Does Free Embedded Insurance Impact Customer Behavior?

By Ola Oyekan and Petr Vaclav

Reinsurance News, December 2022

Embedding insurance with products or services at the point of sale has been touted as a silver bullet for improving coverage access for underserved consumers.

With global estimates of over $3 trillion in market value, it is not surprising that there has been a huge focus on the potential of embedded insurance. However, the concept of embedded insurance is not new—early models of microinsurance involved mobile network operators (MNOs) offering free embedded insurance to improve the loyalty of their subscriber base. The distribution of products via mobile has created scale and access for millions of underserved individuals to experience insurance for the first time (in most cases). Indeed, there are currently over 130 mobile-enabled insurance services across 28 countries, with over 43 million policies issued in 2020 alone.

The new wave of embedded insurance products (v2.0) is largely driven by digitalization accelerated by COVID-19, resulting in customers being more comfortable to transact online. While earlier models of embedded insurance focused primarily on simplifying customer acquisition, the new models leverage technology, data analytics, and artificial intelligence across the value chain. Indeed, emerging InsurTech players are utilizing technology (via plug and play solutions and APIs) to enable any aggregator or platform to seamlessly integrate insurance solutions into their customer journey. By creating a frictionless path from acquisition to claims payment, the hope is that embedded insurance will encourage customer loyalty while increasing activity and service usage to generate additional revenue for a non-insurance company.

But does the approach work? To measure the impact of free embedded insurance on customer behavior, RGA and Inclusivity Solutions* conducted an analysis of an embedded insurance campaign run by an MNO in Cote d’Ivore, West Africa.

Business Objective

The objective of the campaign was to encourage subscribers to increase their use of the MNO’s mobile money services by offering free embedded hospital cash insurance as an incentive. The key questions explored in the study include:

- How does the behavior of subscribers change after registering for free insurance?

- Is there an increase in volume and quantity of mobile money transactions for subscribers who register for free embedded insurance?

Data/Method

In order to qualify for free embedded hospital cash insurance, subscribers had to utilize the MNO’s mobile money service and make at least five monthly transactions with an aggregate value of at least 5,000 XOF (or US$10). For each month that transaction thresholds were met, subscribers were offered one month of hospital coverage providing a specified payout per day for any hospitalization of three days or more. Subscribers had the option to register (opt in) or not register (opt out) for the insurance offering.

The study tracked the behavior of around 3.5 million subscribers across a period of 13 months, including both subscribers who registered for the insurance offer and those who did not. Only subscribers who had at least three months of transactions before and after the free insurance was offered were included in the analysis. This stipulation ensured there were enough observed months available to measure the change in behavior of subscribers. In addition, subscribers were grouped into cohorts of similar characteristics to accurately compare the behavior of registered versus non-registered subscribers.

An uplift analysis was then conducted to compare the behavior of subscribers who registered (opted in) for the free insurance with those who did not accept the offer. The behavior change was measured by the change in the total count and value of mobile money transactions per month.

Results

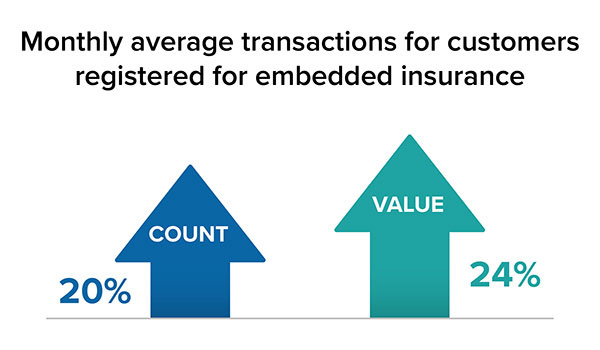

The analysis found significant positive uplift in the total count and transaction values of subscribers registered for free embedded insurance compared to those not registered. Figure 1 (below) shows an overall transaction average increase of 20 percent per month for registered customers. Similarly, there is an average increase of 24 percent in transaction values per month for registered customers.

Figure 1

Overall Uplift—Average Monthly Transaction Count and Value

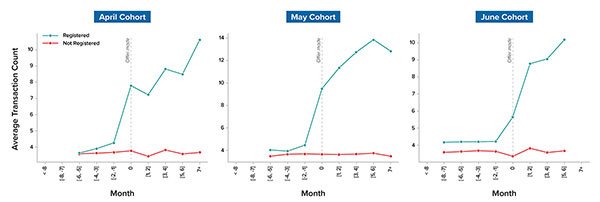

Furthermore, the analysis for the different monthly cohorts of subscribers demonstrates that the behavioral change before and after free embedded insurance registration shows a significantly positive uplift. Most importantly, this uplift is sustained, both in average monthly transaction count and value, for registered compared to the non-registered group.

As shown in Figure 2 (below), registered subscriber adoption rises the month in which free embedded insurance is offered (month 0) and is sustained thereafter. In contrast, no significant change or uplift occurs in unregistered subscribers.

Based on the analysis, free embedded insurance seems to encourage consumers to use their mobile phones for more transactions. The higher the transaction count and transaction value of registered subscribers, the greater the customer retention and revenue for the mobile network operator.

Figure 2

Uplift Per Cohort—Average Monthly Transaction Count and Value

From a behavioral science perspective, why do those who select the free insurance subsequently transact more than those who don’t? One reason is: The free insurance increases the perceived value of the service as a whole. And, importantly, it makes the value more salient and front of mind. There may also be an element of reciprocity at play. Reciprocity is a powerful determinant of human behavior because people often reward the positive actions of others with equal behavior. Those benefitting from the free insurance may feel an obligation to use the mobile network for other services, rather than an alternative.

Conclusion

So, does free embedded insurance impact customer behavior? The mobile network operator use case presented here demonstrates the improved retention and revenue benefits of embedded products for a non-insurance company. For insurers, the new wave of embedded insurance products can further help close the protection gap by leveraging innovative technology to streamline the customer journey and enforce insurance’s value proposition. More importantly, the approach can help make insurance accessible to millions of underserved customers globally.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

*RGA has invested in Inclusivity Solutions, the InsurTech company that works with mobile operators and other mass-market aggregators to deliver digital insurance solutions that meet the needs of emerging customers.

Ola Oyekan, Ph.D., microinsurance (mass market) specialist, RGA South Africa.

Petr Vaclav, vice president, Decision Science, Global Data and Analytics, RGA.