actions to business outcomes. This is enabled by modernizing the technology and then changing how actuaries work, learn and interact with others.

Imagine if calculating and booking reserves are table stakes for actuarial valuation functions. How valuable would it be to your organization to have a valuation function that recommends reinsuring a block based on projections that indicate future unplanned reserve and capital requirements?

The business acumen path does not make sense for all organizations. This path is for your organization if it expects actuaries to run the business in senior or executive leadership roles, has an IT organization willing to flexibly partner with actuaries, and an engaged actuarial community with an appetite for change.

If you are interested in this path, we’ll share our experiences, some learned the hard way.

- You must establish consensus with leaders in actuarial and IT on this new way of working. How will actuaries work with modernized technology? Actuaries must interact differently with technology to create capacity for actionable insights. Actuaries cannot be expected to maintain the status quo and still have capacity to provide better analysis with more business value. Although a detailed vision is helpful, we advise a visual operating model that helps the actuarial function grasp what you are trying to build and how they will interact with it to deliver actionable insights.

A few questions to consider: - Will data and models be built and sustained centrally?

- What else needs to be true?

- Will you need to rethink your governance policies and functions?

- How does the new way of working compare to our current way of working?

- You must engage with change management professionals and jointly establish program goals and objectives, success metrics, and a strategic communication strategy. Change management should have a leadership role in the program with the authority to assess the impact of changes and direct change management activities. Actuaries and IT are excellent at building new things and delivering change, but neither are skilled to prepare the organization for change. The more prepared the actuarial and IT communities are for the change being delivered, the more likely the transformation will be successful.

- Program leadership must establish a strategy for transforming the actuarial function. A simple strategy that can be clearly articulated will help focus your program while also help the actuarial function comprehend how work being done in their area is working toward building the new way of working. For example, your program could have the following three pillars in your strategy. These are meant to just serve as examples and not define which pillars are necessary for your organization’s strategy. We recommend working with experts in these areas to determine the right fits for your organization:

- Create capacity by modernizing data, models and processes;

- rethink how actuaries work, learn and interact through organizational design; and

- decide how the modernization will be delivered (e.g., agile development).

While the three recommended strategy pillars above may not be comprehensive, they are an excellent start for a comprehensive strategy.

The business acumen path is most likely a substantial change for most organizations because it requires actuarial and IT professionals to work differently. Actuaries will be expected to use new technology, use technology differently, and partner better with IT to ensure technology delivers needed capabilities. A significant investment in organizational design is vital to making this path work.

Organizational design is the science of defining the components of an organization such that it achieves its business strategy. In this case, the business strategy is the business acumen path—actuaries providing prospective analysis and producing actionable insights. Organizational design is much more than structure: It includes goals and objectives, workflows, skills, mindsets, incentives and more. There are several organizational design models to choose from. We recommend engaging with an organizational design expert and to be thoughtful about how actuaries will work, learn, and interact with modernized solutions and IT partners.

Your strategy should include a pillar that addresses how the program will deliver work. If you choose agile, then it is important for actuarial and IT leaders to create an environment and purpose that motivates their people and encourages the consideration of ideas. Leaders should establish team norms and expected behaviors. For instance, to move quickly the team must be able to address capacity constraints. If your data engineer does not have capacity to build a necessary pipeline, then team norms must allow for another team member to step up and complete the work subject to the data engineer’s peer review. If an actuary is aware of a data curation process, then IT must consider it. This is a significant departure from how IT resources have traditionally worked on actuarial projects. Team norms will help reduce dysfunction and achieve timely deliverables. Merely selecting agile development will not magically result in the frequent delivery of working software with new functionality. Agile comes in many flavors. Invest in defining the agile process and clarifying key roles and responsibilities.

A challenge with the business acumen path is ensuring actuaries working in this framework can continue to be innovative without full autonomy to develop the technology they use in their business processes. Although organizational design should help prepare actuaries and IT for this new way of working, technology must be developed to enable actuaries to be innovative and respond to emerging needs and issues. Rigid, brittle and complex technology that requires IT support to investigate data issues or address frequent bugs in modeling or orchestration prevents actuaries from being able to respond quickly to emerging needs and issues.

The Hybrid Path

The goal of this path is for actuaries to own the development of actuarial technology while partnering with IT for support services. By reducing barriers and empowering actuaries to develop their own solutions, a high-performing team can generate actionable insights more quickly.

