How to Recruit and Hire High Quality Actuarial Talent

By Rahat Jain and Matt McPhail

The Stepping Stone, July 2023

Introduction

The insurance industry is rapidly transforming as companies gravitate towards mergers & acquisitions, establish special purchase vehicles, and optimize their reinsurance structures. This shift introduces companies to new financial risks, government regulations, and product markets. As a result, more companies are seeking the guidance of actuaries to navigate these new areas and maintain their competitive edge.

These growth opportunities will lead companies to set up functional areas for non-traditional skillsets (e.g., new venture and deal modeling teams) or new product management (e.g., VA pricing) that previously did not exist within the organization. In the case of special purchase vehicles, there could be cases where an entire (re)insurance entity (e.g., CEO, board of directors, pricing & valuation teams) would need to be created from the ground up. However, attracting and retaining actuarial talent can often be a cumbersome task.

This is the first installment of a two-part series that aims to provide valuable insights on how a new (re)insurance company can become an attractive destination for actuaries (Part I) and then how to retain them (Part II), thereby facilitating the company’s long-term growth.

How to Hire Actuarial Talent

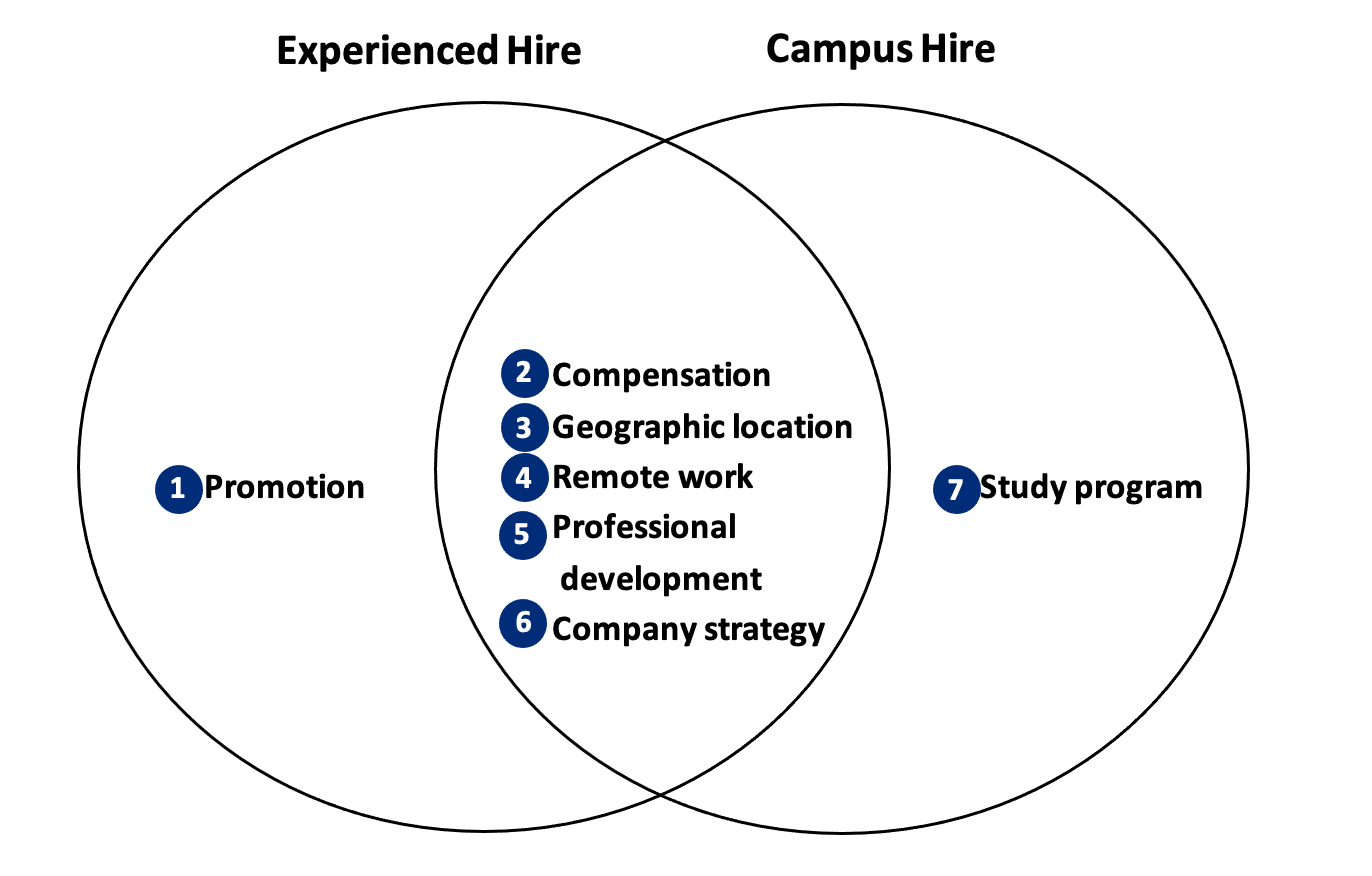

Figure 1

Hiring Talent—Campus Hire (Straight from College) vs Experienced Hire (3+ Years of Experience at a Company)

1. Promotion

The prospect of quicker career advancement at a new organization can motivate actuaries to switch employers, as they may have access to senior roles that might not be available to them in their current company. When the firm requires the actuary to move from an actuarial hotspot (e.g., New York) to non-actuarial hotspot (e.g., Nashville), the proposition of a progression in their career path can be essential to recruiting quality actuarial candidates.

2. Compensation

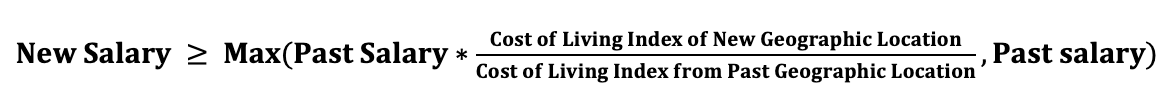

