Cayman Reinsurance Market and Opportunities

By Yiru (Eve) Sun, and Ghislain Ghyoot

Reinsurance News, December 2023

In the past decade, U.S. life and annuity insurance companies’ utilization of asset-intensive reinsurance has grown significantly. Bermuda remains the most prolific offshore jurisdiction in which most asset-intensive reinsurance entities and insurers’ affiliates are licensed. The Cayman Islands have received more and more attention from the industry of late. Many reinsurers and insurers have set up entities or affiliates in Cayman, with many more in the pipeline. The main drivers for insurers to set up offshore affiliates include optimizing capital, enhancing tax benefits, obtaining more regulatory and investment flexibility, etc., similar to the initial motivation for asset-intensive reinsurance, while internal reinsurance to insurer’s affiliate allows the insurer to retain the business and therefore the profits. Here we will discuss Cayman’s reinsurance market growth momentum, and the main benefits that Cayman offers. In general, Cayman can be considered as a good alternative to Bermuda, instead of a competitor.

Macroeconomics: Strong Fiscal Status

On a macroeconomic level, Cayman has an extremely strong fiscal status. The Cayman government debt-to-GDP ratio reduced significantly from 21.1 percent in 2013 to 4.5 percent in 2021,[1] which corresponds to US$265 million government debt.[2]

The strong macroeconomics have made Cayman a premier global financial hub. Cayman is rated Aa3 with a stable outlook by Moody’s, which is the highest among the offshore islands. This provides Cayman entities a high ceiling as each entity’s rating is limited by its jurisdiction’s rating. AM Best has also concluded that there are "low levels of economic, political and financial risk" in Cayman. That’s why Cayman has been the top 1 jurisdiction for offshore funds for over a decade. For example, around 85% of the world's hedge funds are domiciled in Cayman.[3] Although traditionally a captive insurance domicile, consistently ranking in the top three domiciles globally for captives, Cayman’s reinsurance industry has really just started to take off. For now, the volume and size of these entities are smaller relative to that of the funds industry in Cayman, but it is anticipated that over the next few years this will begin to balance out.

Life and Annuity Reinsurance Growth Momentum in Cayman

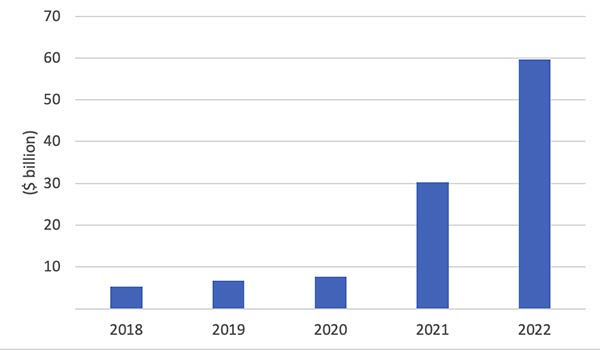

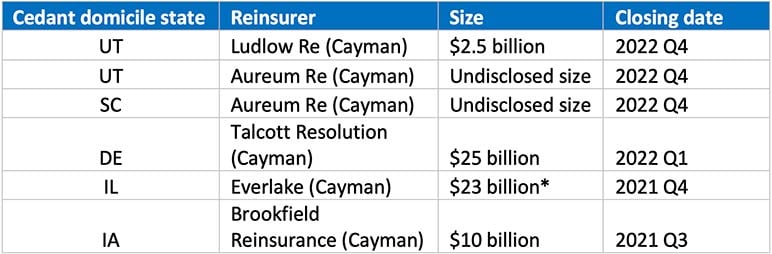

Cayman has seen rapid growth in life and annuity reinsurance business. Figure 1 covers 12 Cayman life reinsurers. From 2020 to 2021, their total assets under management (AUM) increased three times, and from 2021 to 2022 it increased another 97%. By the end of 2022, their total AUM has reached US$59 billion,[4] which corresponds to approximately 8% of the assets that U.S. life and annuity insurance companies transferred to asset-intensive reinsurers.[5] Table 1 lists some of the life and annuity reinsurance transactions that have been successfully closed and reinsured to Cayman reinsurers in the past two years. One of these Cayman reinsurers has confirmed to date they have not had any issues or concerns from the U.S. states’ regulators in terms of approving the transactions and giving full reserve credits to the cedants.

Figure 1

Total Assets of Cayman Life Reinsurers

Table 1

Some Recent Life and Annuity Reinsurance Transactions to Cayman Reinsurers

*This was a merger & acquisition transaction, not a reinsurance transaction.

