Beginning of a New Era—Impact of Global Issues in (Re)Insurance

By Jeremy Waite

Reinsurance News, June 2024

The global nature of the reinsurance industry has enabled the diversification of risk away from concentration in specific regions to the larger global market. However, record catastrophe losses, inflation stemming from increased interest rates, geopolitical tensions and heightened climate risk are putting operating pressures on insurers and reinsurers. The increasing frequency of higher-magnitude natural disasters against the backdrop of a bearish market with rising interest rates sets up a perfect storm for reinsurers to harden their pricing to reflect a more prudent risk appetite.

Growth in New Drivers of Loss Against the Backdrop of Climate Change

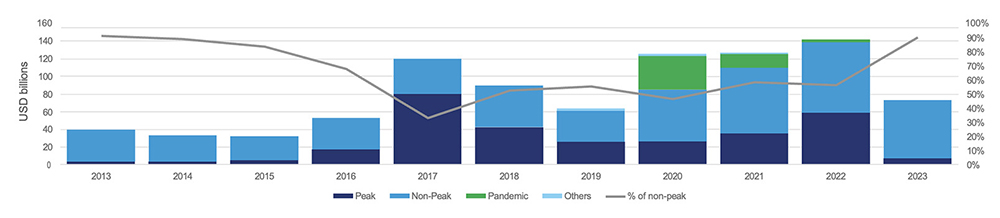

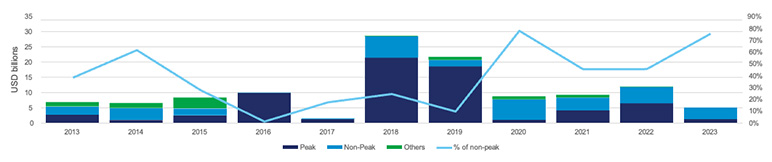

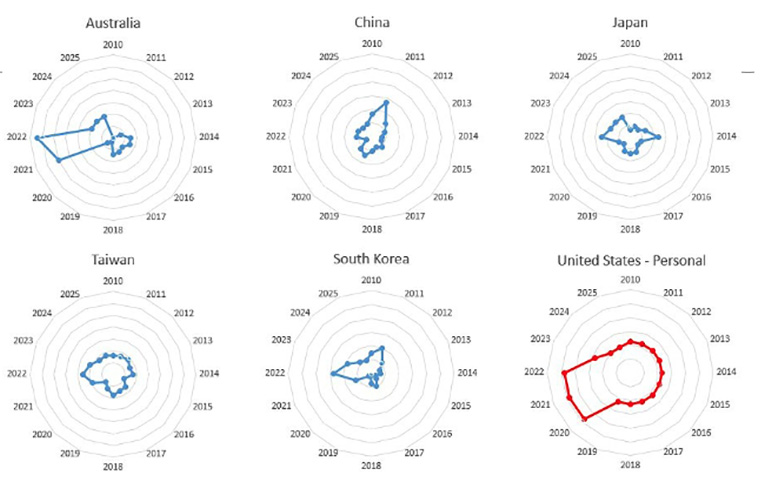

Although (re)insurers have been reporting record catastrophe-related losses since 2017, many of them occurred due to smaller, non-peak perils events. Over the past five years, peak perils such as cyclones and earthquakes have accounted for less than half of the insured losses, while non-peak perils, such as severe convective and winter storms, wildfire and flooding, have become the secondary driver to annual aggregate catastrophe losses. More non-peak losses occur in catastrophe-prone regions, such as Australia and Japan, in addition to typical typhoon and earthquake-related peak-peril losses.

