Inside the Emerging Insurance Opportunity in Latin America

By Israel Ramírez

Reinsurance News, February 2025

Latin America presents an intriguing target market for insurers looking to grow their international presence. Opportunities include an emerging middle class, low penetration to date, and willing partners to help ease entry. Challenges exist, however, including low digital adoption and distribution channel limitations, but new solutions are available.

Exploring Emerging Insurance Opportunities in Latin America

The 33 countries collectively recognized by the United Nations as Latin America span two continents and numerous islands. They feature a wide variety of languages, traditions, and cultures. The differences among those countries can often be stark.

But when it comes to the insurance industry, there is one overarching commonality: Opportunity. The Latin American insurance market is fertile ground for growth and innovation that promises to both benefit insurance companies and positively impact quality of life for average citizens.

Already, Latin America is one of the fastest-growing regional insurance markets in the world. A study of nine countries—Argentina, Brazil, Chile, Colombia, Ecuador, Guatemala, Mexico, Panama, and Peru—revealed a 212% increase in gross written life insurance premiums (GWP) from 2011 to 2022.[1] That is just a portion of the overall growth in the insurance market, from $63 billion GWP in 2011 to $173 billion in 2022, a 176% increase.[2] (See Figure 1)

Figure 1

Total Latin American Gross Written Premiums (GWP) ($, billion)

Yet this diverse market can be difficult to master. It features unique challenges that must be identified and addressed by insurers looking to maximize their effectiveness in the region.

This article examines the scope of the opportunity in Latin America and delves into the challenges faced by insurers looking to grow their market share in the region.

The Opportunities

The most immediate strategic prospects for insurers in the Latin American market stretch across three main areas.

An Emerging Target Market

Latin America is rapidly transforming into an attractive region for insurers, driven by dynamic demographic and economic shifts. With a burgeoning middle class, low insurance penetration rates, and unique avenues for distribution, the region presents substantial growth potential for insurers willing to navigate its unique challenges and adapt their offerings to local needs.

Latin America’s middle class has more than doubled in the past 30 years, from 120 million to 274 million people.[3] Better still, this growth has accelerated in the past two decades. Today, 48% of the Latin American population is considered middle class, up from 32% in 1981.[4] (See Figure 2)

Figure 2

Top 10 Middle Class Countries in Latin America

This growth is not happening at the expense of the wealthy but rather for the benefit of those formerly considered part of the region’s poor. The percentage of those in Latin America’s lower class has shrunk and now equals that of the newly formed middle class.[5] Middle-class growth has been fueled by a combination of job creation that has reduced unemployment rates and a shift away from informal employment, such as day labor, small-scale manufacturing or agriculture, or unlicensed transportation services.

That said, the World Bank estimates that one-third of those considered middle or upper class in Latin America are one shock away—such as a natural disaster, serious illness, or loss of a job—from being pushed back into poverty.[6] That makes financial protection through insurance an increasingly attractive option.

Low Penetration

The Latin American market is largely untapped when it comes to insurance protection. For example, whereas roughly 50% of those in the US have life insurance, less than 15% of the Latin American population hold life policies.[7] Insurance density—defined as premiums paid annually per capita—is dramatically less in Latin America ($295) than in the United States ($7,500).[8] This gap underscores a compelling opportunity to expand the market for life and health insurance in the region. As financial literacy and awareness around the benefits of insurance products increase, demand is poised to rise, providing insurers with fertile ground to engage new customers.

A Waiting Partner

So how do insurers enter this emerging market? Local players dominate around two-thirds of Latin America’s health insurance and life insurance business, and approximately half of the non-life market.[9] Global companies make up most of the other one-third, with regional players holding around 2% of GWP.

A proven approach for market penetration in Latin America has been through bancassurance and other strategic alliances with local financial institutions. By leveraging the established trust and extensive reach of these institutions, insurers can introduce insurance products effectively. Bancassurance serves as an integrated distribution channel that aligns well with consumer behaviors in Latin America, where direct-to-consumer digital sales may still face adoption challenges.