The hybrid path makes sense for actuaries who are versatile generalists: They can synthesize deep domain knowledge and open-source technological expertise. Technology-oriented actuaries want and need flexibility to build custom end-to-end solutions from data curation to modeling to reporting. The IT function on this path is focused on core support roles: Infrastructure, security, cloud and network management.

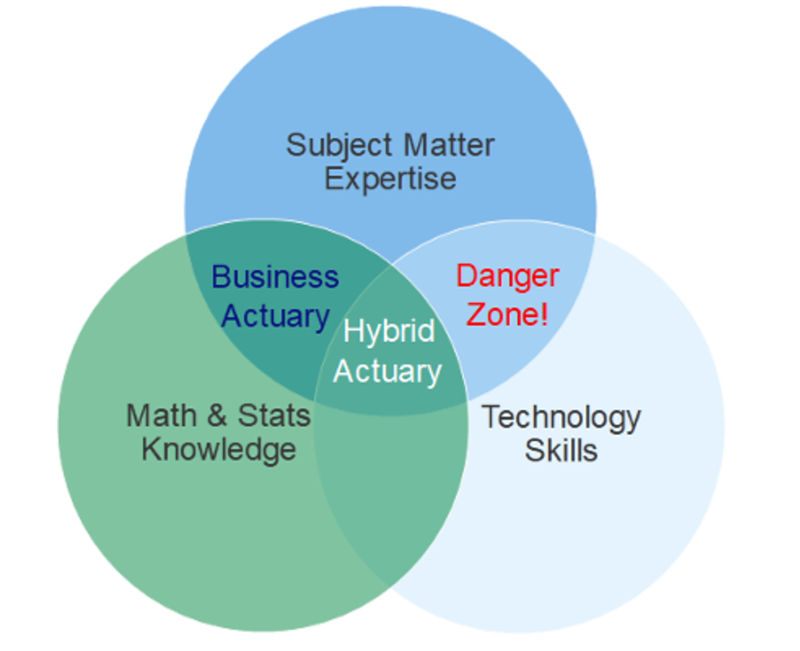

How does this path differ from the business acumen path? In 2013 Data Scientist Drew Conway wrote a famous blogpost titled, “The Data Science Venn Diagram” where he described a data scientist as a professional at the intersection of substantive expertise, statistical knowledge, and hacking skills. Figure 1 adopts Conway’s diagram for the actuarial profession. Substantive expertise and statistics knowledge are synonymous with the key business knowledge and domain knowledge attributes of the Business Acumen path. Hacking skills, or technology skills, are the key differentiator of the hybrid path. Hybrid actuaries choose to focus as much of their time and energy on technology as they do on business acumen, which requires less reliance on dedicated IT professionals.

Figure 1

The Actuary Venn Diagram

The hybrid path may be a good fit for a small and nimble organization that already has a team of technology-oriented actuaries who are accustomed to building their own solutions using open-source software. Actuaries in pricing, data analytics or other similar roles may also find this path attractive because the work is often highly bespoke, which demands adaptive teams and technology.

The hybrid path requires a culture of continuous learning to ensure actuaries are using the best tools for the job. Learning can come in the form of internal and external training. Internal programs can include formal training on a specific topic or informal office hours. For external learning, massive open online courses (MOOC’s) are available from sites like Coursera, Udemy, and Posit. The authors recommend:

- Programming languages: R, Python, Julia, SQL—data wrangling, data visualization, working with databases, predictive modeling, packaging.

- System change management: Git and a GitHub-equivalent.

- Project management & collaboration tools: Jira and Confluence.

- Reporting: Quarto (R, Python, Julia).

- Interactive dashboards: Shiny (R, Python), Power BI, Tableau.

Technology training is not a substitute for existing continuing education requirements. As Figure 1 above shows, technology skills are but one piece of what comprises a hybrid actuary, and to deliver on the actuarial modern value proposition the other components cannot be allowed to atrophy.

The hybrid path also requires embracing software development principles like version control (Git workflows), code reviews, unit testing and continuous integration/continuous delivery. Companies considering this path will need strong and empathetic leaders who are well-versed in these skills that can “walk the talk,” mentor and teach best practices to junior staff. As hybrid actuary teams grow in sophistication, they will eventually need to develop their own software packages and interactive reports, which will require IT assistance for centralization, distribution and hosting.

