The Influential Actuary

By Hellen Hou and David C. Miller

The Stepping Stone, September 2024

On May 31, the Joint Risk Management (JRM) and Leadership & Development (L&D) sections held their regular book club session to discuss The Influential Actuary[1] by David C. Miller. We had 50+ SOA members attend the meeting who passionately shared their experiences and engaged with the author. This article shares insights about the book and discussion.

Know What Makes People Tick

Dave shared three steps to adapt our style to that of our counterpart, which is a critical skill of influence:

- Identify our style and where we “fit” relative to other styles;

- Learn how to “read” other people and identify their styles; and

- Adapt our style to match theirs.

Behavioral assessments like the DISC model can give us a reference point for this skill. For example, suppose you are primarily a “C” style and therefore value accuracy, thoroughness and doing things the right way. You are trying to influence an executive who is a “D” style, who values decisiveness, bottom-line results and speed. Problems could arise if you don’t adapt: the D wants the project done yesterday while the C wants to make sure it’s done perfectly, no matter how long it takes.

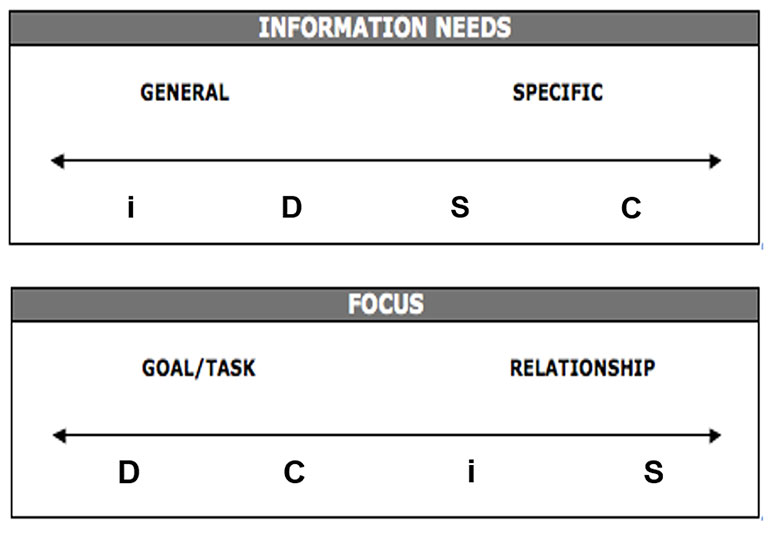

We discussed these dynamics and looked at continuums of behaviors in order to see where and to what extent one needs to adjust. The more distance between the two styles on the continuum, the greater the adjustment that will be needed. In the situation above, as a C-style, you would want to make the following adjustments, at a minimum, when working to influence the D-style executive:

- You tend to want to go into a lot of details and be specific whereas the executive will want to cut to the chase. Initially, gear your presentation at a higher level—the “50,000 foot view.”

- Adjust to focus more on the task vs. relationship, although in this example, it will be a relatively small adjustment.

- Raise your energy level and be less laid back in your presentation.

- Increase your pace of speech and get to your point more quickly.

Figure 1 shows where all 4 styles (D, I, S, C) are positioned for each category on a continuum.

Figure 1

DISC Styles

Questions for reflection and application:

“Can you think of a person you have worked with where your different styles caused miscommunication and even conflict?”

“How did you adapt your style to communicate with them more effectively?”

High Impact Communication

There tend to be “culture differences” between actuaries and non-actuarial executives. As actuaries, we are proud of our models, we want to be thorough and we want to be precise: Why might that be a problem?

The typical executives to whom you may be presenting are likely to:

- Be smart but not subject matter experts.

- Have short attention spans.

- Want the bottom line… fast.

- Want you to summarize an hour of material into five, maybe 10 minutes if you’re lucky.

The Executive Summary is a nice tool to help you organize your presentation. Here is the anatomy of an Executive Summary:

- Situation. Start by summarizing the current situation. “We are here today because ABC product sales have been struggling.”

- Implications. How is this problem impacting the bottom line? You must answer the implicit question “So what?” This will raise the engagement of your audience.

- Options. Lay out options to address the problem. This shows you have taken a thoughtful approach.

- The recommendation. Don’t just bring the problems to senior management and let them decide. Propose a solution.

- The Rationale. Finally, support your recommendation with the rationale for why it is the best solution.

Question for reflection and application:

“What approach has been most effective for you when communicating with executives?”

Know and Be Known

“One of the biggest myths is that you can become successful on your own. The truth is that you can only achieve great things with the help of other people.” – Lee Dittmar, former partner, Deloitte Consulting

As actuaries, we have all invested and are still investing in our knowledge and technical portfolios. How much effort have you invested in developing your relationship portfolio?

You may think that you are a stellar performer and question why you need to spend time developing relationships, the time that you can use to deliver more work. Some benefits of having a large and diverse relationship portfolio are:

- Increases your resources. The more people you know, the more access you have to information, skills, wisdom, money and influence.

