Water in the Desert

By Ronnie Klein

Reinsurance News, August 2021

This article explores why life insurance sales have not increased dramatically during the worst pandemic in 100 years, and what affect this is having on the reinsurance industry.

We all learned about supply and demand throughout our educations as part of basic economic theory. It is a simple concept that is described in many ways but none so eloquently as written by John Locke in 1691—“The price of any commodity rises or falls, by the proportion of the number of buyers and sellers.”[1] Locke was an English economist and wrote these words in a letter to Parliament with the goal of letting the free-market set interest rates as opposed to having the government set a cap, which was requested by certain merchants. While he never used the term “supply and demand,” most economists cite Locke as the father of this concept. It wasn’t until 1767 when “supply and demand” first appeared in print in a paper written by Sir James Steuart titled “Inquiry into the Principles of Political Economy.”[2]

It is not difficult to find evidence of this theory put to use in everyday life. Take, for instance, water. Selling drinking water in the city of Zurich, Switzerland might not demand a high price since clean mountain water flows regularly from fountains throughout the city. While visitors may be skeptical of how sanitary this water is, locals freely fill their water bottles at these fountains. However, selling this same commodity in a desert should yield completely different results. Weary travelers who are hot and thirsty should be willing to pay nearly any price for a cool drink of this life-sustaining fluid.

Water in the desert may not be a great example of supply and demand since most people who enter the desert these days know exactly how long they will be there and prepare accordingly. It is not often that we hear of a person lost in the desert without water except, perhaps, in movies. And, there is not a rush for aspiring entrepreneurs to set up shop in the desert due to high demand of water (which would increase the supply, thus lowering the price according to Locke).

However, purchasing products during a 1-in-100-year event such as a pandemic is a completely different story. According to Forbes Magazine, computer sales for 2020 were at the highest level since 2014, up 13 percent from sales in 2019.[3] People are stuck at home and doing business via video conferencing. It stands to reason that many will opt to upgrade their home computer equipment. Computer sales are not the only industry that increased sales. Other industries also thrived during the pandemic. Peloton, a provider of high-end exercise equipment and online workouts preferred by US President Joe Biden, saw its membership more than double since the beginning of the lockdowns, according to BBC News.[4] Netflix, the popular online streaming service almost doubled its new membership rate in the first quarter of 2020, although growth has slowed as the lockdowns are easing.[5]

What to watch on television and how to get exercise are certainly important decisions during a pandemic. One might think that how the family will survive if the breadwinner dies might be an equally important decision. Yet the sale of life insurance during the pandemic has been disappointing, to say the least. The Medical Information Bureau (MIB) monitors application activity, but does not know the status of the ultimate sale of these applications. Assuming all things equal, an uptick in application activity should lead to a similar uptick in sales. MIB reported that for 2020, applications for life insurance in the US increased by 3.7 percent.[6]

However, the Life Insurance Marketing and Research Association (LIMRA), announced that sales of US life insurance policies increased by a mere 2 percent in 2020 with a decrease in premiums by about 3 percent.[7] The 3.7 percent increase in application translated into a 2 percent increase in number of policies sold. This is quite disappointing during a pandemic, not to mention that about one-third of life insurers expanded accelerated underwriting in 2020.[8] There are reports that some companies relaxed non-med limits to USD3 million or even USD5 million. This in itself should have increased applications and sales more than 3.7 percent and 2 percent, respectively. So, what is holding back that sale of life insurance policies during the pandemic?

One reason commonly mentioned is that the pandemic caused many people to lose their jobs, especially in the hospitality industries. Hotel workers, restaurant staff, airline personnel, cruise workers and conference employees either were let go or had their hours slashed in the past year. The pandemic caused even more job losses than the Great Financial Crisis of 2008–2009.[9] Certainly, people who are out of work and worried about paying the rent or mortgage and putting food on the table will not have the means to purchase life insurance. The life insurance industry should have expected a downturn in new business sales.