A challenge with the hybrid path is delegation and ensuring that hybrid actuaries are making the best use of their time. The attitude of “I can do it faster myself” might result in short-term gains, but in the long run can create key person risks and burnout. Leaders of hybrid teams will need to consider the economic principle of comparative advantage. Even if a person is the most skilled at a task it doesn’t mean they should spend time on it because their knowledge and skill could be more valuable elsewhere.

A second, related challenge is selecting the right balance for working with IT departments. Although the hybrid path requires less reliance on IT than traditional operating models, it by no means requires zero support. Key proficiencies like infrastructure and security will always be in the domain of IT departments. Tasks like data management, data engineering, and promoting solutions to production may also require dedicated IT support, depending on the environment.

A third challenge is attracting the right talent. A key first step is recruiting leadership that has both the requisite actuarial and technology skills. Recruiting mid- and junior-level talent is less of a challenge as the rise of the data science profession has proven that a significant talent pool of technology-oriented mathematicians exists.

Conclusion

Now more than ever, organizations must be more purposeful concerning actuarial roles and responsibilities.

The authors see opportunities to realign what organizations need from their actuaries with what we’re positioned to do, around two talent models:

|

|

Value |

Watch points |

|

Business Acumen Actuary |

Better technology is an opportunity to shed non-core responsibilities and return to our actuarial roots. Improving comfort with IT solutions’ reliability and sustainability. |

Requires very strong IT support and a new way of partnering with IT. Don’t forget to invest in efficiently using new technology—must deliver valuable insights with your domain expertise. |

|

Hybrid Actuary |

Better technology enables faster development of in-depth custom solutions. May be a necessity for businesses operating under rapid change. Utilize powerful open-source languages with low barriers to entry. |

Collaborate effectively with IT partners and do not create silos. Don’t forget your actuarial roots—domain expertise is our core strength. |

For decades, actuaries have been problem solvers for our organizations, playing both roles explained above.

Many of us entered our profession learning and maintaining legacy solutions. That may change for the next generation of actuaries as new technologies extend our capabilities.

Actuaries’ tools and data are no longer siloed—now we typically share with underwriting, claims and the rest of the organization. Organizations must be more purposeful around how actuaries focus to obtain maximum impact.

Organizations will get better results from their actuaries by choosing one specific talent model to leverage emerging technologies. Those who foster an environment with a strong sense of shared purpose and a consistent approach to using technology that aligns to the chosen path, will realize the most value.

That’s why we believe the modern value proposition helps actuaries and their employers orient to actuaries’ new future.

Actuarial modern value proposition: Actuaries partner with other professionals to advise, direct, and lead organizations to act purposefully and ethically. Actuaries uniquely combine expertise in statistics, finance, insurance products, professionalism, problem-solving and ethics. Actuaries understand complex financial systems, analyze uncertain events, and design creative ways to mitigate and monetize risk.

Between hybrid and business acumen, there is no clear right answer for every organization. We expect both paths will thrive. It’s important to make a conscious choice so your organization is focused and each actuary has a clear path to the modern value proposition.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Winston Tuner Hall, FSA, MAAA, is the 2nd vice president of engagement and strategy for Actuarial Transformation at The Standard. Winston can be contacted at winston.hall@standard.com.

Matt Heaphy, FSA, MAAA, is the head of pricing and risk analytics at Martello Re. Matt can be contacted at matt.heaphy@martellore.com.

Romina Egan, FSA, MAAA, is the retirement product officer for F&G. Romina can be contacted at Romina.Egan@fglife.com.

Matt Wininger, FSA, MAAA, leads Legal & General Retirement America’s pricing people, operations, efficiency, and special projects. MWininger@LGRA.com.

References

Actuarial and IT Collaboration: Bridging the Gap—Actuarial and IT (soa.org)

Pace of Change / Need for Transformation: Businesses Anticipate Unprecedented Rate of Change in 2024, New Accenture ‘Pulse of Change Index’ Shows

Venn Diagram: http://drewconway.com/zia/2013/3/26/the-data-science-venn-diagram

Star Model for Organizational Design: See the StarModel - https://jaygalbraith.com/