Flexible Accounting Treatment and Capital Requirement

Flexible accounting treatment is one of the main drivers that attract companies to Cayman. (Re)insurers can adopt internationally recognized accounting standards, i.e., they can select U.S. statutory, or U.S. GAAP, etc., and they can propose modifications, like modified STAT or even modified GAAP, to the Cayman Islands Monetary Authority (CIMA), or choose to do hybrid arrangements. CIMA will accept a modified or hybrid accounting approach if the entities external auditor can audit and confirm it is internationally recognized despite the modification. With modified coinsurance (ModCo) or funds withheld (FWH) reinsurance to Cayman, the insurer may get the combination of lower reserve, increased capital and improved solvency ratios, while all ceded reserves are fully or even over collateralized.

Cayman can provide (re)insurers with more flexibility in capital methodology as well. While there is a prescribed capital requirement within the insurance laws and regulations, they are typically seen as a starting point from which to develop a bespoke capital requirement. Since Cayman is neither NAIC (National Association of Insurance Commissioners) equivalent nor Solvency II equivalent, when companies apply for their license in Cayman they can apply for their own bespoke capital model which has been supported by appropriate actuarial consultation, whether that be in-house or outsourced. For example, Cayman entities could adopt a capital model equivalent to AM Best's Capital Adequacy Relativity (BCAR) level, instead of NAIC risk-based capital (RBC). In addition, the capital or the over-collateralization assets that the Cayman entities hold can be held with a greater portion in high-yield assets in Cayman than in U.S. The intent with the flexibility is to allow entities to get closer to economic value—but not below it—without jeopardizing policy holder security.

Some reinsurers in Cayman have obtained an AM Best rating, but typically smaller and/or new entities have not yet done so. Almost all the reinsurers in Cayman that obtained an AM Best rating achieved an A- or even higher. Therefore, insurers that reinsure to Cayman reinsurers, or internally transfer to their Cayman reinsurance affiliate, will take comfort that they won’t receive a negative impact on the rating agencies’ view on the insurer. Otherwise, it would be inconsistent for these rating agencies to maintain higher ratings and a stable outlook for these Cayman reinsurers.

Different Classes in Cayman

There are various class types that a (re)insurer can choose from when applying for a license in Cayman. The minimum capital requirement and the prescribed capital requirement are different for each class type. Many new entrants chose to set up as a Class B(iii) entity. Operationally it is faster in terms of application submission and approval. Class B(iii) licenses carry the lowest minimum capital requirement and do not require the entity to have a physical presence of staff or premises in Cayman. The entity can instead rely on Cayman-based licensed and regulated insurance managers and have their key staff visiting Cayman periodically (annually) for Board meetings for example. Class C is usually used for special-purpose reinsurers, i.e., for securitizations. Class D is the license type for stand-alone, self-managed entities. Class D requires the entities to have the majority of the team to be based in Cayman including C-suite executives, administration team, finance team, etc. The entities can choose to migrate their license from Class B(iii) to Class D over time, but this is not specifically required in the law currently. A Class B(iii) license already allows entities to accomplish their business goals, including conducting large-scale reinsurance transactions with third parties.

It's worth noting too that Cayman is exploring NAIC equivalency and is in advanced talks on this matter with the NAIC. While a due date is not yet available, it is understood that adopting NAIC equivalency will be on an opt-in basis within a Class D license category.

Other Benefits of Cayman

As Cayman already has a lot of institutional investors, there are many top tier law firms, big four auditing firms, as well as very strong representation of top 10 firms, along with all their accounting, consulting, and tax advisors, as well as insurance management companies. Cayman provides a very diverse and experienced pool of local and international professionals. This makes it possible for (re)insurance entities or affiliates to use these services instead of hiring staff locally in Cayman.

Operationally, it is much faster and cheaper to set up a reinsurer or a reinsurance affiliate in Cayman. Cayman reinsurers can also proceed faster and therefore likely offer more competitive terms when closing transactions.

Around 90% of Cayman business is derived from the U.S., which includes all industry sectors, not only insurance or reinsurance. Only about 2% of risks underwritten by the insurance industry in Cayman originates from Europe. As there is no material business connection with Europe, there is no consideration for Cayman to adopt Solvency II equivalency. This provides the advantage to companies that do not have UK or European nexus, as there is less uncertainty associated with regulatory changes.

Many companies have already set up entities in both Cayman and Bermuda to benefit from both sides of the regulatory regimes and are using them for different business purposes. It helps to enhance these companies’ competitiveness as they can choose whichever jurisdiction is most beneficial for a specific transaction, whether that be driven by cedant, or shareholder/financing requirements. That shares the sentiment that Cayman should not be considered as a competitor to Bermuda, but instead a good alternative. Given the macroeconomics volatility and the regulatory changes, etc., Cayman may play an important role in a (re)insurance company’s contingency planning.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Yiru (Eve) Sun, FSA, MAAA, Ph.D., is a managing director at Aon. She can be reached at Eve.Sun@aon.com.

Ghislain Ghyoot, is a director at Aon. He can be reached at ghislain.ghyoot@aon.com.