Diving a bit more deeply into this theory will show that the cost of an all-access membership to Peloton is about USD39 per month and it costs about USD14 per month for a standard Netflix membership. According to Policygenuis, the cost of a USD500,000 10-year-level-term life insurance policy for a 40-year-old will cost about USD20 per month for someone in “good health” and even less for someone in the “best health.”[10] The cost for a 50-year-old would basically double that of a 40-year-old. Peloton and Netflix increased sales considerably during the pandemic, while sales of life insurance were disappointing, even though insurance would have been a cheaper option at many age groups. Financial difficulties most assuredly caused many people to move the purchase of life insurance down on their list of priorities. But if Peloton and Netflix found a way to increase sales, it stands to reason that the life insurance industry could have had similar results given monthly costs are not much different.

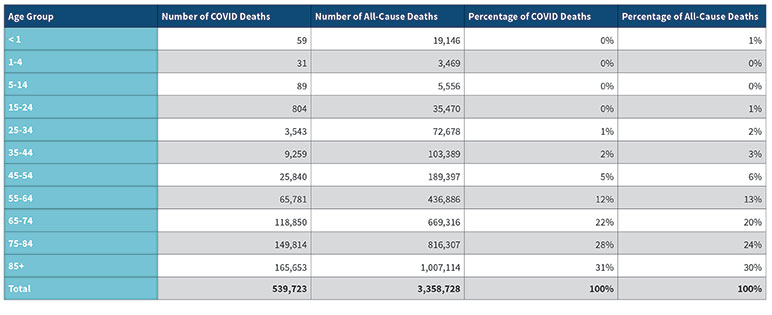

Another reason commonly mentioned is that the pandemic has only affected people over age 65 who typically do not need life insurance protection. Is this statement, made often in the media, really true? Actually, the percentage of deaths occurring in the US from COVID-19 versus from all-causes by age does not vary substantially (see Figure 1). This shows that younger age groups have a similar percentage increase in mortality due to the virus than at older age groups. Therefore, life insurance should be an important purchase at this time for all ages.

Figure 1

COVID-19 Mortality Versus All-Cause Mortality by Age Group

Source: CDC

The third misconception will seem quite preposterous to anyone who has worked in the life insurance industry. Many people considering the purchase of life insurance are concerned that the policy will have a COVID-19 exclusion. If the reader does not believe that this is true, try entering “will my life insurance policy pay if I die from COVID-19” in your browser search engine. You will see article after article trying to assure readers that a life insurance policy will pay, with the appropriate caveats that the policy must be current and that it cannot be an accident-only policy. The problem is that these articles are either in the general media or written by agent groups. Not many come from life insurance industry associations or from insurers themselves.

In summary, the world is in the midst of the worst pandemic in a century that has, at the time of the writing of this article, taken nearly 3.4 million lives and sales of life insurance have remained flat at best. Job loss with its associated decrease in disposable spending could be one reason, although non-essential products such as Netflix movies and Peloton exercise equipment have seen a spike in sales. The pandemic only affecting older people is just not statistically correct. And, fear that life insurance policies will not pay for Covid-19 related deaths is unfounded.

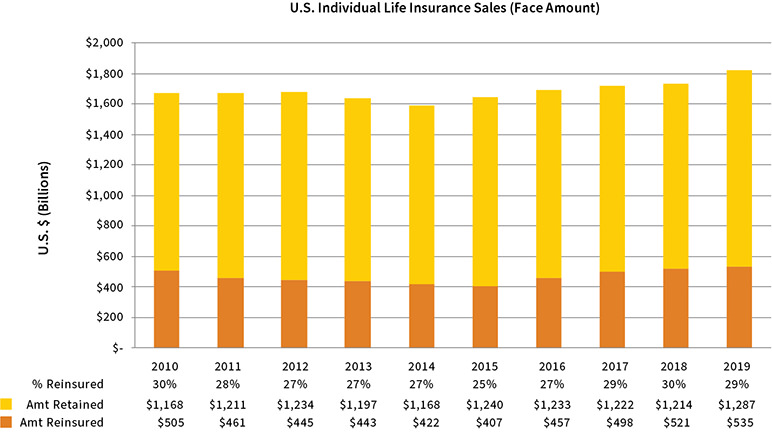

So, what does this have to do with reinsurance companies? A quick look at the most recent Life Reinsurance Survey Results, performed by the Society of Actuaries and Munich Re, will paint the picture (see Figure 4). The amount reinsured increased from USD505 billion to USD535 billion in the nine-year time period shown. This is an annual average growth rate of a whopping 0.6 percent. The chart shows that cession rates have varied from 25 percent to 30 percent over this time horizon, but it is the underlying life insurance sales that is the true cause of this disappointing result. Many reinsurers look at other reinsurance companies as their competitors when the real competitor seems to be Peloton and Netflix. That is, flat sales of life insurance has much more to do with reinsurance sales than market share or cession rate.