Stocks Versus Bonds—Not a Perfect Diversification After All

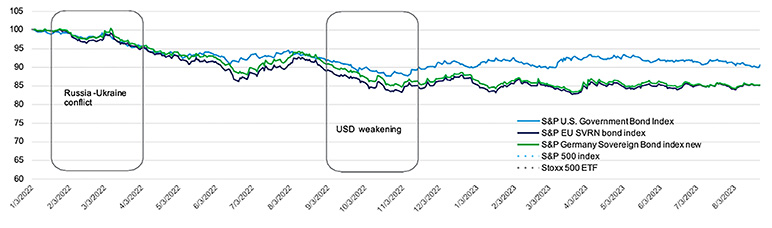

Since 2020, interest rates have been rising. Typically, during periods of rising interest rates, bonds purchased earlier in the period when rates are lower will tend to have lower market values later in the period. Mark-to-market accounting rules require insurers to adjust the value of assets to market value, even if the (re)insurers intend to hold them to maturity. (See Figures 1–2)

Figure 1

Non-peak Perils Account for More Than Half of the Global Large Losses on Average

Figure 2

39% of Asia Pacific Large Losses Came from Non-peak Perils on Average

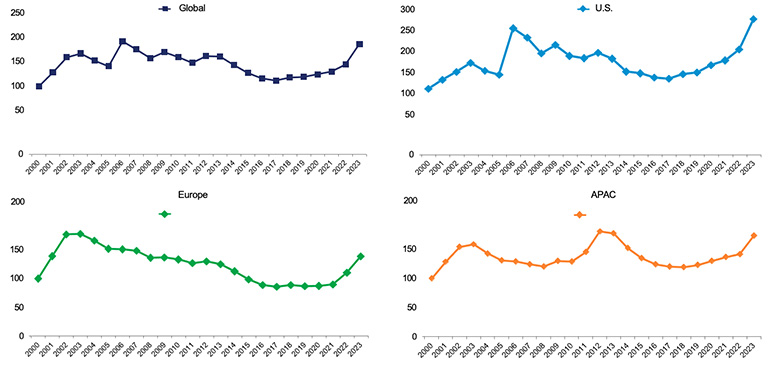

Rising interest rates have also inhibited the post-COVID-19 economic recovery, leading to more conservative market sentiments on global stock markets. In 2022, both bond and stock markets were reporting negative returns (see Figure 3).

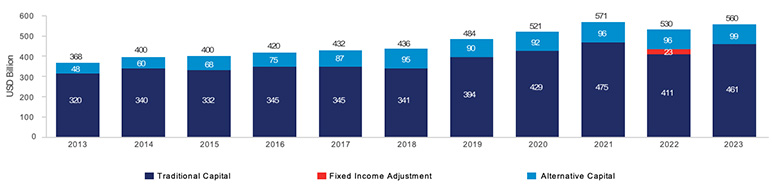

Most (re)insurers invest conservatively by allocating approximately 75% of their assets into fixed-income instruments. The declining market value of their fixed-income portfolio will flow through the profit and loss account either as unrealized loss or as negative other comprehensive income (OCI), leading to a decline in accounting capital (Exhibit 1).

Reinsurers must then focus on improving underwriting profit in order to minimize the negative impact on earnings (and capital) due to the fall in investment returns (and their returns on equity or ROEs). This is especially important, as reinsurers are more susceptible to natural catastrophe losses, in view of heightened climate risk.

Inflation (Including Social Inflation) in Some Regions had Been a Driver for Leading Reinsurers to Rethink Underwriting and Pricing Strategy and Become More Selective on Capacity Allocation

The recent spike in the consumer pricing index can be divided into two waves of supply-chain disruption:

- The first wave of inflation in 2021 was driven by COVID-19 (2020), which led to delays in global production and shipment for both raw and finished goods due to the implementation of lockdown measures worldwide.

- The second wave has been driven by the Russia-Ukraine war, which has caused blockages in key shipping routes and disrupted the global supply chain (particularly of energy and shipments of food commodities).

Figure 3

US and Europe Key Bonds and Stock Market Performance

The persistency of inflation under these ongoing geopolitical tensions will continue to be uncertain.

Additionally, social inflation (the tendency for costs to rise above typical economic inflation levels, due to court cases, other legislative reasons or societal drivers) has become an emerging trend observed in many developed jurisdictions.

Increased catastrophe frequency will prompt increases in costs due to post-event demand surge (demand for building and materials exceeding supply due to reconstruction work after a destruction event).