Companies can incentivize potential hires to move from their current company by giving them competitive salaries and benefits (e.g., health care, matching pension plan contributions). Salary per unit cost of living should be used as a metric when determining the compensation package of a potential hire. If relocation is required, the company can incentivize the move by offering a salary greater than the candidate’s current salary adjusted for the cost-of-living change. The following is a guide for how the salary of a new hire can be calculated:

If company does not know a candidate’s past salary, they can utilize their requested salary range to approximate this.

3. Geographic Location

If a company requires an actuary to relocate, they should consider providing an allowance for related expenses. This includes costs related to packing and transportation, breaking a lease/selling a house, temporary living in the new city, family assistance (i.e., job assistance for a spouse and scouting for a new school for children), and changes in cost of living.[1] The comprehensiveness of the package should increase with experience; experienced hires usually have more ties with their current location, and therefore will require more time and resources to move.

Relocation to a different country will require specialized support, especially if there are immigration or travel restrictions. The firm should support new employees in the moving process with legal aid and other forms of international relocation assistance.

4. Remote Work

Companies that are not in an actuarial hotspot (e.g., Indianapolis, Detroit), should consider remote work as an alternative to moving. Many actuarial tasks (e.g., reserving and valuation) can be performed remotely just as easily as in person. Remote jobs can increase the talent pool because many potential candidates are geographically immobile, or simply like where they are currently. As remote work has become increasingly common over the last few years, many actuaries are stating preferences for seeking a job with remote or hybrid arrangements.

5. Professional Development

Actuaries are continuously looking for opportunities to develop and learn new skills. Companies that are able to demonstrate that there will be plenty of learning opportunities will have an advantage attracting talent.