- Increases your access. Having more quality relationships will give you greater access to people, places, situations and opportunities.

- Elevates your thinking. Your diverse network can present different perspectives and broaden your horizon.

- Increases your visibility. Your reputation precedes you: people know you before you walk in the room.

- Enlarges your circle of influence.

- Enriches your life.

Now that we know the importance of developing relationships, how can we build lasting relationships?

- Make friends at conferences, networking sessions and volunteer organizations. The fact that you attend the same event indicates some common interest, which facilitates the relationship development.

- Conduct one-on-one coffee chats with leaders and peers at your company. Send an invite to the C-level executives and you will be surprised how willing they are to meet with you. Don’t underestimate the power of developing relationships with peers or even colleagues who are currently at a lower level than you. You will grow together within the organization.

- Start early—don’t wait until you are a manager or when you join consulting to build relationships. Start now. Building relationships is a numbers game: the more people you meet, the more quality relationships you may develop. There will always be people with whom you don’t click, so don’t get discouraged.

Questions for reflection and application:

“How have you found relationships to be an asset to your career?”

“Who are the five most impactful people in your organization? What can you do to develop or enhance your relationship with them? What things have you done?”

Master Your Mindset

“What is the biggest reason people don’t succeed?”

There are many contributors to actuaries not reaching their goals, for example:

- They are not clear on their goals

- They don’t know what to do to reach those goals

- They lack the necessary skill

By far the biggest reason people don’t reach their goals is…they get in their own way. More specifically, it is about what they think and believe. Being more influential is about taking risks and moving out of your comfort zone. When you do this, you soon encounter internal resistance. The solution is to manage your mindset.

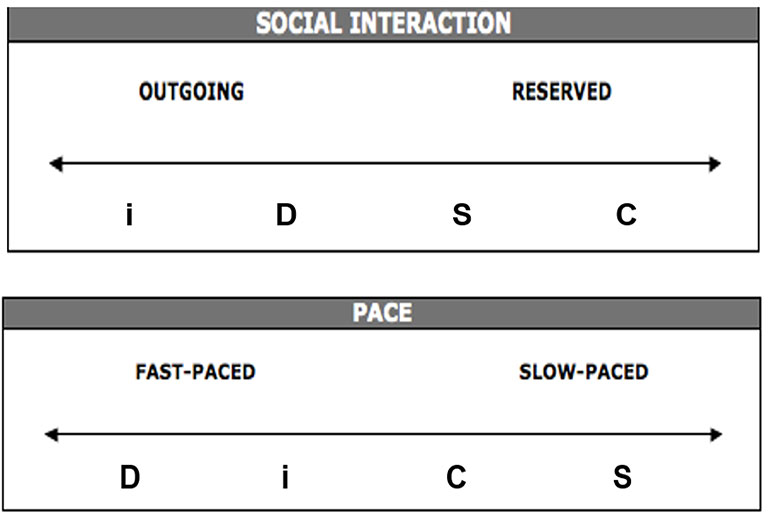

Your thoughts are the seeds to your feelings and your feelings affect what you do. Our belief about a situation will create a reality before we give it a chance to show up for itself.

Let’s say, for example, I know my career would benefit by getting some mentoring from a rockstar executive at work, but since I firmly believe “she won’t have time for me,” I never ask her and I seal my fate. Instead, what if I replaced that belief (which I made up in my head) with “I don’t know if she will have time or not, but let me ask”? Your future could look very different.

Questions for reflection and application:

“Think of a time you held yourself back from taking an impactful action or a risk at work. What thoughts or beliefs held you back?”

“If you eventually overcame that resistance, what helped you move forward and take action?”

Conclusion

Actuaries are technical and successful at being individual contributors who solve difficult problems, but we sometimes struggle when we move into leadership positions or communicate to non-technical audiences. The Influential Actuary shares practical insights to develop well-rounded actuaries, and the lively book club discussion exchanged ideas about knowing the audience, communicating effectively, building relationships, and mastering your mindset. Developing and perfecting these skills can change your career trajectory and make you a more effective leader and communicator.

The SOA Book Club just wrapped up the first half of 2024 with The Ideal Team Player by Patrick Lencioni. Stay tuned for an article on the discussion!

The next book in the lineup will be The Black Swan: The Impact of the Highly Improbable by Nassim Nicholas Taleb. We will meet on September 25 to talk about Taleb's concept of Black Swan events— rare and impactful occurrences that defy traditional risk assessment models. Through facilitated discussions, we will explore how these concepts translate to real-world scenarios encountered within the insurance landscape. SOA members can register for free.

Hellen Hou, FSA, CFA, is the Head of Model Governance at Guardian Life. She can be reached at Jue_Hou@glic.com or via LinkedIn.

David C. Miller, FSA, MAAA, is Director of Annuity Pricing at USAA and author of The Influential Actuary. He can be reached at David.Miller5@usaa.com or via LinkedIn.

Endnote

[1] Get your digital copy of The Influential Actuary for free at https://www.actexlearning.com/exams/p/the-influential-actuary.