Economic and social inflation will drive up the cost assumptions used by (re)insurers in their reserves provisioning and pricing strategies. These impacts will reflect significantly on (re)insurers with heavy casualty/long tail exposure, prompting them to review their underwriting appetites and be more stringent on their capacity allocation.

As Asia Pacific countries were less impacted by inflation compared with the rest of the world, they reported relatively lower reserve risk.

How Were All These Factors Driving 2023 Renewals? (Pricing, Retention, Portfolio Pricing and Risk Appetite)

Reinsurers Become Pricing-driven in Light of Hard Retro and Lower Dedicated Capital

Due to unrealized investment losses and the absence of new capital, reinsurers and retrocessionaires tend to deploy their capital strictly to risks with adequate pricing.

Dedicated reinsurance capital declined by 12% in 2022, with traditional capital falling 13.5% on an absolute basis. It is expected to bounce back over the course of 2023 due to earnings improvement, but is still likely to only reach 2021 levels. Despite stable retrocession market capacity, the cost and level of attachment rose in the Jan. 1 renewals, with reinsurers taking on more risk. Global property catastrophe pricing increased by ~28% during January renewals, while, on average, Asia Pacific property catastrophe pricing increased by 15%–20% on a risk-adjusted basis. This was driven partly by higher retrocessional costs. In view of high inflation and interest rates, it is expected that reinsurers will continue to prioritize adequate risk pricing for sustainable combined ratio improvement across all lines and regions, particularly on long-tail business.

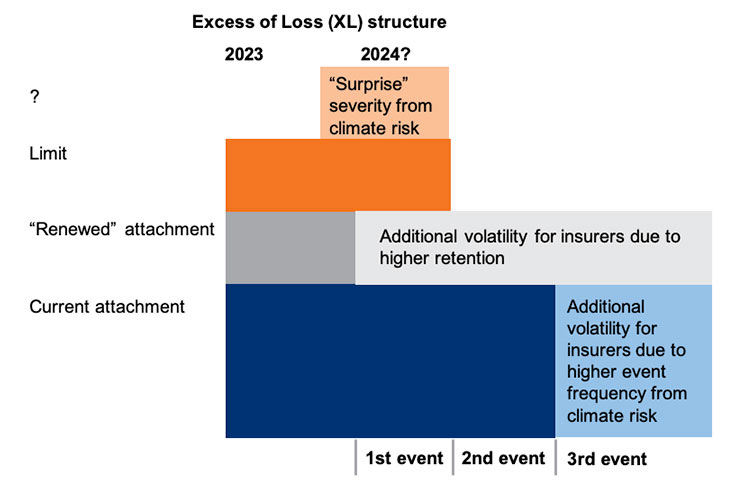

Insurers are Forced to Retain More Risk on Their Own Books in Response to the Hardening Market

Lower layers are typically priced at higher ROLs to reflect the higher probability and frequency of losses, constituting the largest cost portion of the property excess of loss program. These are where the dollar impact of industrywide price hardening is most prominent.

Decreased capacity from the retro market has reduced available reinsurer capacity that can be provided to the insurance market. As a result, insurers have had to increase their retention to partially offset the impacts of rising costs and decreased capacity. (See Figures 4–7)