Figure 2

U.S. Recurring Cession Rate

Source: Society of Actuaries

The solution is evident. The life insurance industry has to get out of its comfort zone and actively market during the pandemic. There should be a clear, concise and coordinated message coming from insurers and insurance associations that life insurance is affordable, necessary to all age groups and pays for deaths due to COVID-19. And now couldn't be a better time to act when the governments of most mature insurance markets are making, or already have made, generous stimulus disbursements to its citizens by means of enhanced unemployment benefits, tax credits or actual cash payments. For example, in the US, a family of four earning less than USD150,000 would receive USD6,400 under the American Rescue Plan.[11] With a 2019 median family income in the US of about USD68,000, this would translate into a nearly 10 percent increase in earnings for the year.

Some of the American Rescue Plan money will obviously go to offset back rent or mortgage payments, but wouldn't it be prudent to use a portion to purchase a life insurance policy on the family breadwinner? Yet there is no coordinated effort by the life insurance industry to highlight that affordable life insurance that pays for death due to COVID-19 would be a good purchase during a 1-in-100-year-event, just as Rescue Plan monies are appearing in the bank accounts of eligible households.

And, aren’t these households, those earning less than USD150,000 per year, exactly the same market that the life insurance industry has been attempting to target—sometimes called the “middle markets?” Where is all the technology that we have been hearing about? Wouldn't now be a good time to “pull out all of the stops” and reach those markets with a clear and concise message using this technology? The life insurance industry has much preferred to “let sleeping dogs lie” instead of mounting a coordinated marketing campaign.

Is it possible that the life insurance industry would have a difficult time selling water in a desert? Would these insurers fail to use technology to notify weary desert travelers where water is available? Would there be a 90-page document to review and sign before receiving a drink? Would the process be so complex that a third party is needed to explain how to get access to the water? And, would it take six weeks until the water is actually delivered?

Life insurance protects families from the financial hardships of premature death. It is a product with noble intentions, yet the industry is still fearful—fearful of lawsuits, fearful of losing favorable tax status, fearful of technology companies entering its space. The reinsurance industry only thrives if the underlying life insurance industry thrives. Reinsurers should be doing everything possible to improve life insurance sales including bringing new ideas to the industry. Taking a step back is sometimes difficult in our daily lives when we have so many “important” (internal) meetings to attend. It could not be a better time for the life insurance industry to shine. It is paying claims to needy families during a pandemic. The life insurance industry should also be selling record numbers of policies (and making a record number of cessions to its reinsurance partners).

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Ronnie Klein, FSA, MAAA, is founder of Obtutus Advisory GmbH located in Zurich, Switzerland. He can be contacted at ronniefsa@aol.com.

Endnotes

[1] http://la.utexas.edu/users/hcleaver/368/368LockeSomeConsiderationsAlltable.pdf

[2] https://www.gutenberg.org/files/60411/60411-h/60411-h.htm

[3] https://fortune.com/2021/01/11/covid-computer-sales-lenovo-hp-dell-apple/

[4] https://www.bbc.com/news/business-54112461

[5] https://www.bbc.com/news/business-52376022

[6] https://www.prnewswire.com/news-releases/us-life-insurance-activity-hits-record-growth-in-2020-reports-the-mib-life-index-301208070.html

[7] https://www.limra.com/en/newsroom/news-releases/2021/limra-u.s.-life-insurance-policy-sales-increase-2-in-2020/

[8] https://www.nerdwallet.com/article/insurance/covid-19-accelerates-no-exam-trend-in-life-insurance

[9] https://apnews.com/article/us-news-consumer-spending-coronavirus-pandemic-layoffs-economy-3c333ee7a095c3e0985496fba47bbc12

[10] https://www.policygenius.com/life-insurance/life-insurance-cost/

[11] https://home.treasury.gov/news/featured-stories/fact-sheet-the-american-rescue-plan-will-deliver-immediate-economic-relief-to-families