The Challenge: Low Digital Adoption

Digital-only products tend to struggle in Latin America. The emerging middle class has traditionally not had the financial means or lived in areas with the infrastructure needed to access technology-driven products. According to a 2022 survey by McKinsey and LIMRA, Latin American consumers appreciate digital interaction, with more than two-thirds beginning their search for life insurance online. However, most of those policies are not ultimately purchased through digital channels.[10]

The Solution: A Hybrid Approach

The reality of low digital-adoption highlights a need for a hybrid approach that combines the convenience of digital platforms with the trusted, personalized support of agents. Such a model aligns well with the regional consumer preference for engaging with a familiar agent while also benefiting from the accessibility of digital tools.

Local distribution preferences further emphasize the importance of a hybrid approach, particularly for middle- and lower-income products that may offer limited commissions and tend to be less attractive to agents. This underlines the value of establishing strategic alliances with financial institutions to bolster distribution opportunities.

A multi-channel approach that optimizes the reach and retention of customers by blending digital efficiencies with the credibility and connection provided by in-person agents is essential to adapting to local preferences.

Profitable And Resilient

From Caribbean shores and windswept Patagonian plains to the bustling global cities of Mexico City and São Paulo, Latin America is a region rich in opportunity for insurers. The real question, however, is whether that opportunity is profitable. Data indicates it can be. According to a study by McKinsey & Company, the Latin American insurance industry is highly profitable, as measured by return on equity (ROE), compared to the global average and all other major insurance markets. The McKinsey analysis showed ROE in Latin America was 22.3% in 2019 and 16.6% in 2022, far greater than the global average of 10.4% and 8.8%, respectively.[11]

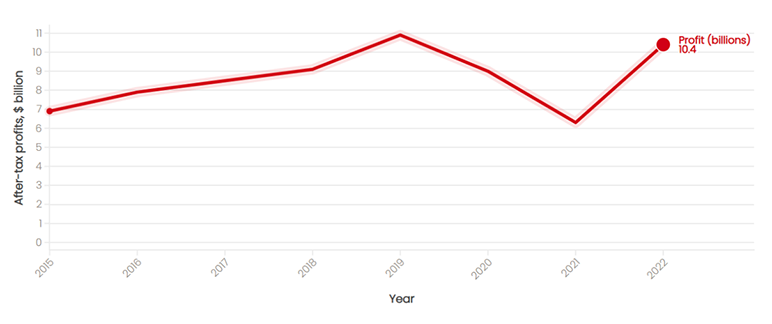

In addition, the Latin American market has proven resilient. Though profitability growth slowed during the COVID-19 pandemic, it remained healthy throughout, generating $9 billion in profit in 2020, $6.3 billion in 2021, and $10.4 billion in 2022.[12]

This profitability and resiliency further solidify Latin America as an area of opportunity for our industry going forward. (See Figure 3)

Figure 3

Latin America’s Insurance Industry Profits

For insurers considering expansion into Latin America, these factors point to a compelling opportunity, balanced by the need for a deep understanding of local consumer preferences and the willingness and ability to address structural challenges. By prioritizing a tailored approach that balances digital innovation with trusted distribution channels, insurers can unlock the region’s growth potential. Strategic partnerships with financial institutions and a commitment to a hybrid distribution model offer a pathway to sustainable expansion, widening access to financial protection throughout Latin America.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Israel Ramírez is pricing director, Research and Development, Latin American Markets, for RGA. Israel can be contacted at Israel.Ramirez@rgare.com.

Endnotes

[1] https://www.mckinsey.com/industries/financial-services/our-insights/insurance/global-insurance-report-2023-capturing-growth-in-latin-america

[3] https://assets.publishing.service.gov.uk/media/5a7bff2b40f0b645ba3c610b/The_stable_consumer.pdf

[5] https://www.worldbank.org/en/news/feature/2012/11/13/crecimiento-clase-media-america-latina

[6] https://blogs.worldbank.org/en/latinamerica/challenges-Latin-America-Caribbean-eradicating-poverty

[9] https://www.mckinsey.com/industries/financial-services/our-insights/insurance/global-insurance-report-2023-capturing-growth-in-latin-america

[10] Survey by McKinsey and LIMRA of 1,000 consumers per country in Chile, Colombia, Mexico, and Peru, fielded online in March 2022

[11] https://www.mckinsey.com/industries/financial-services/our-insights/insurance/global-insurance-report-2023-capturing-growth-in-latin-america