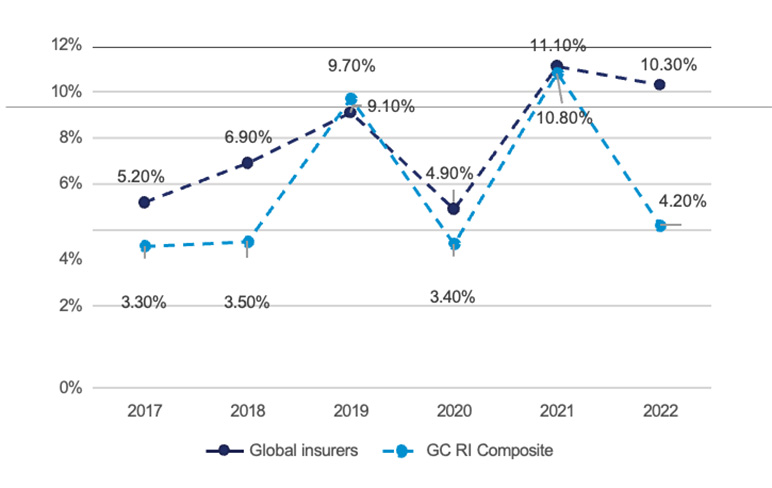

Figure 4

Return on Equity—Global Insurers Versus Guy Carpenter Reinsurers’ Composite

Figure 5

Asia Pacific Inflation Versus US

Figure 6

Guy Carpenter Property Catastrophe Rate on Line (ROL) Index Increases to Record Level

Figure 7

Dedicated Reinsurance Capital Recovers

Nearly one-third of Asia Pacific programs had increased their retention toward one-in-10 years (from previously one-in-five years on average), leaving insurers with decreased earnings protection for catastrophe losses at the lower return period.

What Does it Mean for (Re)insurers?

Insurers Should Expect Higher Volatility on Their Return on Equity

As insurers increase their retention, they expect to retain all lower-return-period catastrophe losses previously ceded to reinsurers. However, considering heightened climate risk, increasing occurrences of non-peak perils events could leave insurers more susceptible to increased catastrophe loss retention. Without adequate rate movements and proper risk selection in underwriting processes, this could potentially jeopardize insurers’ capital. Retaining more risk may also limit an insurer’s ability to pursue growth opportunities, as more capital may be required to support increased (catastrophe-related) risk exposure.

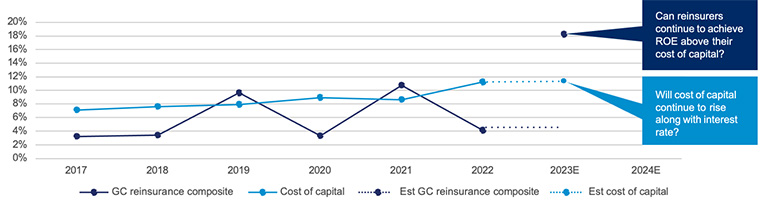

Uncertainty Remains Whether Reinsurers’ ROE Will Exceed Their Cost of Capital, Despite Improvement

Figure 8

Reinsurers Combined Ratio Improved Along with Pricing

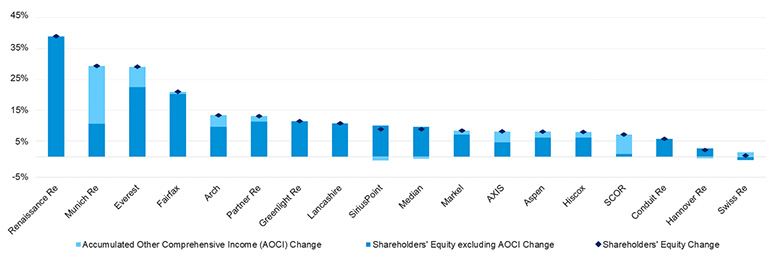

Improvements in pricing adequacy will help reinsurers improve underwriting profitability, as illustrated in their catastrophe loss ratios (see Figure 8 for combined ratios). These changes are largely in line with the upward ROL trend. Additionally, the unwinding of unrealized losses on matured fixed-income securities coupled with higher investment yield will gradually improve reinsurers’ return on equity (and their shareholders’ equity position).

In the past six years, global reinsurers’ average ROE (~6%) stayed below their cost of capital. Higher interest rates have increased the cost of capital, from ~8% in 2020 to above 11% in the first half of 2023. It is still too early to tell if the earnings improvement in the first half of this year (before the hurricane/typhoon season began) will become a sustainable trend, as if pricing improvement is adequate to counter the more frequent and severe catastrophic losses in view of climate change. Also, the rebound on investment return remains uncertain, given the current environment of high inflation and interest rates. A more concrete shift in the pricing cycle can be achieved only when reinsurers are earning sustainable returns higher than their cost of capital consistently, in order to allow for more flexible reinsurance pricing and attract more capacity.