This is relevant for both experienced hires and new grads. Experienced hires might be looking for opportunities to take on more responsibilities and develop new strategic initiatives, whereas new hires may seek to work alongside more experienced hires and have exposure to a wide array of functions. Additionally, exposing staff to more traditional learning methods such as conferences (e.g., SOA Life Meeting, SOA ImpACT Conference) and continuous learning courses on interesting new job functions (e.g., coding languages) are important to differentiate a company from its competitors.

6. Company Strategy

An important factor in attracting talent is for the candidate to understand and believe in the company’s strategy. This includes the prospect for long-term growth and profitability of the company as well as potential for future career growth. It is important for companies to articulate the strategy they are pursuing to actuarial candidates and relate it directly to how that will impact the actuary’s work and career prospects.

7. Study Program

Companies that provide support to new actuarial graduates in acquiring their required designations can attract and retain top talent, since not all companies offer a comprehensive study program. By covering exam fees and study materials, and providing paid study time, companies can demonstrate their commitment to their employees' professional development. This fosters a culture of learning and helps to build a skilled workforce that can tackle the complex challenges of the actuarial field.

Additionally, companies can also offer scholarships for outstanding interns based on manager recommendation. Offering scholarships for top-performing interns can help incentivize them to sign a full-time offer with the company for when they graduate. This strategy demonstrates the company's commitment to investing in and developing its employees, which can facilitate building a positive reputation and attracting top talent to the organization.

|

Interns: Many companies offer an internship program to attract talent during college. Companies use this as a recruiting tool, where a large percentage of new hires for their actuarial programs come from the internship program without the need for any scholarships beyond that. |

Case Study

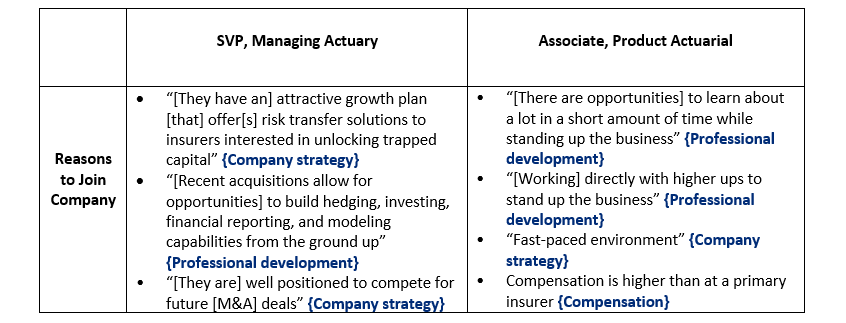

We looked at a company formed out of the divestiture of another insurer’s legacy business. The company grew rapidly from there through additional acquisitions, which required them to hire and retain more actuaries to keep up with their growth. We interviewed two actuaries at different levels, seeking insights into why actuaries chose to join. Responses from two interviewees can be seen in Figure 2.

Figure 2

Results from Interview

The case study in Figure 2 reveals significant factors that incentivize actuaries to join a company. While senior-level actuaries tend to prioritize embracing new challenges and taking ownership of new initiatives, junior-level actuaries prioritize learning opportunities and obtaining their professional designations.

Conclusion

In conclusion, hiring actuaries requires an intricate approach that considers more than just technical skills and qualifications. Employers may attract top talent by offering competitive salaries and benefits packages, while also advertising their most positive traits (e.g., collaborative environments and flat organizational structures) during the hiring process. By prioritizing the hiring of actuaries, organizations can ensure a stable and capable workforce that drives growth and success.

Hiring the right actuarial talent is important, retaining them is equally important to ensure growth. The upcoming segment of this series will concentrate on strategies for newly established insurance companies to retain actuaries.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Rahat Jain, FSA, CERA, MAAA, is a manager with Oliver Wyman. He can be reached at rahat.jain@oliverwyman.com or via LinkedIn.

Matt McPhail, FSA, is a vice president with Fortitude Re. He can be reached at matt.mcphail@fortitude-re.com or via LinkedIn.