How Should Insurers get Ready for this Unprecedented Market Landscape?

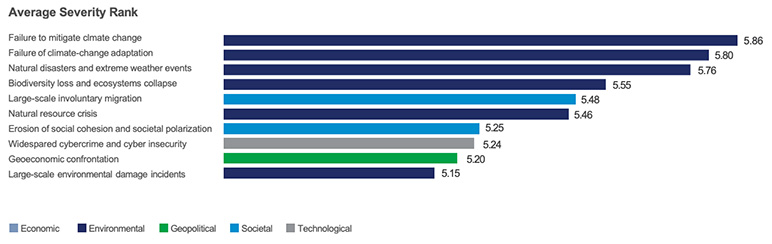

Prepare for Elevated Climate Risk

The 2023 Intergovernmental Panel on Climate Change (IPCC) report links greenhouse gas emissions to a 1.1°C increase in global surface temperature since 1850–1900. According to the Global Risks Report 2023, published by the World Economic Forum in collaboration with Marsh McLennan, the majority of future risks are environmental in nature, which may lead to larger and more frequent insurance claims.

The link to increased losses is likely spread over time, but at least some contribution of the increased loss activity can be explained by climate change.

When reassessing the impact of retention changes on overall retained exposure, insurers must consider climate risk scenarios and how these may increase the risk capital required.

Enhancing Data and Modeling Capability will be a Necessary Game Changer

(Re)insurers currently rely on either in-house or vendor-developed catastrophe models to simulate probable losses for prescribed natural events. The reliability of the outcome depends on the granularity of data, technology deployed on exposure measurements, scientific research and engineering methods.

Models on traditional (peak) perils, such as typhoon and earthquake, are built with relatively more robust data using probabilistic methods that enable the incorporation of various climate change scenarios. However, catastrophe models on non-peak perils, such as flooding, convective storms, winter storms and wildfires, lack credible vendor models to conduct relevant hazard risk and loss assessments.

Data enhancements that include risk-adjusted factors based on location and hazard zones can reduce model uncertainties, allowing insurers to conduct appropriate peril pricing and manage region-specific exposure growth. (See Figures 9–11)

Figure 9

Reinsurers’ Shareholders’ Equity Rebounded in the First Half of 2023 from a Lower Capital Base at Year-end 2022

Figure 10

Can ROE Remain above the Cost of Capital?

Figure 11

Failure to Address Climate Change could Lead to Severe Consequences

Open to Innovative Reinsurance Capital Solutions to Manage Volatilities

With reinsurers likely to continue tightening underwriting capacity and pricing before their earnings exceed their cost of capital, insurers will need to deepen their understanding on their own earnings and capital volatilities, and thus seek appropriate reinsurance/risk-transfer instruments.

Insurers should know their optimal retention relative to their capital and earnings and secure the required reinsurance capacity to minimize both horizontal volatility (arising from multiple low return period (non-peak) perils) and vertical volatility (from “surprise/black swan” natural catastrophic events) before the next renewal. For example, insurers may consider seeking whole account quota share to reduce their retention under a higher attaching point on an excess of loss program or transfer a part of their retained risk via non-traditional reinsurance capacity and pricing techniques such as parametric covers. (See Figure 12)

Figure 12

How can Insurers Reduce Volatility under These Scenarios?

Back to Basics—Be a Prudent Underwriter

Overall, insurers will need to implement other fundamental measures to improve their book’s performance, such as repricing of original risk to improve long-term rate adequacy, using quality data with a matrix of parameters to conduct anti-risk selection, and seeking alternative solutions (such as pooling) to offload homogenous poor risk out of portfolios where anti-selection is not permitted. In the long run, insurers that deliver underwriting books with superior performance and reduced volatility will be in a stronger position to bargain with reinsurers for advantageous terms and conditions.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Jeremy Waite, Asia Pacific catastrophe advisory group lead. He can be contacted at Jeremy.Waite@guycarp.com or +852 55298856.